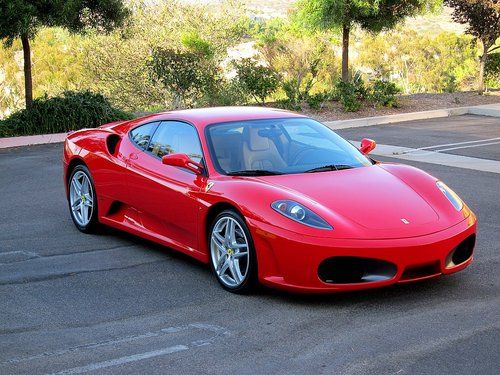

2005 Ferrari F1 F430 Coupe 6-speed Red Calipers Leather 12k Miles on 2040-cars

Houston, Texas, United States

Engine:8

Fuel Type:Gasoline

For Sale By:Dealer

Transmission:Manual

Body Type:Coupe

Cab Type (For Trucks Only): Other

Make: FERRARI

Warranty: Vehicle does NOT have an existing warranty

Model: 430

Mileage: 12,606

Exterior Color: Red

Disability Equipped: No

Interior Color: Tan

Doors: 2

Drive Train: Rear Wheel Drive

Ferrari 430 for Sale

2008 ferrari f430 f1 spider yellow challenge rims carbon fiber bose 6k mi(US $179,991.00)

2008 ferrari f430 f1 spider yellow challenge rims carbon fiber bose 6k mi(US $179,991.00) 2005 ferrari f430 spider f1! carbon! daytonas! loaded!!(US $139,900.00)

2005 ferrari f430 spider f1! carbon! daytonas! loaded!!(US $139,900.00) $1149 mo. w.a.c.,f1, shields, carbon interior pkg,yellow calipers, pwr. daytonas(US $167,900.00)

$1149 mo. w.a.c.,f1, shields, carbon interior pkg,yellow calipers, pwr. daytonas(US $167,900.00) 2006 ferrari f430 f1 red tan 4600 miles as new! $197k msrp 100% california rare(US $146,500.00)

2006 ferrari f430 f1 red tan 4600 miles as new! $197k msrp 100% california rare(US $146,500.00) Brnd new clutch,nxt major service 9/14,all books,keys,covers,tools(US $137,500.00)

Brnd new clutch,nxt major service 9/14,all books,keys,covers,tools(US $137,500.00) 2005 ferrari f430 430 coupe / f1 / f-1 / stereo / exhaust / stock available(US $135,888.00)

2005 ferrari f430 430 coupe / f1 / f-1 / stereo / exhaust / stock available(US $135,888.00)

Auto Services in Texas

Wolfe Automotive ★★★★★

Williams Transmissions ★★★★★

White And Company ★★★★★

West End Transmissions ★★★★★

Wallisville Auto Repair ★★★★★

VW Of Temple ★★★★★

Auto blog

2015 Ferrari 458 Italia to go turbo?

Wed, 04 Jun 2014Forced induction has definitely hit trend status when it comes to performance cars. Whether it's the supercharged Hellcat V8 in the Dodge Challenger SRT, the latest twin-turbocharged M3/M4 or even the entry-level speed of the Ford Fiesta ST, if you want the fastest car in any given segment, in all likelihood it has a turbo or supercharger. Even Ferrari hasn't avoided the bandwagon with the latest iteration of the California that replaces the original 4.3-liter V8 with a 3.9-liter turbo V8 offering 552 horsepower for more power and better fuel economy. If recent rumors prove true, it might not be the only Prancing Horse to use this engine for long.

According to Car in the UK, Ferrari is planning to boost the 3.9-liter V8 up to around 670 hp and place it in a refreshed 458 Italia in 2015. If true, that is an astounding increase over the version from the latest California and a roughly 70-hp improvement over the current 458 Speciale.

