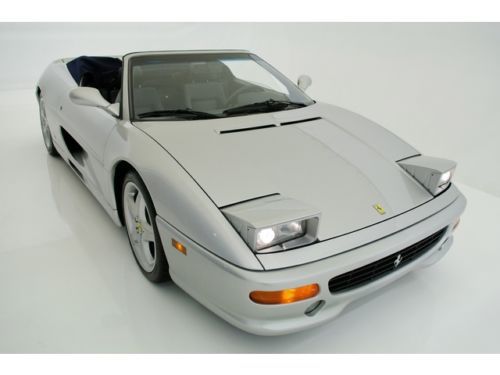

Ferrari 355 Spider 6 Speed Leather 13 In Stock. on 2040-cars

Spring, Texas, United States

Ferrari 355 for Sale

1998 ferrari 355 spider 36k miles 6sp books records well maintained priced sell(US $52,995.00)

1998 ferrari 355 spider 36k miles 6sp books records well maintained priced sell(US $52,995.00) Ferrari f355 spider convertible(US $64,900.00)

Ferrari f355 spider convertible(US $64,900.00) Only 2 owners, 20k miles, fully serviced, stunning(US $64,900.00)

Only 2 owners, 20k miles, fully serviced, stunning(US $64,900.00) Amazing ferrari, triple black, super clean, super low miles, all service history

Amazing ferrari, triple black, super clean, super low miles, all service history 1988 fiero - gtp ferrari 355 spyder(US $26,000.00)

1988 fiero - gtp ferrari 355 spyder(US $26,000.00) 1995 ferrari f355 spider coupe 2-door 3.5l

1995 ferrari f355 spider coupe 2-door 3.5l

Auto Services in Texas

Wynn`s Automotive Service ★★★★★

Westside Trim & Glass ★★★★★

Wash Me Car Salon ★★★★★

Vernon & Fletcher Automotive ★★★★★

Vehicle Inspections By Mogo ★★★★★

Two Brothers Auto Body ★★★★★

Auto blog

Ferrari builds one-off hybrid F12 TRS roadster

Mon, 16 Jun 2014When Ferrari makes an open-top version of one of its V12 super-GTs, it typically comes in particularly low production numbers. Maranello only made 448 examples of the 550 Barchetta Pininfarina, 559 of the 575 Superamerica and 599 units of the 599 SA Aperta. What we have here, however, is not just the first F12 roadster we've seen yet, but also the most exclusive.

Called the F12 TRS, it's obviously based on the F12 Berlinetta, but with some key modifications. Not the least of which is the open-top body-style (which may or may not have a folding roof mechanism of some kind), coupled with some unique bodywork like a cowled rear deck and reshaped hood. But the TRS (which we can only assume is some tribute to the 250 Testa Rossa) is also said to pack an F1-derived KERS hybrid assist, presumably similar to the one in the LaFerrari - or more poignantly, in the 599 HY-KERS concept - to give the 6.3-liter V12 even more juice than the prodigious 730 horsepower it produces in stock Berlinetta form.

The vehicle, apparently spotted in the garage at the company's Fiorano test track, appears to be a one-off built by Ferrari's Special Projects division for one discerning and evidently very wealthy customer who is said to have paid $4.2 million for the privilege.

Future Ferraris could be based off single, modular platform

Wed, Sep 2 2015Thanks to its imminent initial public offering, Ferrari sits at the precipice of being an independent sports-car maker for the first time in decades. With Sergio Marchionne still at the helm, expect the famous brand to push even harder to grow sales around the world. According to an investigation of the company's future by Automobile, the next-generation of Ferraris could ride on a shared, modular platform and embrace turbocharging even more. Modular underpinnings, like Volkswagen's MQB or Volvo's SPA, are hugely popular in the industry because they let automakers cut development time and share more parts among models. According to Automobile, Ferrari is prepping an aluminum space frame that could support front- and mid-engine models. The design would also allow electronics, suspension parts, and powertrains to be shared among the Prancing Horse's vehicles. The first Ferrari using this platform could be the next-gen California, which is predicted to launch around 2017. The more aggressively styled hardtop convertible could also have an entry-level version with a twin-turbo 2.9-liter V6, possibly shared with the Alfa Romeo Giulia Quadrifoglio. Contrary to previous rumors, Automobile reports that the Dino might not be getting this engine, but instead could pack a bespoke, 600-horsepower V6 behind the driver. The coupe would carry a price tag of around $200,000. Also, look for Ferraro to celebrate its 70th anniversary in 2017 with a car Automobile refers to as the LaFerrarina, because it would use the LaFerrari's platform for a grand-touring model. Related Video:

2016 British Grand Prix kept mostly calm and carried on

Mon, Jul 11 2016Three bursts of chaos decided the course of the British Grand Prix. The first was a literal cloudburst a dozen minutes before the race, which poured water on the Silverstone Circuit while drivers sat on the grid. Six minutes before the lights-out, the race director decided to start the race behind the Safety Car. The field loped around the wet track for five laps. When the Safety Car pulled off, the three leaders – Mercedes-AMG Petronas' Lewis Hamilton, followed by teammate Nico Rosberg and Red Bull's Max Verstappen – stayed out. Behind them, the second chaotic moment occurred: a big group of drivers made pit stops for intermediate tires. When Manor's Pascal Wehrlein spun at Turn 1 on Lap 7, officials issued a Virtual Safety Car. With the rest of the field slowed down, the three leaders ducked into the pits on Lap 8 for intermediates. The fortuitous timing meant all three drivers rejoined the track in their original positions. By Lap 9, with racing resumed, Hamilton had a 4.9-second lead on Rosberg. From that point, even as the track dried, no one bothered Hamilton during what one commentator called "a measured drive." The Brit won his home grand prix, taking the checkered flag seven seconds ahead of Rosberg. Rosberg had to earn second place on track. The German's car didn't respond well to the intermediate tires, so Verstappen excecuted an outstanding pass on Rosberg on the outside through Chapel on Lap 16. After everyone switched to slicks, Rosberg's Mercedes reclaimed its mojo and the German hunted Verstappen down, passing the Dutchman on Lap 38. The final touch of chaos happened when Rosberg's gearbox threw a tantrum on Lap 47 of the 52-lap race. Rosberg radioed his engineer, "Gearbox problem!" His engineer replied, "Affirm. Chassis default zero one. Avoid seventh gear, Nico." The race stewards allowed the engineer's first two statements, but stewards said the instruction about seventh gear contravened the rule that "the driver must drive the car alone and unaided." After the race, officials added ten seconds to Rosberg's time, demoting him to third behind Verstappen. Rosberg's is the first penalty arising from radio communication restrictions. Unsurprisingly, Mercedes will appeal. At this year's Baku race the radio controversy stemmed from engineers refusing to tell drivers what to do. Now we know what happens when the pit wall gets loose lips.