2002 Ferrari 360 Modena F1 Coupe / Black / Nero / Low Miles / 12 In Stock on 2040-cars

Ontario, California, United States

Vehicle Title:Clear

Fuel Type:Gasoline

For Sale By:Dealer

Transmission:Manual

Make: Ferrari

Warranty: Vehicle does NOT have an existing warranty

Model: 360

Mileage: 17,733

Options: Leather

Sub Model: Base Trim

Exterior Color: Black

Interior Color: Black

Doors: 2

Number of Cylinders: 8

Engine Description: 3.6L V8 FI DOHC 40V

Ferrari 360 for Sale

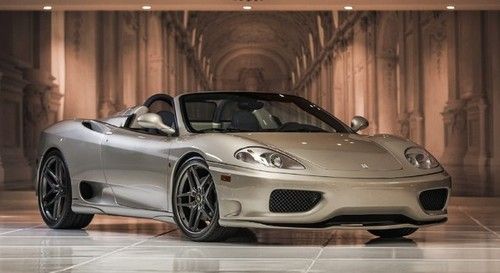

360 spyder*triple black*f-1*daytona*shields*carfax cert*we finance*fla(US $107,890.00)

360 spyder*triple black*f-1*daytona*shields*carfax cert*we finance*fla(US $107,890.00) 2002 ferrari spider(US $89,900.00)

2002 ferrari spider(US $89,900.00) Belt service just completed & documented! finance & warranty option!

Belt service just completed & documented! finance & warranty option! 2004 ferrari spider(US $95,999.00)

2004 ferrari spider(US $95,999.00) 2000 ferrari 360 modena coupe 2-door 3.6l

2000 ferrari 360 modena coupe 2-door 3.6l 2005 ferrari 360 spider f1 rosso corsa w/ tan / loaded with options / serviced(US $117,999.00)

2005 ferrari 360 spider f1 rosso corsa w/ tan / loaded with options / serviced(US $117,999.00)

Auto Services in California

Zoe Design Inc ★★★★★

Zee`s Smog Test Only Station ★★★★★

World Class Collision Ctr ★★★★★

WOOPY`S Auto Parts ★★★★★

William Michael Automotive ★★★★★

Will Tiesiera Ford Inc ★★★★★

Auto blog

Ferrari FF pitted against Oldsmobile Vista Cruiser in crazy Generation Gap comparison

Thu, 13 Nov 2014The folks behind Generation Gap have lost their minds with this latest video. The goal here is to determine the ultimate family cruiser, but the choices are what you would least expect, with a heavily modded 1970 Oldsmobile Vista Cruiser going up against a 2012 Ferrari FF.

You might anticipate an over-40-year-old Oldsmobile to pale in comparison to any modern Ferrari, but this wagon has a ton of secrets under its skin thanks to Lingenfelter. First, it packs a supercharged LS3 V8 with a claimed 650 horsepower and a six-speed manual gearbox. That big upgrade in power is further helped with air suspension and massive Wilwood disc brakes. The result is nothing short of deafening, with blaring yelps whenever the driver even nudges the accelerator.

The alternative sounds just as good, albeit in very different way. The Ferrari's 6.3-liter V12 pumps out 651 hp and 504 pound-feet with a part-time all-wheel drive system. While the FF lacks a lot of the hauling ability of the Olds, it makes up for the deficit in handling, luxury, and in many eyes, simply by having the famous prancing horse on the grille.

Rain prolongs the Championship battle | 2016 Brazilian Grand Prix recap

Mon, Nov 14 2016Rain and an old-school circuit are the antidotes to Formula 1's constricting technical regulations and Tilke tracks. At Brazil's Autodromo Jose Carlos Pace – otherwise known as Interlagos – rain Saturday night and on race day washed away everyone's careful plans, except for those of the man at the front of the pack. Lewis Hamilton put his Mercedes-AMG Petronas ahead of the field throughout the weekend. On Sunday, a storm-delayed start behind the Safety Car assured Hamilton of a clean path to the lead and a clear track. The Briton didn't waste it, pulling out a gap on teammate Nico Rosberg behind, and Rosberg appeared to have no interest in going hard after Hamilton. Safety Cars and red flags kept resetting the gap to zero, though. After the Mercedes-AMG GT S led the first seven laps, it emerged again on Lap 13 for another six laps when Marcus Ericsson crashed his Sauber. Seconds after racing resumed, Kimi Raikkonen aquaplaned his Ferrari into the wall on the front straight. That caused the first red flag, leading to another eight-lap Safety Car interval, then a second red flag stoppage due to conditions on Lap 28, then three more Safety Car laps, and then, finally, racing again. Hamilton never surrendered his lead. The Briton changed tires once during a stoppage, and drove fast enough to cover the full race distance despite the intermissions. Afterward, he said "it was a very easy race." Rosberg had it harder, defending against the preternatural Max Verstappen in third. Barring misfortune it's already clear the Red Bull pilot has at least one Driver's Championship in his career future. In Brazil the young Dutchman drove like he's worthy of the hardware right now. After Verstappen passed Rosberg for second on Lap 34, the Red Bull driver pitted for intermediate tires on Lap 44 – a huge gamble in the conditions – coming back out in fifth. That tire wager failed, giving Rosberg a safe position in second when Verstappen had to pit for extreme wets on Lap 54 of 71. The teenager re-emerged in 16th. Over the race's final 17 laps Verstappen passed 13 drivers at six different places on track. He ran it close-but-clean a couple of times, especially when getting around Sebastian Vettel and Sergio Perez, but he was simply untouchable. Not only did the Dutchman score an amazing third place, he put in what could be the drive of the season.

Possible Ferrari F70/F150 specs emerge from private showings

Fri, 01 Feb 2013At a private showing in Maranello, a group of lucky souls got to sneak a peek at the upcoming successor to the Ferrari Enzo, which has been referred to as both the F70 and F150 (not that F-150). While we still don't get any name confirmation or a definitive idea (aside from spy shots) as to what the newest Ferrari supercar will look like, one of the attendees did manage to pass along some vital performance information about the car as well as production numbers that are said to be limited to just 499 units.

The report on Auto-Blog.com.mx confirms that the Enzo successor will utilize an 800-horsepower V12 paired with a hybrid KERS good for another 150 hp. The engine's peak power kicks in at a screaming 9,200 rpm, while peak torque (not divulged) will be available at just 1,000 rpm. That kind of power could be great in just about anything, but the report also says that this new Ferrari model will have a dry weight of just 2,799 pounds (about the same as the Subaru BRZ and Scion FR-S twins and just slightly more than a Mazda MX-5 Miata). Rumored speed times include a top speed of 229 miles per hour, and the ability to run from 0-60 mph in less than three seconds; doubling that speed takes an extra second.

We've already seen the car's carbon fiber chassis and now we're just waiting to see the production car in real life, but Ferrari has not announced when the car will be introduced.