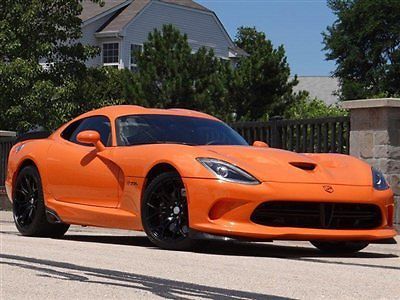

2014 Dodge Srt Viper Ta Edition #49 Of 93 Orange/blk Only 1,600 Miles Like New!! on 2040-cars

Naperville, Illinois, United States

Dodge Viper for Sale

2004 dodge viper srt-10 convertible 2-door 8.3l mamba edition 73/200 3rd gen.(US $43,000.00)

2004 dodge viper srt-10 convertible 2-door 8.3l mamba edition 73/200 3rd gen.(US $43,000.00) 1994 dodge viper rt10 convertible

1994 dodge viper rt10 convertible 2004 dodge viper srt10 black mamba 8.3l v10 manual rwd convertible rebuilt

2004 dodge viper srt10 black mamba 8.3l v10 manual rwd convertible rebuilt Srt-10 convertible, 8.3l v10 505hp, leather loaded, salvage repairable damaged(US $21,900.00)

Srt-10 convertible, 8.3l v10 505hp, leather loaded, salvage repairable damaged(US $21,900.00) 1995 dodge viper 2-dr. open top manual transmission clean vehicle history(US $37,995.00)

1995 dodge viper 2-dr. open top manual transmission clean vehicle history(US $37,995.00) 2006 dodge viper srt-10 convertible 2-door 8.3l(US $57,000.00)

2006 dodge viper srt-10 convertible 2-door 8.3l(US $57,000.00)

Auto Services in Illinois

USA Muffler & Brakes ★★★★★

The Auto Shop ★★★★★

Super Low Foods ★★★★★

Spirit West Motor Carriage Body Repair ★★★★★

South West Auto Repair & Mufflers ★★★★★

Sierra Auto Group ★★★★★

Auto blog

2014 Dodge Dart Blacktop hits the pavement ahead of Detroit

Tue, 07 Jan 2014Dodge is getting ready to spread the Blacktop-themed love to the smallest member of its lineup. Last year, the automaker offered up Blacktop versions of the Avenger, Challenger, Charger, Durango, Grand Caravan and Journey. And now the Dart, too, gets its dark on for 2014, with the $295 package offered on Dart SXT models equipped with the Rallye Appearance Group. The Dart Blacktop will make its debut at the Detroit Auto Show next week.

As with the other Blacktop special-edition models, the Dart Blacktop gets glossy black accents for a "sporty, sinister look." The blacked-out treatment spreads across the 18-inch wheels to the crosshair grille, grille surround and headlamp bezels. The interior sees a similar treatment, with black and light tungsten or black and ruby red cloth to go with red accent stitching on the instrument panel, center console and seat bolsters.

For the 2014 model year, all Dart SXT and Limited models receive the 2.4-liter MultiAir2 Tigershark engine with 184 horsepower and 174 pound-feet of torque, and since the Blacktop is based on the SXT, that's the powerplant buyers of this special-edition will get, too. Expect the 2014 Dart Blacktop to hit dealers in the first quarter, and while you're waiting, feel free to read more in the official press release below.

Dodge recalls 27k Darts for bracket that can disrupt transmission module

Thu, Sep 17 2015Dodge is recalling 27,520 examples of the 2013-2015 Dart with dual-clutch gearboxes. The mounting bracket for the transmission control module can affect the part's operation and cause the compacts to suddenly shift into neutral. According to the automaker, 23,688 of them are in the US, 3,376 in Canada, 5 in Mexico, and 451 elsewhere. The National Highway Traffic Safety Administration reports these examples carry build dates between February 24, 2012, and June 16, 2015. There are also no reports of accidents or injuries. Because of the way the bracket is mounted, the part can put too much force on the control module's circuit board and cause it to shift out of gear. The engine and airbags remain operable if this happens. To fix things, dealers will install a redesigned mount and replacement module. Related Video: Statement: Mounting Bracket September 14, 2015 , Auburn Hills, Mich. - FCA US LLC is recalling an estimated 23,688 cars in the U.S. to replace certain control modules and mounting brackets that may contribute to a loss of motive power. The Company is unaware of any related injuries or accidents. An FCA US investigation prompted by a small number of warranty claims discovered a control-module mounting bracket may apply too much force and disrupt the function of a circuit board within the module. This condition, unique to certain cars equipped with dual dry-clutch transmissions (DDCT), may cause the transmission to shift into neutral. However, the engine remains on and the vehicle's air-bags, as well as other safety features, are unaffected. The condition may also be preceded by the illumination of a dashboard warning light. Customers who observe this are urged to contact their dealers. The campaign is limited to certain 2013-2015 Dodge Darts equipped with DDCTs. Additional vehicles will be recalled in Canada (3,376), Mexico (five) and outside the NAFTA region (451). Affected customers will be advised when they may schedule service, which will be performed free of charge. Service will entail installation of a redesigned mounting bracket and replacement of the control module. Customers with additional questions may call the FCA US Customer Information Center at 1-800-853-1403.

Chevy Corvette Stingray defeating rivals where it matters most

Wed, 16 Jul 2014Everything is coming up roses for the award-winning Chevrolet Corvette Stingray, as new data from the North American Dealers Association dissected by GM Authority reveals that America's sports car is handily outselling two of its more expensive rivals.

Through June of 2014, the NADA notes that the Corvette has rung up 17,744 sales, handily besting the Porsche 911 and positively spanking the SRT Viper. Of course, you're sitting there thinking, "Corvette is outselling the much more expensive Porsche and Viper. Sky blue, water wet." But what's impressive here is just how thoroughly the Chevrolet is beating its two rivals, with this data serving as a testament to just how popular the seventh-generation sports car has become.

So far this year, Porsche has managed to move 5,169 911s, according to NADA. Considering that the base model starts at nearly $15,000 more than the most heavily optioned Stingray, and that Porsche owners have a vast, expensive options catalogue to select from, Stuttgart's sales are still plenty impressive in relation to the nearly 18,000 Corvettes sold.