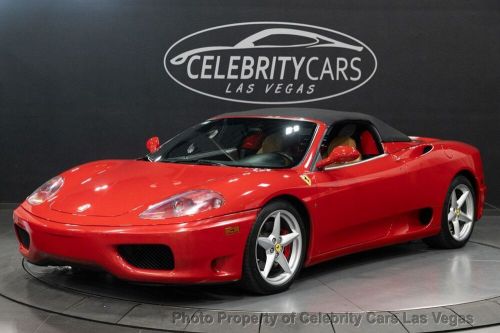

2001 Ferrari 360 Modena F1 / Fresh Major Service on 2040-cars

Engine:--

Fuel Type:Gasoline

Body Type:Coupe

Transmission:--

For Sale By:Dealer

VIN (Vehicle Identification Number): ZFFYU51A510123128

Mileage: 12138

Make: Ferrari

Trim: Modena F1 / Fresh Major Service

Drive Type: --

Features: --

Power Options: --

Exterior Color: --

Interior Color: Grigio Scuro

Warranty: Vehicle does NOT have an existing warranty

Model: 360

Ferrari 360 for Sale

2004 ferrari 360 f1 spider(US $119,750.00)

2004 ferrari 360 f1 spider(US $119,750.00) 2001 ferrari 360(US $169,900.00)

2001 ferrari 360(US $169,900.00) 1999 ferrari 360 modena(US $149,900.00)

1999 ferrari 360 modena(US $149,900.00) 2004 ferrari 360 modena(US $79,000.00)

2004 ferrari 360 modena(US $79,000.00) 2000 ferrari 360 modena very low miles(US $98,999.00)

2000 ferrari 360 modena very low miles(US $98,999.00) 2003 ferrari 360 spider(US $75,000.00)

2003 ferrari 360 spider(US $75,000.00)

Auto blog

Did Ferrari block Montezemolo from becoming F1 chairman?

Wed, Dec 24 2014The Formula One Group has appointed a series of new directors to its board. But while ousted Ferrari chief Luca di Montezemolo is among them, the latest reports suggest that he was earmarked to become the group's chairman, but that Sergio Marchionne blocked the appointment. Montezemolo, for those just joining us, served as chairman of Ferrari since 1991, but was ousted just a couple of months ago by Sergio Marchionne, chief executive of parent company Fiat Chrysler Automobiles who took his place at the head of the table in Maranello. During his tenure as Ferrari chief, Montezemolo sat as the team's representative on the F1 board (and also as chairman of the Formula One Teams Association), but despite having broken ties with Ferrari, Luca was renominated to the board as an independent member. That seat on the board, however, could have been at the head of the table, according to circulating reports, had Marchionne not expressed certain reservations, if not blocked the nomination outright. Montezemolo's appointment would have meant that both the F1 Group and the FIA would have been headed up by former Ferrari men, although Marchionne was quoted as saying that if it had been his call, he would have prevented Jean Todt from being elected to the presidency of the FIA as well. The chairmanship of the Formula One Group is separate from the role held by Bernie Ecclestone, who will continue to run the sport's day-to-day operations. Ecclestone has also rejoined the board along with Paul Walsh, the former head of distilling giant Diageo who was also tipped as a favorite to chair the F1 board. That role instead will return to Peter Brabeck, the former head of Nestle, who had previously stepped down from the chair of the Formula One Group.

Race Recap: 2014 Singapore Grand Prix is back-to-front

Mon, 22 Sep 2014To paraphrase Guy Fawkes, 'Remember, remember the twenty-first of September.' That's the day the 2014 Formula One Championship took another big turn - and at one of the year's least interesting races, traditionally - putting Lewis Hamilton back at the top of the standings. Not only that, it did so by borrowing the template from the British Grand Prix this year: put Hamilton in front, retire Nico Rosberg.

It was close until then, though, Hamilton lining up on pole for Mercedes AMG Petronas just seven thousandths of a second ahead of Rosberg. Daniel Ricciardo, the year's greatest opportunist, took third ahead of his teammate Sebastian Vettel in the Infiniti Red Bull Racing, followed by Fernando Alonso in fifth for Ferrari. The Williams' looked like they'd be in trouble on Friday, but as usual they dredged up some pace on Saturday, Felipe Massa taking sixth ahead of Kimi Räikkönen in the second Ferrari, the second Williams of Valtteri Bottas in eighth. Kevin Magnussen saved a little bit of face for McLaren in ninth, and Daniil Kvyat did another solid job to line up tenth in his Toro Rosso.

Before it even started, the race wouldn't look the same.

BMW hires Ferrari chief engineer Fedeli

Wed, 08 Oct 2014There's going to be a little bit more Prancing Horse in some future BMWs because the Bavarian brand is hiring Ferrari chief engineer Roberto Fedeli to join the company in November. Fedeli's new position is still somewhat of a mystery though, and he reportedly might be lending his talents to the high performance M division or possibly even Rolls-Royce. When asked by Automotive News Europe, BMW said that it "currently can't say what his role will be."

Regardless of his new job, Fedeli was a big get for BMW because of his strong résumé. He has been with Ferrari since 1988 and led the engineering for the famous Italian automaker's vehicles since 2007. Fedeli tendered his resignation in September at around the same time that chairman Luca di Montezemolo announced his decision to leave the company. However, Ferrari told ANE that there was no connection between the two events.