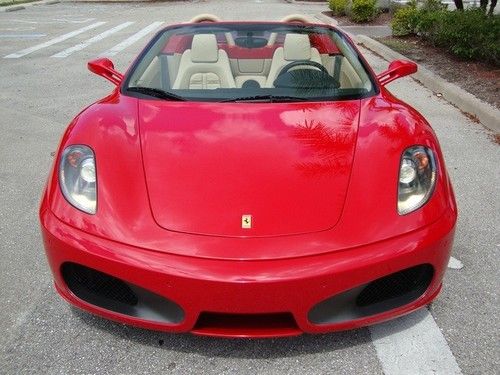

Red/tan F1 Shields Red Calipers Daytona's Hifi Bluetooth 3k Mi on 2040-cars

New Port Richey, Florida, United States

For Sale By:Dealer

Engine:4.3L 4308CC V8 GAS DOHC Naturally Aspirated

Body Type:Convertible

Fuel Type:GAS

Transmission:F1

Warranty: No

Make: Ferrari

Model: F430

Trim: Spider Convertible 2-Door

Doors: 2

Fuel: Gasoline

Drive Type: RWD

Drivetrain: RWD

Mileage: 3,619

Number of Doors: 2

Sub Model: Spider

Exterior Color: Red

Number of Cylinders: 8

Interior Color: Tan

Ferrari 430 for Sale

Super clean 430 coupe with lots of extras!(US $114,900.00)

Super clean 430 coupe with lots of extras!(US $114,900.00) 2009 scuderia rosso scuderia carbon carbon and more carbon(US $174,900.00)

2009 scuderia rosso scuderia carbon carbon and more carbon(US $174,900.00) F1 shields calipers challenge carbon fiber stitching(US $134,900.00)

F1 shields calipers challenge carbon fiber stitching(US $134,900.00) 2006 ferrari approved cpo 430 coupe, rosso corsa/beige(US $129,900.00)

2006 ferrari approved cpo 430 coupe, rosso corsa/beige(US $129,900.00) 2005 ferrari f430 spider nart blue/beige f1 navi only 2900 miles(US $145,900.00)

2005 ferrari f430 spider nart blue/beige f1 navi only 2900 miles(US $145,900.00) 2006 ferrari 430 spider f1 yellow/black daytonas shields carbon stitching bt

2006 ferrari 430 spider f1 yellow/black daytonas shields carbon stitching bt

Auto Services in Florida

Zephyrhills Auto Repair ★★★★★

Yimmy`s Body Shop & Auto Repair ★★★★★

WRD Auto Tints ★★★★★

Wray`s Auto Service Inc ★★★★★

Wheaton`s Service Center ★★★★★

Waltronics Auto Care ★★★★★

Auto blog

Ferrari vs. Ferrari: Cut convertibles unloved by collectors?

Mon, 05 Aug 2013The New York Times' Wheels blog has a really interesting story on a pair of Ferraris that are set to be auctioned off in Monterey during the Pebble Beach Concours d'Elegance. While the two cars are similar on the surface, their differing histories and Ferrari's attitude towards one of them has led to a sort of experimental auction process.

On the one hand, we have one of ten 1967 275 GTB/4 NART Spiders, in the classic Rosso Corsa and appearing at RM Auctions and seen above. On the other, we have a Fly Yellow version that started life as a 1965 275 GTB Coupe, and was converted into a NART Spider. Called a "cut" car, this particular replica is one of about 100 GTB Coupes that were converted into convertibles to satiate the climbing demand for ultra-rare Spiders.

This will mark one of the first times that an original NART Spider will go toe to toe with a replica of itself at auction, and will answer a number of questions about just how important provenance is in the collector car world. Head on over to The Times blog for the full story.

Ferrari renews partnership with Marlboro [UPDATE]

Mon, May 18 2015Formula One and Big Tobacco may have parted ways years ago, but the alliance between Ferrari and Marlboro continues on, apparently as strong as ever. Though neither party has made any official announcement or revealed any details of the arrangement, reports from the motorsport press indicate that the Scuderia and Philip Morris – the tobacco company which owns the Marlboro brand – have signed an extension of their longstanding partnership. Marlboro first arrived in Maranello way back in 1973, ramping up over the years to become its main sponsor by '93. The Italian outfit changed its name to Scuderia Ferrari Marlboro after the tobacco brand parted company with McLaren in '97. After tobacco advertising was ultimately banned in 2006 (at least in Europe), Ferrari was forced to remove the Marlboro branding from its cars, but the name stuck – and so did the logo, in various forms of obscurity and subliminality through 2010. The Marlboro name was dropped from the team's handle in 2011, but that didn't stop the two from renewing their partnership. And now they've reportedly extended again through 2018. Though the deal hardly comes as a surprise (even given the complete lack of discernible public association between the two), we don't doubt that Maurizio Arrivabene – the former Marlboro exec who recently took over the struggling team – had something to do with it. UPDATE: A spokesman for Scuderia Ferrari downplayed the significance of the story, telling Autoblog by correspondence that "the contract is extended through 2018 and details are confidential." UPDATE 2: Philip Morris International responded to our inquiry with the following statement: "Our agreement with Ferrari has been extended beyond 2015, but we are not in a position to provide financial or other details. This partnership provides us with opportunities such as enabling our adult consumers and business partners to experience motor racing through Ferrari factory visits and attending F1 races."

Exotic cars caught on video racing on neighborhood streets in Beverly Hills

Thu, Sep 17 2015A pair of supercars caught on camera racing around a quiet Beverly Hills neighborhood last week has residents fearing for their safety. The video shows a white Porsche 911 and a yellow Ferrari LaFerrari as they clipped parked cars and blew through stop signs while residents of the upscale community watched in horror. Freelance cameraman Jacob Rogers shot the video of the supercar shenanigans. He later confronted a man outside the house where the Ferrari eventually parked. He asked the man if he cared that he was endangering people's lives. The man became combative and claimed he had diplomatic immunity. "He told me verbatim, 'I could have you killed and get away with it,'" Rogers told NBC Los Angeles. "I told him, 'the press is allowed to be here on the sidewalk on a public street.' He said, '(Expletive) America' and threw a cigarette at me." The Ferrari's plates are from the oil-rich country of Qatar. The race ended with the Ferrari pulling into the driveway of a $45,000-per-month rental home, its engine compartment smoking. Police can be seen arriving in the neighborhood. Los Angeles police are currently investigating the incident. Even though the LaFerrari was still smoking when police arrived they haven't filed charges because no officer witnessed the illegal activities. When police approached the owner of the vehicle he denied doing anything illegal and again claimed diplomatic immunity. Police told NBC they are in contact with the State Department about the man's diplomatic status and the legality of the cars in the neighborhood. Beverly Hills isn't the only swanky zip code plague by hotshot supercar owners. Some of the most expensive homes in London can be found In the Knightsbridge neighborhood - and some of the most expensive cars as well. This summer, the local council of Knightsbridge and nearby Chelsea began exploring a Public Space Protection Order that would fine drivers who rev their engines, drag race on residential streets or blare music, according to Reuters UK. News Source: NBC Los Angeles Government/Legal Ferrari Porsche Racing Vehicles Supercars Videos illegal