Shields+daytonas+f1+challenge Grill+power Seats+hifi on 2040-cars

Richardson, Texas, United States

Vehicle Title:Clear

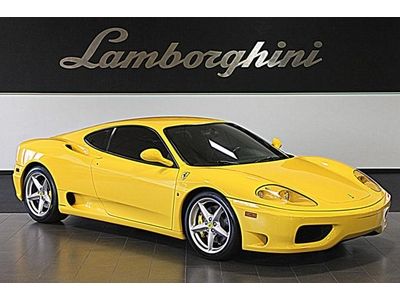

Engine:3.6L 3586CC V8 GAS DOHC Naturally Aspirated

For Sale By:Dealer

Body Type:Coupe

Fuel Type:GAS

Make: Ferrari

Warranty: Vehicle does NOT have an existing warranty

Model: 360

Trim: Modena Coupe 2-Door

Options: Cassette Player

Power Options: Power Locks

Drive Type: RWD

Mileage: 9,773

Number of Doors: 2

Sub Model: Coupe Modena

Exterior Color: Yellow

Number of Cylinders: 8

Interior Color: Black

Ferrari 360 for Sale

1999 ferrari 360 modena f1 red/tan w/ only 39k miles(US $66,888.00)

1999 ferrari 360 modena f1 red/tan w/ only 39k miles(US $66,888.00) 2000 ferrari 360 spider convertible 6speed manual

2000 ferrari 360 spider convertible 6speed manual 2004 ferrari 360 spyder red/tan only 3k miles extremely nice car!(US $107,444.00)

2004 ferrari 360 spyder red/tan only 3k miles extremely nice car!(US $107,444.00) 2005 ferrari 360 spider f1, serviced, blk/blk only 9k miles(US $104,888.00)

2005 ferrari 360 spider f1, serviced, blk/blk only 9k miles(US $104,888.00) Ferrari 360 modena

Ferrari 360 modena 360 spider, only 2,615 miles! challenge grilles, modular wheels, daytona seats(US $119,990.00)

360 spider, only 2,615 miles! challenge grilles, modular wheels, daytona seats(US $119,990.00)

Auto Services in Texas

Zeke`s Inspections Plus ★★★★★

Value Import ★★★★★

USA Car Care ★★★★★

USA Auto ★★★★★

Uresti Jesse Camper Sales ★★★★★

Universal Village Auto Inc ★★★★★

Auto blog

Scuderia Corsa ready to recapture glory at Le Mans

Fri, Jun 16 2017There's nothing else in this world like endurance car racing. Be it a relatively short race like the 6 Hours of Nurburgring or 24-hour endeavors like Le Mans or Daytona, drivers and cars alike are put through long and grueling racing that either ends in triumph or heartbreak. At this year's Detroit Grand Prix, we had a chance to sit down with Scuderia Corsa drivers Alessandro Balzan and Christina Nielsen just hours before they left for France to participate in first practice for the 24 Hours of Le Mans. Scuderia Corsa competes in the IMSA WeatherTech Sportscar Championship team in the GT Daytona class. This is the second year Balzan and Nielsen have partnered, and the relationship has been fruitful. The pair won the class championship in 2016 and are currently sitting in second for 2017. Despite being in the sport longer, this will be Balzan's first attempt at Le Mans. The pair will be joined by American Bret Curtis in the race, usually racing against Balzan and Nielsen behind the wheel of a BMW. "There's a lot to prepare for with this race," Balzan said. "Christina raced there last year, so she's helping me prepare. It's not like any other race, even something like Daytona. There's a lot of preparation that goes into this race." Everything from food intake to sleep schedules has to be adjusted and set appropriately. There's 24 hours of on-track action bookended by pre-race prep and a post-race cool down. Your body and mind must adjust accordingly, and it's not as simple as drinking a few cups of coffee and munching on an energy bar. Scuderia Corsa is the defending class champion at Le Mans, though not with Nielsen behind the wheel. The team is backed by Ferrari and competes with 488 GT3s, a stripped out, lightweight, race-only version of the 488 GTB. The cars share a version the 3.9-liter turbocharged V8, but the rest of the car has been extensively modified, bearing little resemblance beyond styling. "The cars don't share much with the regular car," Balzan said. The interior is all removed and the suspension and aero are all different. It looks similar, but it's really changed. It drives like a totally different car." That's par for the course with GT cars. While they might share more in common with road cars than something like the Porsche 919 Hybrid prototype, the world of race cars and production cars are far removed. That said, Balzan and Nielsen both enjoy the road car correlation.

These are the top 10 highest-grossing auctions of Scottsdale 2015

Tue, Jan 20 2015Scottsdale always brings some pretty high-value metal across the auction block, but this year saw a particularly pricey array of classics trade hands. In fact, Hagerty reports that, with over $292 million in total sales from the various auction houses present, this past holiday weekend saw an 18 percent increase over last year – the second-highest year-to-year increase in Arizona automobile auction history. The Pratte Collection auction handled by Barrett-Jackson sold to the tune of $35.5 million, accounting for a large portion of overall sales, but even without that staggering array of classics, there was still an enviable array of machinery on the block this year. The highest-value lot not only of this year's event but of any year prior was the 1964 Ferrari 250 LM that RM Auctions sold for $9.6 million. And as you might have guessed, Ferraris accounted for the lion's share of the top ten results this year – including the first, second, third, fifth, seventh, eighth and both the lots that tied for tenth place on the list. In fact, three out of the top ten were Ferrari 275s. Coming in second place was the 1966 Ferrari 275 GTB Competizione that Bonhams sold for $9.4 million, which – like the 250 LM – was also raced by Scuderia Filipinetti. It was followed by a '59 Ferrari 250 GT LWB California Spyder sold by Gooding & Company for $7.7 million. Barrett-Jackson sold a '66 Shelby Cobra 427 Super Snake for over $5M, Gooding handled a '62 Ferrari 400 Superamerica ($4M), and Barrett-Jackson's 1950 GM Futurliner brought in another $4M for charity. The remaining top ten was filled out by a '67 Ferrari 275 GTB/4 ($3.6M – RM), a '73 Ferrari 365 GTS/4 Daytona Spyder ($3.3M – RM), and a '54 Pontiac Bonneville Special Motorama concept ($3.3M – BJ), with a '66 Ferrari 275 GTB/2 Longnose and an '84 Ferrari 288 GTO tying for tenth place at $2.75M apiece by RM. Featured Gallery Top 10 at Scottsdale 2015 View 11 Photos News Source: Hagerty Ferrari Auctions Classics bonhams rm gooding hagerty

1954 Ferrari 375 MM Scaglietti Coupe named Best In Show at Pebble Beach Concours d'Elegance

Sun, 17 Aug 2014For the first time in the event's 64-year history, the prestigious Best In Show honor at the Pebble Beach Concours d'Elegance has been awarded to a Ferrari. The 1954 375 MM Scaglietti Coupe seen here is owned by car collector Jon Shirley of Medina, WA, and as it turns out, has quite a rich history.

Nevermind the fact that it's currently one of five road-going 375 MMs - this example was ordered by film director Roberto Rossellini, and was actually born as a Pininfarina-bodied competition Spyder. Following an accident, the car's original body wasn't able to be saved, but the chassis was sent to Carrozzeria Scaglietti in Modena for replacement, and the finished product became the company's first passenger car design for Ferrari.

Following its tenure with Rossellini, the car was owned by Mario Savona of Palermo, and later Charles Robert of Paris. Years later, the car was restored by its current owner in 1995, after being found in an underground garage in a Paris suburb.