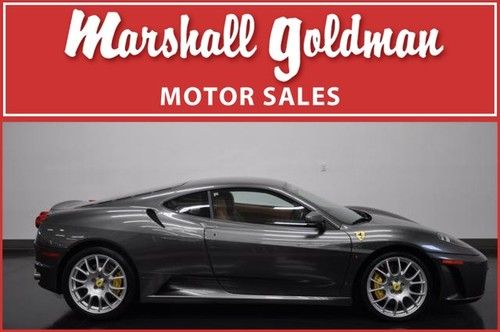

2007 Ferrari F430 Coupe F1 Silverstone Metallic Cuioi Shields Dayt 12,300 Miles on 2040-cars

Cleveland, Ohio, United States

For Sale By:Dealer

Engine:4.3L 4308CC V8 GAS DOHC Naturally Aspirated

Body Type:Coupe

Transmission:Automatic

Fuel Type:GAS

Warranty: Vehicle does NOT have an existing warranty

Make: Ferrari

Model: F430

Trim: Base Coupe 2-Door

Disability Equipped: No

Doors: 2

Drive Type: RWD

Drive Train: Rear Wheel Drive

Mileage: 12,318

Number of Doors: 2

Exterior Color: Gray

Interior Color: Tan

Number of Cylinders: 8

Ferrari 430 for Sale

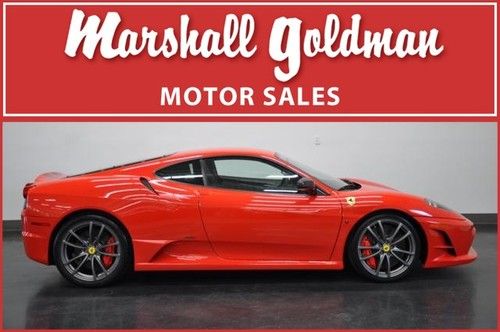

2008 ferrari 430 scuderia in scuderia red 4800 miles ceramic brakes(US $188,900.00)

2008 ferrari 430 scuderia in scuderia red 4800 miles ceramic brakes(US $188,900.00) 2005 ferrari f430 spider f1 novitec pkg

2005 ferrari f430 spider f1 novitec pkg Rosso calipers cd changer carbon fiber daytona electric shields nav sensors hifi(US $169,900.00)

Rosso calipers cd changer carbon fiber daytona electric shields nav sensors hifi(US $169,900.00) 2005 ferrari f430 430 spider f1 black nero / great condition / 12 in stock(US $137,777.00)

2005 ferrari f430 430 spider f1 black nero / great condition / 12 in stock(US $137,777.00) 2007 ferrari f430 coupe f1 / low miles / 7k / rosso corsa / beige / 430 / f 1(US $139,999.00)

2007 ferrari f430 coupe f1 / low miles / 7k / rosso corsa / beige / 430 / f 1(US $139,999.00) 2006 ferrari f430 spider / giallo modena / 6 speed manual transmission / 430(US $139,999.00)

2006 ferrari f430 spider / giallo modena / 6 speed manual transmission / 430(US $139,999.00)

Auto Services in Ohio

Weber Road Auto Service ★★★★★

Twinsburg Brake & Tire ★★★★★

Trost`s Service ★★★★★

TransColonial Auto Service ★★★★★

Top Tech Auto ★★★★★

Tire Discounters ★★★★★

Auto blog

Formula 1 seeking independent engine supplier

Mon, Oct 26 2015Formula 1 could get a new engine supplier in the near future, if Bernie Ecclestone and the independent teams gets their way. According to Autosport, the FIA is soon to open the contract up for bids, and there are already several manufacturers that have expressed interest. Currently Mercedes, Ferrari, Renault, and Honda supply engines – both to their own premier teams (Red Bull and McLaren for the latter two) but also to other teams like Williams, Sauber, and Toro Rosso. Because the new turbocharged V6 hybrid power units cost those four suppliers so much to develop, they're charging their customer teams big bucks – around $20-30 million per season – to provide the engines. These costs are much higher than the $10 million or so it used to cost to purchase a V8 engine under the previous regulations. Ecclestone figures it's time to bring in another supplier who will not run their own team and not play favorites, but will supply engines to private teams at a lower cost. There are already a number of potential suppliers under consideration. One of them is said to be Cosworth, which has a long history in the series stretching back to 1963. The British firm stepped back between 2007 and 2009, returned in 2010, and dropped out again after 2013. The development could be of particular benefit to Red Bull, which has been unable to find an engine supplier and could be forced out of the series as a result. The team has long been powered by Renault, but that relationship has grown sour. And the other three engine manufacturers have not been forthcoming in offering an alternative arrangement for the team. Related Video: News Source: AutosportImage Credit: Cosworth Motorsports Ferrari Honda Infiniti McLaren Mercedes-Benz Renault F1 engine contract

Ferrari 458 with $1M wheels still hasn't found a buyer [w/video]

Sat, 27 Jul 2013Rule number one of modifying a car: When it comes time to sell, people want to pay for the car, and could care less how much you spent in the aftermarket. This is a lesson that the guys at Latitude Wheels in Miami are currently learning.

The wheel company's "flagship show car," a 2011 Ferrari 458 Italia was put up for sale on eBay weeks ago, as reported by Jalopnik. The price? Just a shade under $1.3 million. For a 458 Italia. That normally starts around $230,000. Yeah.

Latitude justifies the car's price based on a very expensive set of wheels. To be exact, the 21-inch fronts and 22-inch rears are forged Vossen Precision Series wheels. Mounted on Pirelli rubber, Latitude claims the package is worth over $1 million. Add onto that the $20,000 in Novitec Rosso carbon fiber pieces - none of the fun, performance stuff Novitec is known for - and you come to an eBay starting price of $1,290,000.

Ferrari 458 Speciale A trots out its 597 sun-drenched ponies [w/video]

Thu, Oct 2 2014To say that Ferrari has made some powerful drop-tops over the years would be like saying the Pope has been known to make a couple of blessings here and there. There was the F50, the 575 Superamerica and the 599 SA Aperta, to name just a few. But this is the most powerful Spider it has ever made. Taking its curtain call at the Paris Motor Show today is the new Ferrari 458 Speciale A – successor to the F430-based 16M Scuderia Spider and lovechild of the 458 Spider and 458 Speciale. That means it's got the same 4.5-liter V8 – all 597 horsepower and 398 pound-feet of it – as the Speciale coupe, but with the folding aluminum roof from the Spider. Best of both worlds, as they say - especially with a 0-62 time quoted at three seconds flat. But since Maranello will only produce less than 500 of them, you'd better check it out in our gallery of live shots above. This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings.