2009 Dodge Viper Srt10 on 2040-cars

Deerfield Beach, Florida, United States

For Sale By:Dealer

Engine:8.4L 8448CC 515Cu. In. V10 GAS OHV Naturally Aspirated

Body Type:Convertible

Transmission:Manual

Fuel Type:GAS

Cab Type (For Trucks Only): Other

Make: Dodge

Warranty: Vehicle does NOT have an existing warranty

Model: Viper

Trim: SRT-10 Convertible 2-Door

Disability Equipped: No

Drive Type: RWD

Doors: 2

Mileage: 3,565

Drive Train: Rear Wheel Drive

Sub Model: SRT10

Number of Doors: 2

Exterior Color: Red

Interior Color: Black

Number of Cylinders: 10

Dodge Viper for Sale

2013 gts 8.4l venom black gts(US $138,990.00)

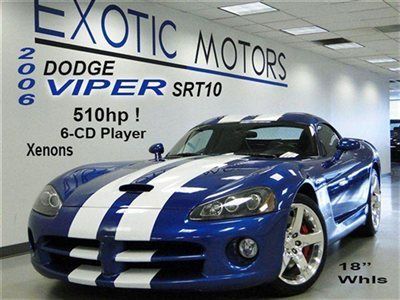

2013 gts 8.4l venom black gts(US $138,990.00) 2006 dodge viper srt-10!! blue w/white-stripes! xenons 6-cd 510hp 18"whls!!(US $49,900.00)

2006 dodge viper srt-10!! blue w/white-stripes! xenons 6-cd 510hp 18"whls!!(US $49,900.00) 8.4l voi-10 edition navigation car cover 2 owners clean carfax exportable(US $72,987.00)

8.4l voi-10 edition navigation car cover 2 owners clean carfax exportable(US $72,987.00) 8.3l bright metallic convertible car cover clean carfax 5k miles we finance!(US $49,991.00)

8.3l bright metallic convertible car cover clean carfax 5k miles we finance!(US $49,991.00) Srt viper bumble bee track and grand touring package(US $117,490.00)

Srt viper bumble bee track and grand touring package(US $117,490.00) 2013 srt viper gts black gunmetal stripes new(US $131,090.00)

2013 srt viper gts black gunmetal stripes new(US $131,090.00)

Auto Services in Florida

Youngs` Automotive Service ★★★★★

Winner Auto Center Inc ★★★★★

Vehicles Four Sale Inc ★★★★★

Valvoline Instant Oil Change ★★★★★

USA Auto Glass ★★★★★

Tuffy Auto Service Centers ★★★★★

Auto blog

Dodge Demon test mule spotted wearing unusual camouflage

Thu, Feb 23 2017The Dodge Demon apparently refuses to stay under wraps. The endless rollout of teasers continues each Thursday, but thanks to both Vin Diesel and our trusty spy photographer we have a whole suite of photos that show a nearly complete car in the flesh. This car appears to have been hiding in plain sight, as some of these photos were captured in the Detroit area. The car or cars in these photos is far less polished than the one shown in all of Dodge's teasers. The Air Grabber hood is unpainted, though it does come with some awesome hood pins. The same goes for the bolt-on fenders, as other pictures show a cleaner integration of the Demon's widebody modification. Despite the large Nitto logo on the top of the windshield, the cars in these photos are both wearing a set of Pirelli PZero All-season Plus tires on non-Demon wheels. It's as if drag radials aren't the best choice for winter driving. This car is fitted with two-piece Brembo brakes, but there's no telling if they're different than the standard Hellcat's. The decals on the side of the car may give clues to some of the Demon's equipment, but based on the LB Performance - commonly known as Liberty Walk- logo, the decals are likely more of a ruse than anything else. Liberty walk is famous in the tuning community for big, bolt-on body kits. The looks perfectly suit these test cars, though Borla exhaust and a Hurst shifter would be a wonderful addition to the Demon. Outside of that, there isn't much new to glean from these photos. Most of our questions about the Demon (horsepower, gearing, price) can't be had from pictures. Look for more news each Thursday in the lead up to the car's debut in New York in April. Related Video: Featured Gallery Dodge Demon Spy Shots View 14 Photos Related Gallery Dodge Demon Teasers View 17 Photos Image Credit: KGP Photography Spy Photos Dodge Coupe dodge hellcat

