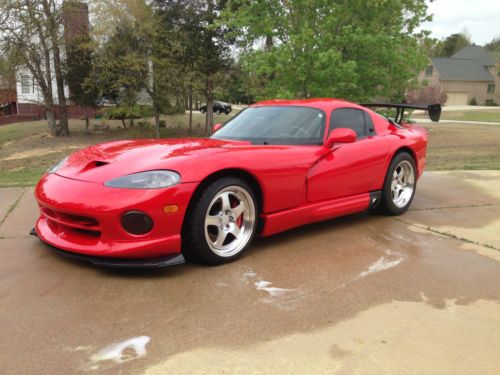

2013 Srt Viper Srt Black $15,000 Off Msrp on 2040-cars

Tomball, Texas, United States

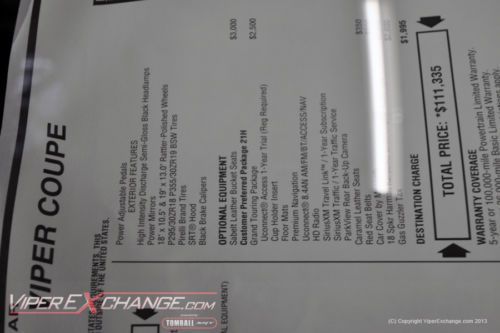

Body Type:Coupe

Vehicle Title:Clear

Engine:8.4

Fuel Type:Gasoline

For Sale By:Dealer

Year: 2013

Number of Cylinders: 10

Make: Dodge

Model: Viper

Trim: Caramel

Options: Leather Seats, CD Player

Drive Type: Manual

Safety Features: Anti-Lock Brakes, Driver Airbag, Passenger Airbag, Side Airbags

Mileage: 6

Power Options: Air Conditioning, Power Locks, Power Windows

Sub Model: SRT

Exterior Color: Black

Interior Color: Tan

Warranty: Unspecified

Dodge Viper for Sale

1996 dodge viper special edition rt 10 8.0l 6 speed 415 hp 1 of 166 low miles(US $42,900.00)

1996 dodge viper special edition rt 10 8.0l 6 speed 415 hp 1 of 166 low miles(US $42,900.00) New 2013 viper gts venom black gts under invoice reserve

New 2013 viper gts venom black gts under invoice reserve 2006 dodge viper twin turbo 1000+ hp first edition #126 coupe(US $90,000.00)

2006 dodge viper twin turbo 1000+ hp first edition #126 coupe(US $90,000.00) 1998 dodge viper gts coupe twin turbo(US $90,000.00)

1998 dodge viper gts coupe twin turbo(US $90,000.00) First hennessey viper venom 600 produced 1993 hardtop 1725 miles one owner(US $75,000.00)

First hennessey viper venom 600 produced 1993 hardtop 1725 miles one owner(US $75,000.00) 2004 silver srt10! viper. there not a nicer one anyplace car collectors car(US $47,990.00)

2004 silver srt10! viper. there not a nicer one anyplace car collectors car(US $47,990.00)

Auto Services in Texas

Wolfe Automotive ★★★★★

Williams Transmissions ★★★★★

White And Company ★★★★★

West End Transmissions ★★★★★

Wallisville Auto Repair ★★★★★

VW Of Temple ★★★★★

Auto blog

Dodge to sell off first Challenger SRT Hellcat for charity

Sun, 27 Jul 2014

Want to get your hands on a new 2015 Dodge Challenger SRT Hellcat, and can't wait to be the first to get one? Las Vegas will be the place to be on September 27. That's where Barrett-Jackson will auction off the very first example. And you'd better bring your checkbook, because the bidding is sure to be fierce with all the proceeds going to charity.

The supercharged Challenger with VIN 0001 has been hand-painted in Stryker Red (usually reserved for the Viper) and features special badging, documentation and accompanying memorabilia - not to mention, of course, that 707-horsepower, 6.2-liter supercharged Hemi V8. The car will be on display this weekend as well at Barrett-Jackson's Hot August Nights auction in Reno.

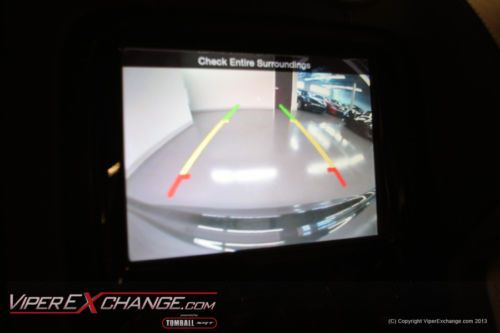

The 2017 Dodge Charger Pursuit will always watch your back

Thu, Feb 9 2017Police cruisers spend the majority of their life parked and idle, waiting for the call to action. A parked car is a vulnerable one, especially when there may be incentive to disable or destroy that vehicle. FCA has worked with InterMotive, Inc., to supply safety technology that will detect movement behind the vehicle through the combined use of radar and the rear-view camera. Even better, FCA is putting this tech in every 2017 Dodge Charger Pursuit at no extra cost. According to InterMotive, the Officer Protection Package is designed to help awareness with an officer is parked and working inside the vehicle. The system will provide an alert if there is anyone moving behind the vehicle to ambush the officer. The system plugs into the OBDII port and is secured under the dash. The device can then be manually switched on. This triggers the rear parking sensors to activate and. If any movement is detected, the officer can look behind the car through the rear-view camera. The system will automatically lock the doors, roll up the windows and flash the taillights. No word on how much the system will cost for non-2017 vehicles, but it is available for order right now. Related Video: News Source: FCA Dodge Technology Police/Emergency

Dodge Viper recall requires small-handed mechanics

Fri, 25 Apr 2014It has been over a year since Chrysler first announced its recall of 3,660 2003-2004 Dodge Vipers because the airbag could suddenly deploy. The repairs are finally beginning, and it appears to be a nightmare for mechanics.

According to the automaker's filing with the National Highway Traffic Safety Administration, the airbag control module can fail, which causes the bag or the seatbelt pre-tensioner to deploy without warning. It took over a year to design the new parts, according to The New York Times. However, Chrysler finally has a new "jumper harness with an in-line diode filter circuit" ready to fix the problem.

The dilemma now moves to the mechanics who have to actually install the part. A 47-step guide from Chrysler explains that the procedure should take about two hours. It's not an easy job, though. Most of the dashboard has to be taken apart, and the instructions include this helpful bit of advice: "Installing the jumper harness and filter box into position is not an easy task. Patience, perseverance, and small hands are required." We wish the best of luck to them. The fix comes just in time for the Vipers to enjoy the summer sun.

2040Cars.com © 2012-2025. All Rights Reserved.

Designated trademarks and brands are the property of their respective owners.

Use of this Web site constitutes acceptance of the 2040Cars User Agreement and Privacy Policy.

0.218 s, 7902 u