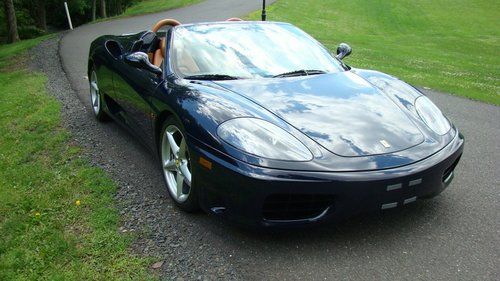

2001 Ferrari 360 Spider Titanium Showstopper Amazing Car Amazing Value on 2040-cars

La Jolla, California, United States

Vehicle Title:Clear

Fuel Type:Other

For Sale By:Dealer

Transmission:Automatic

Make: Ferrari

Warranty: Unspecified

Model: 360

Mileage: 14,668

Options: Leather

Sub Model: Spider F1

Exterior Color: Titanium

Interior Color: Luggage Tan

Doors: 2

Number of Cylinders: 8

Engine Description: 3.6L V8 FI DOHC 40V

Ferrari 360 for Sale

2001 ferrari berlinetta f1 3.6l v8 40v automatic rwd coupe premium leather red(US $84,000.00)

2001 ferrari berlinetta f1 3.6l v8 40v automatic rwd coupe premium leather red(US $84,000.00) 2005 ferrari 360 spider f1 tour de france blue tdf / low miles / 14 in stock(US $109,999.00)

2005 ferrari 360 spider f1 tour de france blue tdf / low miles / 14 in stock(US $109,999.00) 2002 ferrari 360 modena spider f1 rosso corsa / tan / daytona seats red inserts(US $99,999.00)

2002 ferrari 360 modena spider f1 rosso corsa / tan / daytona seats red inserts(US $99,999.00) Ferrari 360 spider - immaculate - low miles(US $84,999.00)

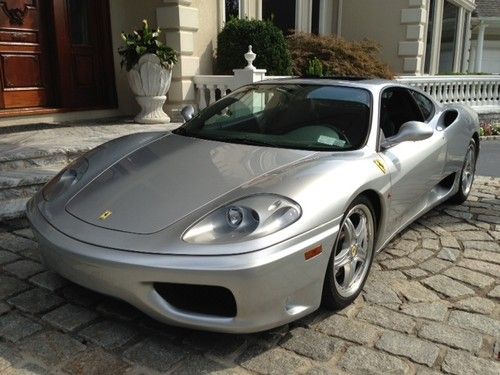

Ferrari 360 spider - immaculate - low miles(US $84,999.00) 2003 ferrari 360 modena coupe f1 silver like new only 9500 miles no reserve!!

2003 ferrari 360 modena coupe f1 silver like new only 9500 miles no reserve!! 2004 ferrari 360 spider tour d france blue tan 6spd manual serviced 12,800 miles(US $99,900.00)

2004 ferrari 360 spider tour d france blue tan 6spd manual serviced 12,800 miles(US $99,900.00)

Auto Services in California

Young`s Automotive ★★★★★

Yas` Automotive ★★★★★

Wise Tire & Brake Co. Inc. ★★★★★

Wilson Motorsports ★★★★★

White Automotive ★★★★★

Wheeler`s Auto Service ★★★★★

Auto blog

F1 Race recap: 2016 Russian Grand Prix same as it ever was

Mon, May 2 2016The three-year-old Sochi Autodrom that hosts the Russian Grand Prix combines beautiful scenery with a hallmark turn 3, a tricky turn 13, and two long DRS zones. So far, however, those haven't added up to exciting races after the first lap. Despite an in-race issue with his car's MGU-K, Mercedes-AMG Petronas driver Nico Rosberg aced the weekend with his first career grand slam: pole position, fastest lap of the race, leading every lap, and victory. Behind him, not much happened on the leaderboard after an incident-filled opening lap. The drama started at turns 2 and 3. Ferrari driver Sebastian Vettel lined up in seventh on the grid because of a five-place gearbox penalty, Red Bull's Daniil Kvyat sat next to him in eighth. Kvyat hit the back of Vettel's Ferrari in the braking zone for Turn 2, shoving Vettel into Daniel Ricciardo – Kvyat's teammate. Kyvat then clobbered the back of Vettel's car at the entry to Turn 3, spinning the German into the wall and out of the race. Kvyat probably regrets saying before the race that he would show Vettel "no mercy" on the first lap. At the back of the grid at Turn 2, Haas F1's Esteban Gutierrez hit Force India's Nico Hulkenberg and Manor's Rio Haryanto. Gutierrez continued, both the Force India and the Manor retired. A brief Virtual Safety Car period ensued, then the actual Safety Car emerged for three laps while marshals cleaned up the track. Mercedes-AMG Petronas driver Nico Rosberg nailed the restart and took off for the rest of the race. Teammate Lewis Hamilton battled his own gremlins all weekend but still finished second, 25 seconds behind Rosberg. During the final qualifying session on Saturday Hamilton's car suffered the same MGU-H failure as in China two weeks ago. The problem relegated him to tenth on the grid. In the race, Hamilton fought his way to second place by Lap 19 out of 53 laps and began closing the 13-second gap to Rosberg. On Lap 37, the gap now under eight seconds, Mercedes told Hamilton his car had a water pressure issue. The malfunction forced the Briton to manage his race and settle for second. Afterward, Hamilton said he was certain he could have won if not for the malfunction. The rest of the top ten barely changed throughout the contest. The first five positions on Lap 21 crossed the finish line in that order 32 laps later. Ferrari's Kimi Raikkonen took the final podium position ahead of the Williams duo of Valtteri Bottas and Felipe Massa.

See what the Chevy C7 ZR1 may be benchmarked against

Tue, 07 May 2013One of the greatest things every Corvette has had going for it, and also one of the most re-used arguments against it, is its price-to-performance equation - long before the Nissan GT-R became the de facto Porsche 911 comparator the Corvette spent decades as Exhibit A. Depending on which side of the argument you stressed, supporters crowed about how much performance you got for how (comparatively) little, detractors carped on how little you got everywhere else in the bargain.

It appears Chevrolet is working as hard as ever to render the argument meaningless. Spy shooters at KGP captured a convocation of European birds of prey leaving the General Motors test center, and aimed at benchmarking the C7 Corvette ZR1. The road train comprised of two C7 Corvette Stingrays, a 2013 Corvette ZR1, McLaren MP4-12C, Ferrari 458 Italia, Audi R8 V10 Spyder and Porsche 911 Carrera S and it was last seen heading down the same kinked-up back roads used to hone the Corvette Stingray.

The C7-series ZR1 and its possible 700 horsepower are still a ways off. If it really is being positioned to compete with the celestial exotica in the testing group, could it be the first Corvette to regularly be the first answer to the question "Cost no object, which would would you rather have?"

Race Recap: 2014 Italian Grand Prix goes heavy on rescue and recovery

Mon, 08 Sep 2014In the two weeks it's taken Formula One to move from Belgium to Italy, fleet-footed rumor has outrun the driver transfer market - Fernando Alonso can't issue enough denials of a departure from Ferrari, McLaren isn't sure what it wants to do with its drivers, Lotus has found out why it stinks this year and that the problem can't be fixed this year, and Nico Rosberg is said to have donated a team-ordered six-figure fine to charity to atone for his Belgian waffling. Oh, and Lewis Hamilton regained his pole-grabbing form.

That's how the Mercedes AMG Petronas man found himself at the head of the grid for the Italian Grand Prix, ahead of his teammate Rosberg by a quarter of a second. And because the high-po Monza circuit loves a high-po Mercedes engine, Valtteri Bottas and Felipe Massa lined up in third and fourth for Williams, followed by Kevin Magnussen and Jenson Button in their McLarens. Alonso flattered the Ferrari again, lining up seventh, followed by the Infiniti Red Bull Racing duo of Sebastian Vettel and Daniel Ricciardo, but Sergio Perez in the Sahara Force India would make it seven out of ten for the Mercedes HPP engine program.

When the lights went out to start the race, Hamilton - and a few other top drivers - discovered that the work of recovery wasn't finished.