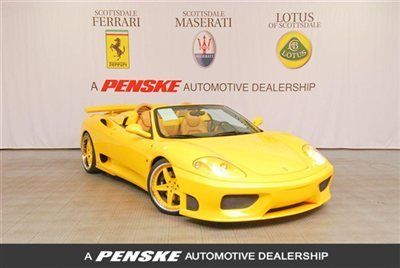

Shields + Low Miles!! + F1 + Modular Whls + Rare Sunroof on 2040-cars

Richardson, Texas, United States

Engine:3.6L V8

Vehicle Title:Clear

For Sale By:Dealer

Model: 360

Warranty: Vehicle does NOT have an existing warranty

Mileage: 19,275

Options: Sunroof

Sub Model: Coupe

Power Options: Air Conditioning, Power Windows

Exterior Color: Yellow

Interior Color: Black

Number of doors: 5 or more

Ferrari 360 for Sale

2003 ferrari 360 spd~novitec body kit~fresh major service~realy clean car~2004(US $105,750.00)

2003 ferrari 360 spd~novitec body kit~fresh major service~realy clean car~2004(US $105,750.00) 2005 ferrari 360 pider low miles (9k!) excellent inside & out black black beauty(US $119,000.00)

2005 ferrari 360 pider low miles (9k!) excellent inside & out black black beauty(US $119,000.00) 2003 ferrari 360 modena spider f1 / low miles 8k / black on tan / super clean!!!(US $107,999.00)

2003 ferrari 360 modena spider f1 / low miles 8k / black on tan / super clean!!!(US $107,999.00) 2005 ferrari 360 spider f1 tour de france blue tdf / low miles / 12 in stock(US $124,999.00)

2005 ferrari 360 spider f1 tour de france blue tdf / low miles / 12 in stock(US $124,999.00) 2004 ferrari 360 modena spider f1 grigio titanio / 12 in stock / great condition(US $109,999.00)

2004 ferrari 360 modena spider f1 grigio titanio / 12 in stock / great condition(US $109,999.00) 2002 ferrari 360 modena coupe 6 speed manual / stick / low miles / super clean(US $97,888.00)

2002 ferrari 360 modena coupe 6 speed manual / stick / low miles / super clean(US $97,888.00)

Auto Services in Texas

Yos Auto Repair ★★★★★

Yarubb Enterprise ★★★★★

WEW Auto Repair Inc ★★★★★

Welsh Collision Center ★★★★★

Ward`s Mobile Auto Repair ★★★★★

Walnut Automotive ★★★★★

Auto blog

Lego provides one of the cheapest ways to own a Bugatti Chiron

Tue, Jan 3 2017Just over a month ago, we got a look at one of the latest Lego Speed Champions sets when Ford revealed the GT and GT40 kit. Now we get to see the rest of the lineup, and it's chock full of F1 and supercar goodness. The official Lego images show that the Bugatti Chiron, Mercedes-AMG GT3, Ferrari FXX K, and F1 cars from Ferrari and Mercedes all made the cut. Each set gets some unique features and most include interchangeable wheel covers. The Chiron comes with some tiny cones suitable for desk slaloms and the Mercedes-AMG GT3 gets an alternate nose. The FXX K comes has the most impressive selection of accessories, though, as it includes a dyno and engine run stand. The F1 sets are divided similarly, but with Mercedes getting more extras. The Brick Fan also reports that the Mercedes kit may be exclusive to select stores. The Ferrari kit only comes with a starting light, but the Mercedes set includes a garage, starting lights, and winner's circle. It'll be up to you whether you put Hamilton or Rosberg in that winner's circle. According to The Brick Fan, these kits are set for release in winter 2017. Since the Ford GT set has a release of March 1, we expect the rest will hit stores in the next couple of months. They're sure to be great additions to anyone's existing Lego garage. Related Video: Featured Gallery 2017 Lego Speed Champions sets News Source: The Brick FanImage Credit: Lego / The Brick Fan Toys/Games Bugatti Ferrari Ford Mercedes-Benz Lego Bugatti Chiron ferrari fxx k

1962 Ferrari 250 GTO Sells For $38 Million At Auction

Fri, Aug 15 2014A 1962 Ferrari 250 GTO became the most expensive car ever sold during an automotive auction Thursday night when a buyer paid $38 million for the vehicle at a Bonhams event. Only 39 of the racers were ever built, and it is a favorite among collectors. One reportedly sold for $52 million in a private sale. If true, it would be the most expensive car ever purchased. Another Ferrari GTO built for legendary racecar driver Stirling Moss sold for $35 million in 2012. Thursday's sale broke the auction record set at a Goodwood auction last year of a Mercedes W196R that was driven by Juan Manuel Fangio to wins in the 1954 German and Swiss Grand Prix races by $8 million. Pretty good for a car that went to the auction block with no reserve, meaning there was no minimum price set for the sale of the car, though bidding started at $11 million, according to the Los Angeles Times. The Ferrari 250 GTO was the star of the show, but it wasn't the only rare Ferrari on the auction block. Bonhams brought ten of the most collectable Ferraris in the world on stage, including a 1962 250 GT Short-Wheelbase Speciale Aerodinamica that went for $6.875 million, a 1953 250 Mille Miglia Berlinetta driven to racing victory by Phil Hill for $7.26 million and even a 1978 312 T3 Formula One car for $2.31 million. All told, the Ferraris sold for $65.945 million, according to Autoblog.

Want to buy a worst-in-show-winning Faux Ferrari Fiero?

Mon, Aug 31 2020UPDATE: This heap sold for $5,001. But don't fret, there are more terrible cars out there for the taking if that's your thing. Today we bring you something truly terrible. It's not just a fake Ferrari built on the guts of an old Pontiac Fiero, it's actually the world's worst fake Ferrari built on the guts of an old Pontiac Fiero. And it's got the award from the Concours d'Lemons to prove it. It's so heinous, in fact, that it has somehow managed to become desirable, at least judging by the bidding history of this bright red affront to Maranello. Powered by a 140-horsepower 2.8-liter V6 engine (covered by an unconvincing and broken fake V12 cover) hooked to an automatic gearbox, this gloriously poor Prancing Horse won't be winning many stoplight drag races. There are bundles of stray wires hanging down from the dashboard, it has high mileage, most of its lights don't work, and it's ugly. Like, really ugly. And to top it off, this Fauxrarri can't currently be registered in its home state of California because it has failed its most recent smog test. Put simply, you're looking at a total piece of junk. But a piece of junk with internet notoriety, having been featured on an episode of Jay Leno's Garage after attending the 2019 Quail Motorsports Gathering — by mistake at first, and then earning a special place next to the porta potties — being the focus of a video series on YouTube and winning the aforementioned ribbon for Worst in Show at Lemons. Somehow, bidding has topped $4,000 at the time of this writing. This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings. If you want to earn the ire of your neighbors — and to be clear, we really wouldn't recommend it — click on over to Cars & Bids to view the auction. There are four days left to hit the "bid" button. Consider yourself warned. Related Video: