2006 Ferrari F430 Spider Convertible 2-door 4.3l on 2040-cars

Fort Lauderdale, Florida, United States

Ferrari 430 for Sale

05 ferrari f430 spider f1 navi gps

05 ferrari f430 spider f1 navi gps 2007 ferrari f430 f1 coupe mirabeau blue beige leather 8,100 miles ceramics tubi(US $144,900.00)

2007 ferrari f430 f1 coupe mirabeau blue beige leather 8,100 miles ceramics tubi(US $144,900.00) F430 spider daytona seats f1 transmission 9800 miles leather yellow

F430 spider daytona seats f1 transmission 9800 miles leather yellow Ferrari 430 f1, all options, ceramic brakes, absolutely pristine,(US $159,777.00)

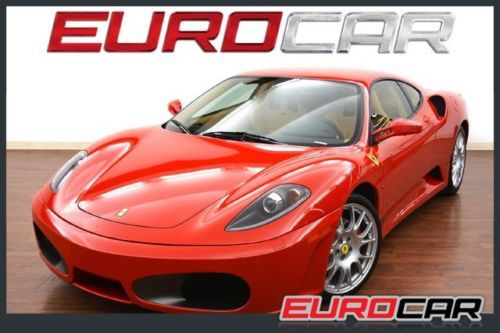

Ferrari 430 f1, all options, ceramic brakes, absolutely pristine,(US $159,777.00) 2006 ferrari f430 coupe f1 red beige hifi carbon fiber

2006 ferrari f430 coupe f1 red beige hifi carbon fiber National finance! documented svc history since new including recent!

National finance! documented svc history since new including recent!

Auto Services in Florida

Zip Auto Glass Repair ★★★★★

World Of Auto Tinting Inc ★★★★★

Wilson Bimmer Repair ★★★★★

Willy`s Paint And Body Shop Of Miami Inc ★★★★★

William Wade Auto Repair ★★★★★

Wheel Innovations & Wheel Repair ★★★★★

Auto blog

1954 Ferrari 375 MM Scaglietti Coupe named Best In Show at Pebble Beach Concours d'Elegance

Sun, 17 Aug 2014For the first time in the event's 64-year history, the prestigious Best In Show honor at the Pebble Beach Concours d'Elegance has been awarded to a Ferrari. The 1954 375 MM Scaglietti Coupe seen here is owned by car collector Jon Shirley of Medina, WA, and as it turns out, has quite a rich history.

Nevermind the fact that it's currently one of five road-going 375 MMs - this example was ordered by film director Roberto Rossellini, and was actually born as a Pininfarina-bodied competition Spyder. Following an accident, the car's original body wasn't able to be saved, but the chassis was sent to Carrozzeria Scaglietti in Modena for replacement, and the finished product became the company's first passenger car design for Ferrari.

Following its tenure with Rossellini, the car was owned by Mario Savona of Palermo, and later Charles Robert of Paris. Years later, the car was restored by its current owner in 1995, after being found in an underground garage in a Paris suburb.

Ferrari 250 GTO heading to The Quail with no reserve

Fri, 04 Jul 2014It's not every day that a Ferrari 250 GTO changes hands. It is, after all, one of the most highly coveted cars ever made, and there were only 39 of them built in the first place. So when one goes up for sale, it tends to fetch millions. Tens of millions, actually, and the prices keep escalating.

Throughout most of the 1980s they were trading hands for six figures. In 1989 one sold for $10 million. A few months later, $13 million. Prices fluctuated in the 90s, but by 2012, one sold for a whopping $35 million, eclipsed the following year at $52 million. Nobody knows what the next one will sell for, but we're about to find out.

That's because Bonhams has got one consigned for its upcoming auction at the Quail Lodge during Monterey weekend next month. And it's offering it without reserve, meaning that it could sell for the opening bid (however unlikely), it could break the previous record or it could land anywhere in between or beyond.

What's the smarter investment, Ferrari stock or a Ferrari?

Sun, Jul 26 2015Fiat Chrysler Automobiles is gearing up to spin Ferrari off into its own company, and float some of its shares on the stock market. But buying and trading in Ferrari stock could face a rather unlikely competitor from within. As Bloomberg points out, the values held by classic Ferraris keeps going up, and by no small margin. Even something as relatively humble as the 80s-era Testarossa, for example, has nearly doubled in value over the past year alone. Meanwhile the value of some models – particularly those built in the 1950s, 60s, and 70s – have skyrocketed nearly seven-fold since 2006. Just look at the 250 GTO, one of the most coveted of classic Ferraris among collectors: not taking inflation into account, they were worth thousands in the late 60s, were already selling for hundreds of thousands in the 1980s, and by now are trading hands – on the rare occasion when they do trade hands – for tens of millions. One sold in 2004 for $10 million, and another in 2013 for over $50 million. Those kinds of increases can make a vintage Ferrari seem like a sound investment. That might make it difficult for Ferrari's stock to compete. The company hopes investors will view it as a luxury goods manufacturer along the likes of Prada, Hermes, or Louis Vuitton Moet Hennessy, the stocks of which tend to increase in value at a greater rate than those of most automakers. But even the best of those luxury stocks have merely doubled in value since 2006, compared to the aforementioned seven-fold increase enjoyed by some classic Ferraris over the same period. Add to that the prospect of actually getting to enjoy owning a classic Ferrari – albeit at the risk of damaging it and hindering its value – and the idea of investing in Maranello's products instead of its stock can seem like a much more enticing prospect. Related Video: