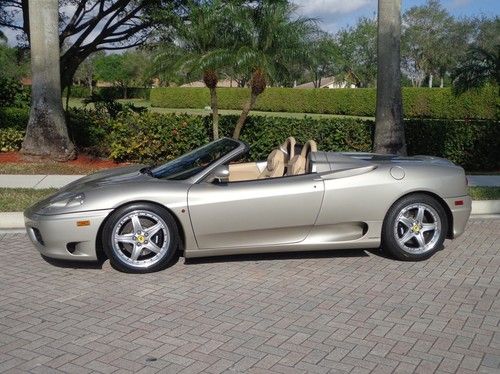

No Reserve Novitec Twin Superchargers Red F1 Spider,upgrades $164,598., 607hp on 2040-cars

Greensboro, North Carolina, United States

Body Type:Convertible

Vehicle Title:Clear

Engine:3.6L 3586CC V8 GAS DOHC Naturally Aspirated

Fuel Type:GAS

Number of Cylinders: 8

Make: FERRARI

Model: 360

Trim: Spider Convertible 2-Door

Options: Leather Seats, CD Player, Convertible

Drive Type: RWD

Safety Features: Driver Airbag, Passenger Airbag

Mileage: 19,577

Power Options: Air Conditioning, Power Windows, Power Seats

Sub Model: Spider

Exterior Color: Red

Number of Doors: 2

Interior Color: Tan

Ferrari 360 for Sale

Auto Services in North Carolina

Xpertech Car Care ★★★★★

Wilmington Motor Works ★★★★★

Wedgewood Muffler Shop ★★★★★

Vander Tire And Auto ★★★★★

Valvoline Instant Oil Change ★★★★★

Transmedics Transmission Specialists ★★★★★

Auto blog

Ferrari borrows $2.6 billion to finance FCA spinoff

Tue, Dec 1 2015Ferrari announced Monday that it is borrowing about $2.6 billion to finance its spinoff from Fiat Chrysler Automobiles. Here's how it breaks down: Ferrari NV, the automaker's parent company based in the Netherlands, is taking out loans totaling 2.5 billion euros. That's equivalent to $2.64 billion at current exchange rates, and is divided between a term loan of $2.12 billion and a revolving credit facility of $529 million. The larger term loan "will be used to refinance indebtedness owing to Fiat Chrysler Automobiles," among other purposes. That ought to constitute the lion's share of the $2.38 billion which the Prancing Horse marque was, according to reports last year, slated to pay its current parent company in order to help FCA fund its ambitious growth plans. The separate line of credit is earmarked "to be used from time to time for general corporate and working capital purposes of the Ferrari group." Though Ferrari is not expected to take any other Fiat Chrysler properties with it, the "group" in this case would include its various financial services and distribution arms around the world that may have been separately incorporated. As noted in the statement below, the financial arrangement "represents a further step towards the separation of Ferrari from the FCA Group," following the separate stock issues from both companies as independent from each other. FERRARI N.V. SIGNS ˆ2.5 BILLION SYNDICATED CREDIT FACILITY Ferrari N.V. (NYSE: RACE) ("Ferrari") announced today that it has entered into a ˆ2.5 billion syndicated loan facility with a group of ten bookrunner banks. The facility comprises a bridge loan (the "Bridge Loan") and a term loan (the "Term Loan") of ˆ2 billion in aggregate and a revolving credit facility of ˆ500 million (the "RCF"). Proceeds of the Bridge Loan and Term Loan will be used to refinance indebtedness owing to Fiat Chrysler AutomobilesN.V. (NYSE: FCAU) ("FCA") and other indebtedness and for other general corporate purposes. Proceeds of the RCF may be used from time to time for general corporate and working capital purposes of the Ferrari group. The Bridge Loan has a 12 month maturity with an option for Ferrari to extend once for a six-month period. Ferrari intends to refinance the Bridge Loan prior to its maturity with longer term debt, including through capital markets or other financing transactions. The Term Loan, which comprises a majority of the total facility, and the RCF each have a maturity of five years.

Ferrari posts record profits on restricted volume

Wed, 19 Feb 2014Most automakers are after one thing and one thing only: selling more cars. Because, after all, selling more cars means making more money. Right? Well that's usually the case, but Ferrari has taken a different approach. Rather than try and sell more cars, Ferrari intentionally sold fewer models in 2013, yet it made more money.

The move was implemented after 2012 emerged as the strongest year in the company's history. Instead of pushing to sell even more cars, it opted to maintain a level of exclusivity by selling fewer - 5.4 percent fewer than the year before, to be specific - thereby ensuring that those it did sell were worth more. As a result, in 2013, Ferrari logged record turnover, profits and finances: on 2.3-billion euros of revenue (up 5 percent from the previous year), Ferrari recorded 363.5 million euros in profit last year - that's roughly $500M USD.

Before you go jumping to conclusions, though, bear a few factors in mind. For one, Ferrari's stakeholders aren't pocketing all that cash - they're reinvesting it into the company: over the course of the same year, Ferrari invested some 337 million euros - 464 million dollars - in research and development. And while the company's extensive merchandizing efforts continue to bring in more cash, at 54 million euros ($74M) raised last year, the branding operation still doesn't account for a sixth of overall revenues. Still, it's little wonder that the experts at Brand Finance have named Ferrari the world's most powerful brand for the second year running.

Ferrari production to increase under Marchionne

Sun, 14 Sep 2014The head of any company has to juggle the relationship between supply and demand. Of course, that applies to automakers too, even ones as high-end as Ferrari. And as with many other decisions, the way Ferrari has addressed supply and demand has come down principally to the principal.

Enzo Ferrari may have only wanted to sell as many vehicles as he needed in order to fund his company's racing department, but with the F40 - the last model made under his watch - Ferrari ended up increasing supply to meet growing demand. However, after Luca di Montezemolo took over in the wake of Enzo's passing, he started constricting supply. He figured Ferrari could sell 400 units of the F50, for example, so he built 399. More recently, Montezemolo undertook a course of action that spread Ferrari into more markets, while simultaneously constricting supply to increase demand and thereby profitability.

It's been a winning formula for Ferrari. Just days ago, the company announced record earnings up by 14.5 percent in the first half of 2014 over the same period last year, which itself had seen a 7.1-percent increase over the year before. Clearly the strategy has worked, but Montezemolo's successor is already eying a different approach.

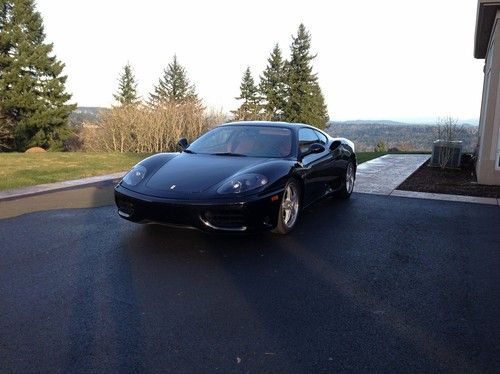

2004 ferrari 360 modena coupe 2-door 3.6l

2004 ferrari 360 modena coupe 2-door 3.6l 2001 ferrari 360 f1 spider

2001 ferrari 360 f1 spider Red over tan, lo miles, loaded and priced 4 quick sale

Red over tan, lo miles, loaded and priced 4 quick sale 2001 ferrari 360 spider convertible 2-door 3.6l

2001 ferrari 360 spider convertible 2-door 3.6l 2000 ferrari 360 f1 - no reserve

2000 ferrari 360 f1 - no reserve Red tan badges, calipers, daytonas and more, incredible shape.

Red tan badges, calipers, daytonas and more, incredible shape.