The extra power would come with a serious challenge of how to maintain the 458's delicious exhaust note. Turbocharged engines are often quieter than their naturally aspirated counterparts, modern Formula One cars serving as a prime example. The California may get a pass because it's more of a GT, but the 458 is the brand's bread-and-butter sports car. It needs to sound like a proper Ferrari V8. However, Car claims Maranello is a step ahead and has a complicated exhaust layout - as is the case with the California T, we might add - ready to keep much of the characteristic yelp in tact.

Stellantis says its 2021 performance has been better than expected

Thu, Jul 8 2021MILAN — Stellantis softened up investors ahead of its electrification strategy event on Thursday by flagging that 2021 got off to a better-than-expected start despite a chip shortage that has hit automakers worldwide. Stellantis, which was formed in January from the merger of Italian-American automaker Fiat Chrysler and France's PSA, faces an investor community keen to hear how it plans to come up with a range of electrified vehicles (EVs) to rival Tesla. At its "EV Day 2021" kicking off at 1230 GMT, Stellantis will disclose significant investments in electrification technology and connected software as it aims to be an industry frontrunner, it said in a statement. In April, Chief Executive Carlos Tavares said it would offer low-emission versions — either battery or hybrid electric — of almost all of its European models by 2025, and they should make up 70% of European sales and 35% of U.S. sales by 2030. Stellantis, the world's fourth-biggest automaker, has 14 brands in its stable, including Jeep, Ram, Opel, Fiat, Peugeot and Maserati.  Stellantis EV Day coverage: Dodge will launch the 'world's first electric muscle car' in 2024 Fully electric Ram 1500 will begin production in 2024 Jeep will have 4xe plug-in hybrid models across the lineup by 2025 Stellantis teases mystery electric Chrysler concept Stellantis previews 4 electric platforms: Here's how they'll be used Fiat says all Abarth models to be electric from 2024 Opel Manta E will be the electric revival of the classic German coupe Stellantis says its 2021 performance has been better than expected  At a similar EV strategy event last week, French rival Renault announced that 90% of its main brand models would be all-electric by 2030, whereas previously it had included hybrids in its target. Germany's Volkswagen, the world's second-biggest automaker after Toyota, expects all-electric vehicles to make up 55% of its total sales in Europe by 2030, and more than 70% of sales at its Volkswagen brand. Stellantis said its margins on adjusted operating profits in the first half of 2021 were expected to exceed an annual target of between 5.5% and 7.5%, despite production losses due to a global shortage of semiconductor supplies. Stellantis shares listed in Milan were down 2.6% at 0920 GMT, underperforming the broader European car index. Bestinver analyst Marco Opipari said Thursday's news was positive but that the stock was suffering from profit taking as it had moved up about 20% since the end of April.

Bonhams auction at Quail Lodge led by 1959 Ferrari 250 GT Competizione

Sat, Aug 15 2015It doesn't take too much knowledge of the classic car market to figure out that, when it comes to values, Ferrari leads the pack. Bonhams 2015 Quail Lodge Auction did absolutely nothing to buck that trend with four of the five top sellers bearing the Prancing Horse. While none came near the auction house's sale of a 1962 Ferrari 250 GTO for $38.115 million last year, there were still beauties in the bunch. The leader among these thoroughbreds was a 1959 Ferrari 250 GT Competizione Alloy Berlinetta (pictured above) that went for $8.525 million, including the buyer's premium. It was one of just seven vehicles made to this specification and raced extensively when new, scoring a win in competition at Watkins Glen. A classic 1971 Ferrari 365 GTS/4 Daytona Spider brought $2.64 million, and a somewhat more modern 1985 288 GTO had the hammer drop at $2.365 million. The final Prancing Horse in the top five was a 1951 212 Inter Cabriolet with a body by Vignale for $2.2 million. It scored second-in-class at the 2014 Pebble Beach Concours d'Elegance. Overturning the Ferrari trend, a 1955 Lancia Aurelia B24S Spider America rounded out the top five with a sale price of $1,952,500. While these are the most expensive vehicles to cross the block, you can check Bonhams' website for the results on all 111 lots. It's a wonderful array of largely European sports cars that are all in top shape.