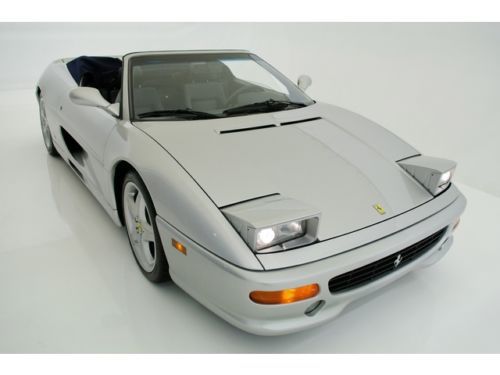

1998 Ferrari 355 Spider 36k Miles 6sp Books Records Well Maintained Priced Sell on 2040-cars

Dallas, Texas, United States

|

1998 FERRARI F355 SPIDER 6 SPEED MANUAL 36,322 ORIGINAL MILES VERY WELL MAINTAINED EQUIPPED WITH

EXTERIOR:

INTERIOR:

MECHANICAL:

THIS ITALIAN THOROUGHBRED AWAITS YOUR CAREFUL INSPECTION PRICED TO SELL ANY QUESTIONS? PLEASE CALL DAVID WAYNE AT (214) 926-5621 THIS CAR IS FOR SALE LOCALLY. WE RESERVE THE RIGHT TO TERMINATE THIS AUCTION. ANY QUESTIONS? PLEASE CALL DAVID WAYNE (214) 926-5621 The

seller shall not be responsible for the correct description, authenticity,

genuineness, or defects herein, and makes no warranty in connection therewith.

No allowance or set aside will be made on account of any incorrectness,

imperfection, effect or damage. It is the responsibility of the buyer to have

thoroughly inspected the vehicle and to have satisfied himself or herself as to

the condition and value and to bid based upon that judgment solely. The seller

shall and will make every reasonable effort to disclose any known defects

associated with this vehicle at the buyer’s request prior to the close of the

sale. Seller assumes no responsibility for any repairs regardless of any oral

statements about the vehicle. |

Ferrari 355 for Sale

Ferrari f355 spider convertible(US $64,900.00)

Ferrari f355 spider convertible(US $64,900.00) Only 2 owners, 20k miles, fully serviced, stunning(US $64,900.00)

Only 2 owners, 20k miles, fully serviced, stunning(US $64,900.00) Amazing ferrari, triple black, super clean, super low miles, all service history

Amazing ferrari, triple black, super clean, super low miles, all service history 1988 fiero - gtp ferrari 355 spyder(US $26,000.00)

1988 fiero - gtp ferrari 355 spyder(US $26,000.00) 1995 ferrari f355 spider coupe 2-door 3.5l

1995 ferrari f355 spider coupe 2-door 3.5l 1999 ferrari f355f1 spyder only 19k miles free shipping to your door!(US $62,955.00)

1999 ferrari f355f1 spyder only 19k miles free shipping to your door!(US $62,955.00)

Auto Services in Texas

Z Rated Automotive Sales & Service ★★★★★

Xtreme Tinting & Alarms ★★★★★

Wayne`s World of Cars ★★★★★

Vaughan`s Auto Glass ★★★★★

Vandergriff Honda ★★★★★

Trade Lane Motors ★★★★★

Auto blog

Fiat Chrysler denies rumors that Ferrari SpA is moving to London

Sat, Dec 13 2014It seems that reports of Ferrari's relocation to London have been somewhat exaggerated. The past few days have seen more than a few stories on the legendary Italian brand's decision to move its tax base out of Italy, and now Fiat Chrysler is speaking out against the scuttlebutt. "These rumors have no grounds," FCA said in a statement obtained by Reuters. "There is no intention to move the tax residence of Ferrari SpA outside Italy, nor is there any project to delocalize its Italian operations, which will continue to be subject to Italian tax jurisdiction." Ferrari's move to London was based on two beliefs. First, that the company would benefit from being located nearer the investor community, should it be listed on a European exchange. FCA, though, said a European listing was only a "possibility," according to Reuters. Instead, the company will be listed on an American market. Aside from the move to benefit investors, it was believed Ferrari was looking to relocate to escape Italy's more oppressive corporate tax rate, which sits around at 31.4 percent, compared to the UK's 20 percent, Bloomberg reports. This denial by Fiat Chrysler, though, should be enough to close the book on Ferrari leaving Italy, no matter how much sense it might make. Related Video:

