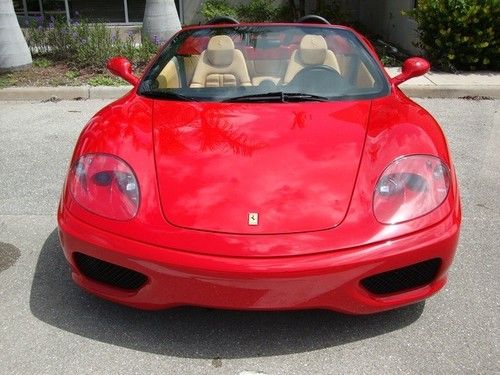

1999 Ferrari 360 Modena Coupe F1 Low Miles Rosso Corsa / Beige / A Must See on 2040-cars

Ontario, California, United States

Vehicle Title:Clear

Fuel Type:Gasoline

For Sale By:Dealer

Transmission:Automatic

Make: FERRARI

Warranty: Vehicle does NOT have an existing warranty

Model: 360

Mileage: 9,203

Power Options: Power Door Locks

Sub Model: Base Trim

Exterior Color: Red

Interior Color: Tan

Doors: 2 doors

Number of Cylinders: 8

Engine Description: 3.6L V8 FI

Ferrari 360 for Sale

Perfect carfax, service done, starting bid price set low to attract attention

Perfect carfax, service done, starting bid price set low to attract attention 2003 ferrari 360 spider convertible 2-door 3.6l(US $95,000.00)

2003 ferrari 360 spider convertible 2-door 3.6l(US $95,000.00) 02 ferrari modena f360 spider f1 only 2,358 original miles near new amazing car

02 ferrari modena f360 spider f1 only 2,358 original miles near new amazing car Red/ tan, serviced, daytona's, modula's last year 7k mi wow!(US $119,900.00)

Red/ tan, serviced, daytona's, modula's last year 7k mi wow!(US $119,900.00) Ferrari 360 modena berlinetta f1(US $71,990.00)

Ferrari 360 modena berlinetta f1(US $71,990.00) Wow red ferrari 360 spyder with all service done and all keys and books(US $99,865.00)

Wow red ferrari 360 spyder with all service done and all keys and books(US $99,865.00)

Auto Services in California

Xtreme Auto Sound ★★★★★

Woodard`s Automotive ★★★★★

Window Tinting A Plus ★★★★★

Wickoff Racing ★★★★★

West Coast Auto Sales ★★★★★

Wescott`s Auto Wrecking & Truck Parts ★★★★★

Auto blog

Ferrari, Mercedes selling cars with faulty Takata airbags

Thu, Jul 21 2016According to the US Senate, a small group of automakers are still selling new cars with faulty Takata airbags. Automotive News reports that Ferrari's entire lineup and various Mercedes-Benz vehicles come with faulty airbags and are subject to being recalled by the end of 2018. US Senator Bill Nelson, (D-FL), claims the affected Ferrari models include: the 2016 to 2017 FF, California T, F12 Berlinetta, F12 TdF, 488 GTB, 488 Spider, and GTC4 Lusso. Mercedes-Benz is also in the mix with the 2016 Sprinter and 2016 to 2017 E-Class Coupe and Convertible. Automotive News reports that both Ferrari and Mercedes-Benz will require its dealers to notify buyers of a recall in the vehicles' future. The National Highway traffic Safety Administration claims the vehicles are legal to be sold, as the airbags are safe until exposed to high humidity for a significant period of time. With the majority of Ferrari drivers storing their vehicles in temperature-controlled garages, this shouldn't be troubling news. What is troubling, however, is that seven out of 17 automakers that Senator Nelson contacted admitted to putting defective Takata airbags into its new cars. Volkswagen, Fiat Chrysler Automobiles, and Toyota are a few automakers that still use Takata's faulty airbags. All have agreed to notify buyers of future recalls. Related Video: News Source: Automotive News-sub.req.Image Credit: Copyright 2015 Lorenzo Marcinno / AOL Government/Legal Recalls Ferrari Mercedes-Benz ferrari ff ferrari f12 berlinetta ferrari 488 gtb ferrari california t ferrari f12 tdf ferrari 488 spider ferrari gtc4 lusso

Ferrari renews partnership with Marlboro [UPDATE]

Mon, May 18 2015Formula One and Big Tobacco may have parted ways years ago, but the alliance between Ferrari and Marlboro continues on, apparently as strong as ever. Though neither party has made any official announcement or revealed any details of the arrangement, reports from the motorsport press indicate that the Scuderia and Philip Morris – the tobacco company which owns the Marlboro brand – have signed an extension of their longstanding partnership. Marlboro first arrived in Maranello way back in 1973, ramping up over the years to become its main sponsor by '93. The Italian outfit changed its name to Scuderia Ferrari Marlboro after the tobacco brand parted company with McLaren in '97. After tobacco advertising was ultimately banned in 2006 (at least in Europe), Ferrari was forced to remove the Marlboro branding from its cars, but the name stuck – and so did the logo, in various forms of obscurity and subliminality through 2010. The Marlboro name was dropped from the team's handle in 2011, but that didn't stop the two from renewing their partnership. And now they've reportedly extended again through 2018. Though the deal hardly comes as a surprise (even given the complete lack of discernible public association between the two), we don't doubt that Maurizio Arrivabene – the former Marlboro exec who recently took over the struggling team – had something to do with it. UPDATE: A spokesman for Scuderia Ferrari downplayed the significance of the story, telling Autoblog by correspondence that "the contract is extended through 2018 and details are confidential." UPDATE 2: Philip Morris International responded to our inquiry with the following statement: "Our agreement with Ferrari has been extended beyond 2015, but we are not in a position to provide financial or other details. This partnership provides us with opportunities such as enabling our adult consumers and business partners to experience motor racing through Ferrari factory visits and attending F1 races."

All the cars of the monster Baillon Collection barn find are headed to auction [w/video]

Sat, Jan 10 2015Automotive barn finds are exciting for the thrill and surprise of the hunt. Of course, you're far more likely to find a rusting Chevy under a tarp, but there's always that chance to scoop up a forgotten Porsche or Shelby for a song. That aspect makes the massive Roger Baillon Collection so bittersweet. There were so many great classics sitting under an open shed in France, but they were there so long that many of them became just bare husks. Ahead of the February 6 auction in Paris, auction house Artcurial has released descriptions and images of the entire 59-car hoard. While the 1961 Ferrari 250 GT SWB California Spider and 1956 Maserati A6G 2000 Gran Sport Berlinetta Frua remain the stars, there are a few surprises among the bunch. The original announcement makes no mention of several modern Ferraris – at least compared to the rest of the collection – among the lots. They include a thoroughly beat 1982 308 GTSi without headlights and portions of the paint gone. There's also a 1988 Mondial Cabriolet that looks good on the outside, but Artcurial says needs a mechanical overhaul. A rather attractive gray 1978 400 GT is in similar condition. Scroll through the gallery above for the names and price estimates for all of the vehicles in the collection. If there's one you're particularly interested in there are even more photos and full descriptions in Artcurial's auction catalog. Also check out the video below to see what some of these classics looked like before they were hauled out of Baillon's lean-to after years of sitting in decrepitude. This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings. Featured Gallery Roger Baillon Collection Auction View 59 Photos News Source: Artcurial, Artcurial Briest - Poulain - F. Tajan via YouTube Ferrari Maserati Auctions Classics ferrari 250 retromobile artcurial