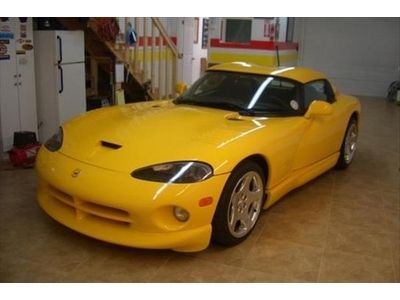

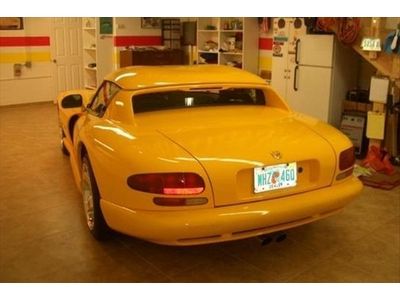

Must See One Owner Convertible Roadster 7k Miles Garage Kept on 2040-cars

Hollywood, Florida, United States

Body Type:Convertible

Vehicle Title:Clear

Engine:8.0L 7990CC 488Cu. In. V10 GAS OHV Naturally Aspirated

Fuel Type:GAS

For Sale By:Private Seller

Make: Dodge

Model: Viper

Warranty: Unspecified

Trim: R/T-10 Convertible 2-Door

Options: Leather Seats, CD Player, Convertible

Drive Type: RWD

Safety Features: Anti-Lock Brakes, Driver Airbag, Passenger Airbag

Mileage: 7,400

Power Options: Air Conditioning, Power Locks

Sub Model: RT/10

Exterior Color: Yellow

Interior Color: Black

Number of Doors: 2

Number of Cylinders: 10

Dodge Viper for Sale

2013 dodge gts

2013 dodge gts 2009 dodge viper srt-10 vi10 edition coupe #2 of 100(US $70,000.00)

2009 dodge viper srt-10 vi10 edition coupe #2 of 100(US $70,000.00) Fast! navigation rearview camera usb port aux xm 8.1l v10(US $49,888.00)

Fast! navigation rearview camera usb port aux xm 8.1l v10(US $49,888.00) 2001 dodge viper gts coupe 2-door 8.0l(US $36,000.00)

2001 dodge viper gts coupe 2-door 8.0l(US $36,000.00) Extremely rare 1 of 88 made $90k invested! corsa exhaust, k&n, upgrades $ mint!

Extremely rare 1 of 88 made $90k invested! corsa exhaust, k&n, upgrades $ mint! 2003 dodge viper srt-10 convertible 2-door 8.3l 12k miles(US $49,877.00)

2003 dodge viper srt-10 convertible 2-door 8.3l 12k miles(US $49,877.00)

Auto Services in Florida

Yow`s Automotive Machine ★★★★★

Xtreme Car Installation ★★★★★

Whitt Rentals ★★★★★

Vlads Autobahn LLC ★★★★★

Village Ford ★★★★★

Ultimate Euro Repair ★★★★★

Auto blog

Dodge not being dropped by Chrysler, CEO reaffirms

Mon, 16 Sep 2013Dodge isn't going anywhere. Despite some rumor and speculation over the future of the crosshair grille and the cars that wear it, Dodge brand boss, Tim Kuniskis, sat down with TheDetroitBureau.com, explaining that the marque isn't going anywhere. His sentiments echo those of SRT boss Ralph Gilles, who told a group of enthusiasts in July that "Dodge is here to stay!"

Dodge's death won't be "a part of a master plan to consolidate brands," Kuniskis told TheDetroitBureau.com. Instead, the brand, which is ultimately under the command of Fiat/Chrysler CEO, Sergio Marchionne, will likely ditch some of its badge-engineered models, like the Dodge Grand Caravan. A more focused Dodge, which was something Gilles has already hinted at, will likely see it exploring areas of the market that haven't been exploited by other Chrysler brands.