Forza Motorsport 6's new drivable Hot Wheels cars are the best

Tue, May 3 2016Each month, Turn 10 Studios releases a new car pack for the latest installment of its Forza Motorsport video game. Sometimes that means less-than-exciting stuff coming to our Xbox Ones – BMW X6M, bleh – but this time our inner seven-year-old is beyond ecstatic. Two of the seven cars are based on actual Hot Wheels models. And. They're. Awesome. First we have the 2011 Hot Wheels Bone Shaker. Yes, there are flames on the side. And yes, there's a giant skull where the grille should be. This one came from the imagination of "Mr. Hot Wheels" Larry Wood, whose design was so popular it inspired an actual real-world creation. Like all good things in this world, it's powered by a small-block Chevy V8. Oh, and it has no roof. This will be a popular one among gamers. The other digitized Hot Wheels creation is a 2005 Ford Mustang. A modest vehicle, sure, but the toy designers have festooned this pony car with a wild paint scheme and the body mods to emphasize it. Originally developed to celebrate the 'Stang's 50th birthday, this Hot Wheels car trades Americana for wild Japanese style. There's just one functioning life-size version of this car in existence as well, but if you look hard, you might be able to find one of the 1:64 scale models that inspired it. Other highlights from this month's car pack include the latest Ford Focus RS – finally time to replace that NASCAR-V8-powered, all-wheel-drive 2009 Focus RS – the 2015 McLaren P1 GTR, the 2016 Chevrolet Camaro SS, the aforementioned X6M, and Alain Prost's 1990 Ferrari 641 F1 car. The Hot Wheels Car Pack is available for download today. Related Video: Featured Gallery Forza Motorsport 6: Hot Wheels Car Pack News Source: Turn 10 Studios via YouTube Toys/Games BMW Chevrolet Ferrari Ford McLaren Racing Vehicles Performance video games Hot Wheels forza motorsport chevy camaro ss forza motorsport 6

Do we finally know which hybrid hypercar is fastest?

Sun, Oct 11 2015In order to properly compare and contrast the performance characteristics of competitive automobiles, a number of variables have to be sorted out. For instance, to diminish the human component, the same driver must be used for each lap, that driver has to be capable of wringing the maximum level of performance from each vehicle, and they should all be checked and prepared to make sure they are within manufacturer specs before hitting the track. Speaking of which, the conditions at the track – and, of course, it goes without saying that the cars have to be tested at the same location, on the same day – have to be as similar as possible. Naturally, arranging all of these variables is difficult, if not impossible, and that's especially true when the contenders are the Ferrari LaFerrari, McLaren P1, and Porsche 918 Spyder. As range-topping models from well-established performance players, these three hybrid hypercars are often lumped into the same category. But which one is fastest? Well, that's been a tough nut to crack, in part because the manufacturers themselves haven't always been willing to play along when it comes time to test these machines head-to-head-to-head. And so, with all that (probably unnecessary) preamble out of the way, we present to you the video above, in which this particular vehicular pedestal is toppled. All three cars are owned by a man named Paul Bailey, they were tested on the same day at the Silverstone circuit in England, and each had British Touring Car driver Mat Jackson at the helm. We're not going to spoil the results, other than to say that all three vehicles were incredibly fast and within spitting distance of one another at the finish line, as you would expect. Intriguingly, this video is said to be part one in a three-part series, so we have more Ferrari vs. McLaren vs. Porsche action to look forward to. Related Video: News Source: TheSUPERCARDRIVER via YouTube Green Ferrari McLaren Porsche Convertible Coupe Hybrid Performance Supercars Videos porsche 918 spyder mclaren p1 silverstone hypercar ferrari laferrari laferrari