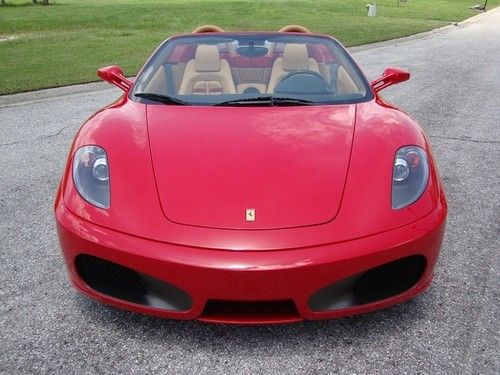

F1 Spider Red/tan 8k Mi, Daytona, Inserts, Shields, Calipers on 2040-cars

New Port Richey, Florida, United States

For Sale By:Dealer

Engine:4.3L 4308CC V8 GAS DOHC Naturally Aspirated

Body Type:Convertible

Fuel Type:GAS

Transmission:F1

Warranty: No

Make: Ferrari

Model: F430

Trim: Spider Convertible 2-Door

Doors: 2

Fuel: Gasoline

Drive Type: RWD

Drivetrain: RWD

Mileage: 8,034

Number of Doors: 2

Sub Model: F1 Spider

Exterior Color: Red

Number of Cylinders: 8

Interior Color: Tan

Ferrari 430 for Sale

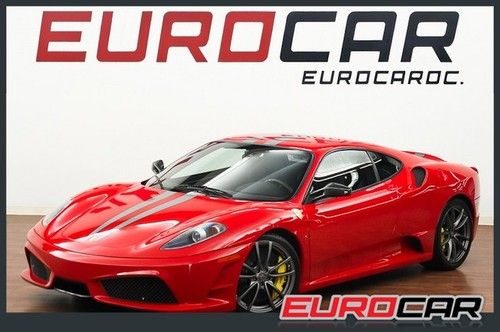

Low miles carbon fiber carbon ceramic brakes racing stripes museum car pristine(US $209,888.00)

Low miles carbon fiber carbon ceramic brakes racing stripes museum car pristine(US $209,888.00) Carbon ceramic brakes, daytona seats, shields, f1 transmission......(US $179,000.00)

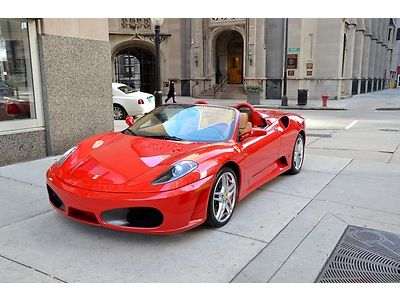

Carbon ceramic brakes, daytona seats, shields, f1 transmission......(US $179,000.00) Challenge grille+shields+power seats+upgraded audio+carbon fiber(US $129,999.00)

Challenge grille+shields+power seats+upgraded audio+carbon fiber(US $129,999.00) 2007 f430 spider f1, one-of-a-kind, only 4900 miles, highly optioned, pristine!(US $159,888.00)

2007 f430 spider f1, one-of-a-kind, only 4900 miles, highly optioned, pristine!(US $159,888.00) Black 2007 ferrari f430 f1 spider single owner(US $139,900.00)

Black 2007 ferrari f430 f1 spider single owner(US $139,900.00) 2007 ferrari f430 coupe - f1 - scuderia - daytonas - fresh service and new tires(US $129,995.00)

2007 ferrari f430 coupe - f1 - scuderia - daytonas - fresh service and new tires(US $129,995.00)