Kuniskis, not surprisingly, wasn't willing to delve into any detailed product plans, telling TDB that the size of the brand's lineup "remains to be seen." Regardless of how big the brand actually ends up being (it is presently Chrysler's volume brand - and not by a little), hopefully the statements from Kuniskiss can put the rumors of a Dodge closure to bed.

Chrysler to reveal next minivan at 2016 Detroit Auto Show

Tue, Jan 13 2015All eyes in the industry are presently fixed on this year's Detroit Auto Show, but over at Fiat Chrysler Automobiles, they're already looking towards next year's show. That's when the Italian-American automaker says it'll unveil the next Chrysler minivan. The announcement, made on the FCA Corporate Twitter feed, promises that the next Pentastar minivan will debut in January 2016, which (along with the hashtag NAIAS) suggests the next-generation family hauler will debut at the Detroit show next year. Auburn Hills is expected to replace the current Chrysler Town & Country and Dodge Grand Caravan with two all-new models: one keeping the minivan form, and the other shifting into more of a crossover. Just which nameplate gets the new form factor, and which will debut at Cobo next year, we don't know. Odds are good that it'll be the minivan not the CUV, though. Chrysler's minivan has been a winning business for the Detroit automaker, pioneering the segment, outselling the competition and marketing around the world under more brands and nameplates than just about anything else in the industry. The vehicle has been sold as the Dodge Caravan, Chrysler Town & Country, Chrysler Voyager, Plymouth Voyager, Lancia Voyager, Ram Cargo Van and Volkswagen Routan, to say nothing of long-wheelbase Grand versions of many of the aforementioned nameplates. News Source: FCA via Twitter Detroit Auto Show Chrysler Dodge Minivan/Van Detroit 2016 Detroit Auto Show chrysler town and country dodge grand caravan dodge caravan

China's Great Wall confirms its interest — in Jeep, or all of FCA

Tue, Aug 22 2017HONG KONG/SHANGHAI — Chinese automaker Great Wall Motor reiterated its interest in Fiat Chrysler Automobiles NV on Tuesday, but said it had not held talks or signed a deal with executives at the Italian-American automaker. China's largest sport utility vehicle manufacturer made a direct overture to Fiat Chrysler on Monday, with an official saying the company was interested in all or part of FCA, owner of the Jeep and Ram truck brands. Automotive News first reported the news, quoting Great Wall Motor President Wang Fengying as saying she planned to contact FCA to discuss acquiring the Jeep brand specifically. Those comments sent FCA shares higher but also raised questions over the ability of China's seventh-largest automaker by sales to buy larger Western rival FCA, or even Jeep, which some analysts value at as much as one-and-a-half times FCA. Great Wall sought to dampen speculation on Tuesday. It confirmed it had studied Fiat Chrysler, but said there was "no concrete progress so far" and "substantial uncertainty" over whether it would eventually bid. "The company has not built any relationship with the directors of FCA nor has the company entered into any discussion or signed any agreements with any officer of FCA so far," the company said in an English-language stock exchange filing. It did not give further detail. Fiat Chrysler stock dipped on the statement on Tuesday. Great Wall said trading in its Shanghai-listed shares would resume on Wednesday after having been suspended. Fiat Chrysler declined to comment on Great Wall's statement. On Monday, it said it had not been approached and was fully committed to implementing its current business plan. FLUSHING OUT RIVALS? Great Wall Motor, which was early to spot China's love of SUVs, had revenue of $14.8 billion last year and sold 1.07 million vehicles - but that compares with FCA's 2016 revenue of 111 billion euros ($130.6 billion). Analysts said Great Wall would need to raise both debt and equity to complete any deal, meaning its chairman Wei Jianjun could lose majority control. One possible scenario, according to analysts at Jefferies, would see Wei keeping a roughly 30 percent stake, while Great Wall would raise $10-$14 billion in debt and $10 billion in equity - hefty for a group currently worth just $16 billion. Ultimately, politics could be the clincher.