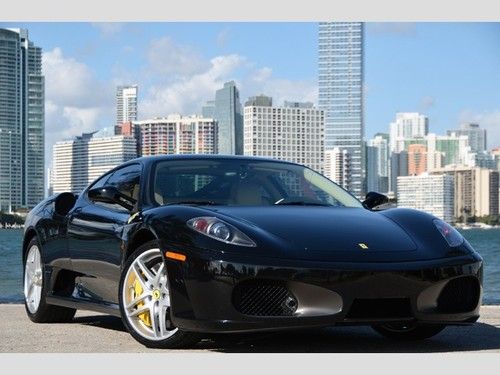

Black 2007 Ferrari F430 F1 Spider Single Owner on 2040-cars

Los Angeles, California, United States

Vehicle Title:Clear

Engine:4.3L V-8

Fuel Type:Gasoline

For Sale By:Dealer

Number of Cylinders: 8

Make: FERRARI

Model: 430

Trim: SPIDER 2DR CONVERTIBLE

Options: Leather Seats, Convertible

Safety Features: Anti-Lock Brakes, Driver Airbag, Passenger Airbag, Side Airbags

Drive Type: REAR-WHEEL

Power Options: Air Conditioning, Cruise Control, Power Locks, Power Windows, Power Seats

Mileage: 22,943

Exterior Color: Black

Interior Color: Black

Ferrari 430 for Sale

2007 ferrari f430 coupe - f1 - scuderia - daytonas - fresh service and new tires(US $129,995.00)

2007 ferrari f430 coupe - f1 - scuderia - daytonas - fresh service and new tires(US $129,995.00) 2005 ferrari f430 berlinetta f1 coupe in new condition only 8500 miles

2005 ferrari f430 berlinetta f1 coupe in new condition only 8500 miles 2005 ferrari f-1 430 spider(US $129,900.00)

2005 ferrari f-1 430 spider(US $129,900.00) 2006 ferrari f430 spider convertible 2-door 4.3l

2006 ferrari f430 spider convertible 2-door 4.3l 2007 ferrari f430 f1 berlinetta coupe f1 2-door coupe(US $144,950.00)

2007 ferrari f430 f1 berlinetta coupe f1 2-door coupe(US $144,950.00) 2007 red!(US $118,800.00)

2007 red!(US $118,800.00)

Auto Services in California

Z Auto Sales & Leasing ★★★★★

X-treme Auto Care ★★★★★

Wrona`s Quality Auto Repair ★★★★★

Woody`s Truck & Auto Body ★★★★★

Winter Chevrolet - Honda ★★★★★

Western Towing ★★★★★

Auto blog

Mercedes sues Ferrari-bound F1 engineer for stealing secrets

Tue, Dec 8 2015Mercedes is suing one of its Formula One engineers, one Benjamin Hoyle, claiming he was planning to take sensitive data to a competitor. An experienced powertrain engineer, Hoyle came to Mercedes AMG High Performance Powertrains in 2012 with previous experience at Prodrive and Cosworth. One of four team leaders at the company, Hoyle headed up the performance application department until he notified his employers of his intention not to seek renewal of his contract that expires at the end of this year. Once they found out that Hoyle was switching to Ferrari, the higher-ups at Mercedes reassigned him to other, less sensitive duties, however Hoyle was reportedly discovered accessing race reports and other sensitive data relating to the performance of the team's engines. In response, Mercedes has filed suit against Hoyle, claiming that he "and potentially Ferrari have gained an unlawful advantage." The German automaker is seeking the return of all documents and the payment of its legal fees. It also seeks to prevent Hoyle from working for another F1 team throughout next season. Mercedes AMG High Performance Powertrains is the Daimler's F1 engine division. Based in Brixworth, UK, it was founded back in 1983 together with Ilmor before Mercedes bought it outright. Aside from the company's own works team, the outfit this year powered Williams, Lotus, and Force India, and previously worked with McLaren as well as Sauber. This is not the first time that a case of industrial espionage has emerged in F1. A similar controversy erupted in 2007 surrounding engineers Nigel Stepney and Mike Coughlan. The highly publicized incident became known as "Spygate" or "Stepneygate" and involved the illegal sharing of secrets between Ferrari, McLaren, and Renault. News Source: BloombergImage Credit: Martin Meissner/AP Government/Legal Hirings/Firings/Layoffs Motorsports Ferrari Mercedes-Benz F1 industrial espionage

John Lennon's first car being sold at auction

Thu, 09 May 2013This is what you get as your first car after you've just passed your driver's test at the age of 25: a 1965 Ferrari 330GT 2+2 Coupe. Of course, that's assuming your name also happens to be John Lennon and you've just helped record Ticket to Ride with the rest of your Beatles cronies.

When news of Lennon getting a driver's license made the newspapers in England, luxury car makers parked outside his mansion with offerings and this is the one he chose, painted Azzuro Blue with a blue interior. He paid 6,500 pounds, said to be equivalent to 110,000 pounds today ($170K US).

Bonhams will be auctioning the blue Italian at this year's Goodwood Festival of Speed on July 12. It was just one of 500 built, has been restored to its original condition, has matching numbers and its original license plate number. The pre-auction estimate is between 180,000 and 220,000 pounds ($278K - $340K US).

Ferrari chairman ticked off by Alonso

Wed, 31 Jul 2013Luca Cordero di Montezemolo does not strike us as the kind of person we'd want to cross. We imagine the Chairman of Ferrari as sort of like an automotive Don Corleone, a thought that is further confirmed when we hear about the aftermath of last weekend's Hungarian Grand Prix.

Fernando Alonso made some unsubstantiated remarks that have angered his team, with The Daily Mail reporting that when asked after the race what he wanted for his birthday, the Spaniard responded "Someone else's car." And while no one seems to know exactly what was said, it was enough to prompt a personal phone call from the boss of Ferrari on Alonso's birthday for a dressing down.

Montezemolo reminded Alonso that, "All the great champions who have driven for Ferrari have always been asked to put the interests of the team above their own. This is the moment to stay calm, avoid polemics and show humility and determination in making one's own contribution, standing alongside the team and its people both at the track and outside it."