Auto Services in Florida

Your Personal Mechanic ★★★★★

Xotic Dream Cars ★★★★★

Wilke`s General Automotive ★★★★★

Whitehead`s Automotive And Radiator Repairs ★★★★★

US Auto Body Shop ★★★★★

United Imports ★★★★★

Auto blog

1971 Ferrari 365 GTB/4 Daytona could be world's first great 'condo find' [w/video]

Thu, Dec 11 2014Barn finds are the absinthe of the collector car world right now. They're highly intoxicating and a bit of the 'flavor of the month.' An actual barn isn't necessary, just some form of out-of-the-way long-term storage that involves a car being out of circulation for a long period of time, remaining complete with the time-capsule-like detritus of their slumber-yellowed newspapers, vintage eight-tracks or real pay dirt like a telex printout from Howard Hughes or a receipt from the Playboy Club. RM Auctions has just announced perhaps the first 'condo find' in a 1971 Ferrari 365 GTB/4 Daytona coupe that had been stored in a Toronto condominium building for a quarter century. Like any good barn find, this Ferrari is still covered in a layer of thick dust (the removal of which would likely devalue the car considerably) and still has a cartridge entitled "Disco Rock" shoved in its original eight-track player. And while the one and only owner's taste in music may have been questionable, his taste in cars wasn't. The Daytona was the last front-engine V12 two-seater Ferrari produced during the so-called Enzo-era, when founder Enzo Ferrari was still in command of the company. With its 172 mph top speed, a Daytona was famously used by Dan Gurney and Brock Yates in setting a coast-to-coast record of 35 hours and 54 minutes to win the first Cannonball Baker Sea-to-Shining-Sea Memorial Trophy Dash in 1971. An impulse trip to the Geneva Motor Show in the same year by a Toronto businessman saw him purchase the Daytona where he spent a month touring Europe before sending the car back to Canada on the Queen Elizabeth II. He drove it for eighteen years and put a whopping 90,000 kilometers – 56,000 miles – on the car prior to putting the car up on blocks in a condo garage before a trip to Asia that he anticipated would last just six months. The car remained in that spot until November 14, 2014. The car that originally sold for $18,000 in Geneva, Switzerland in 1971 is expected to bring in excess of $600,000 at RM Auction's Amelia Island sale in March. Carwash not included. This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings. 1971 Ferrari 365 GTB/4 Daytona Berlinetta Chassis no. 14385 Body no.

Ferrari IPO may turn out to be good news for enthusiasts

Tue, Oct 27 2015Sergio Marchionne's strategy to spin off Ferrari from FCA and make the Italian automaker a publicly traded company has been met with ire from a vocal contingent of enthusiasts ever since rumors about the plan began to surface a few years ago. Some of these particularly pessimistic automotive pundits have voiced fears that with stockholders in the mix, it would not only spell the demise of the exclusive Italian supercar maker as we know it, but would in fact "ruin" the company. Call me dense, but I fail to see what the issue is. That isn't to say that I don't understand what's causing the fear. When profitability becomes a higher priority for a brand that's historically relied on exclusivity to keep its products in the highest echelons of desirability, there's a high potential for internal philosophical conflict. And then there are concerns about the sorts of products that Ferrari might develop that aren't the high-performance sports cars that the brand is known for. But individuals with those apprehensions seem to forget that Ferrari has already lent its name to a multitude of things that are not LaFerraris, 488 GTBs, or F12 Berlinettas, including clothing, headphones, and even laptops. But let's assume for a moment that the core anxiety is about future vehicles – including the unspeakable notion that Ferrari might develop an SUV. Why wouldn't Ferrari build an SUV, especially after seeing how incredibly successful that endeavor has been for Porsche? I think it's likely that Ferrari will put engineers to task creating some sort of crossover or high-rolling cruiser with room for the whole family at some point in the near future. And why wouldn't it, after seeing how incredibly successful that endeavor has been for Porsche? After all, the Cayenne accounted for more US sales in 2013 than the Boxster, Cayman, 911, and 918 combined, and it only gave up about a thousand units of sales last year to make room for the Macan crossover, the latter of which Porsche sold nearly as many of as it did Boxsters and Caymans. People want these vehicles, and they're willing to pay quite a bit of money for them. If we use Porsche's recent trajectory as a foreshadowing metric for what's in store for Ferrari, the future actually looks pretty good. After all, those SUV sales keep plenty of cash in Porsche's coffers for the low-volume projects that we enthusiasts love, like the 918 Spyder and the 911 GT3 RS.

In case you forgot, the Dubai Police supercar fleet is the coolest

Tue, Feb 10 2015Ever wonder why the Dubai Police have a fleet of vehicles worth millions and millions and millions of dollars? Why it has a Bugatti Veyron and a Bentley Continental and a Mercedes-Benz SLS AMG with sirens and light bars? Well, here's the reason. This video shows the fleet on display on the Emirate's roads and highways, while also reaching out to the people the police are meant to protect. It's an impressive display of machinery, to be sure. Alongside the Bentley, Bugatti and Mercedes, we spy a Ferrari FF, a Brabus G-Wagen, a BMW M6, a Nissan GT-R, an Audi R8 and a McLaren MP4-12C (although the latest Dubai Police car, the Lexus RC F, is absent). The video even has a very cinematic look and feel to it, which works well with the night scenes and the blues-and-twos of the exotics cruisers. News Source: Dubai Police via YouTube Audi Bentley BMW Bugatti Ferrari McLaren Mercedes-Benz Nissan Luxury Performance Videos dubai ferrari ff mclaren 12c