Special Dodge Challengers get Hellcat bits to celebrate Mopar's 80th birthday

Fri, Feb 10 2017This year, Mopar is celebrating its 80th anniversary, and it's doing so in two-tone style with this very limited edition Dodge Challenger. Only 160 of these Challengers will be built, with 80 in each paint scheme. Buyers can choose between either Billet Silver or the slightly painful sounding Contusion Blue, each of which gets a hand-painted Pitch Black top half. These Challengers are based on the existing 392 Shaker package, but come with an array of upgrades and tweaks. In addition to the custom two-tone paint, the shaker scoop and rear spoiler are painted in the same color, rather than the usual matte black. The cars come with 20-inch wheels and hand-painted 392 logos on the fenders. The 392 cu. in., or 6.4-liter if you prefer, engine produces the same 485 horsepower and 475 lb-ft of torque as its normal counterpart. This Mopar Challenger will have more access to cold air, though, since it has both the shaker scoop and the headlamp intake from the Challenger Hellcat. At the back, there's also exhaust tips borrowed from the most hellish of Challengers. Or at least the most hellish, so far. View 14 Photos Inside, the changes are more minor. Performance seats are added with embroidered Mopar logos in the backrests. The seats and other trim also feature a silver-colored Tungsten stitching. Naturally, a serial number badge makes an appearance inside, too. Owners will also receive a little box of goodies including a booklet, signed rendering, keychain, additional badge, and a certificate showing the date of manufacture. The overall package is rather attractive, but it isn't cheap. To own one of the few Mopar Challengers, you'll have to fork over $56,885. That's a significant premium over the 392 Scat Pack Shaker, which starts at just $44,890 and makes just as much power. You'll also be able to get a 392 Scat Pack Shaker right away, while the Mopar special edition won't be out until spring. Plus, you may not get it until summer because the hand-painting process takes some time. Of course, for some people, the cost and the wait are worth the exclusivity. Related Video: This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings.

Takata adds millions to recall expansion in US [UPDATE]

Thu, May 28 2015UPDATE: Ford spokesperson Kelli Felker has advised Autoblog that of the 1,509,535 total vehicles worldwide that the company is recalling, 966,504 of them are new additions for this expanded safety campaign. Last week, the National Highway Traffic Safety Administration announced that the Takata airbag inflator recalls would expand to an estimated 33.8 million vehicles in the US. However at the time, automakers weren't sure specifically which of their models might be affected under this enlarged campaign. Now, the numbers for BMW, FCA, Ford, and Mitsubishi are being released by the agency. Additionally, Honda is outlining the broadening of its own campaign. BMW's recall amounts to 420,661 vehicles in the US, an increase from 140,696 previously. All of the following models need their front, driver's side airbag replaced: 2002-2005 BMW 325i/325xi/330i/330xi Sedan 2002-2005 BMW 325xi/325i Sportswagon 2002-2006 BMW 330Ci/325Ci/M3 Convertible 2002-2006 BMW 325i/330i/M3 Coupe 2002-2003 BMW M5/540i/525i/530i Sedan 2002-2003 BMW 540i/525i Sportswagon 2003-2004 BMW X5 3.0i/4.4i BMW has received no reports of any injures or deaths from this problem in its vehicles. FCA has 5,224,845 vehicles globally in need of inflator replacements, according to its statement. However, the company is only aware of one injury related to the issue, which occurred in a 2006 Dodge Charger in southern Florida. There are 4,747,202 vehicles worldwide from the company that are affected on the front, driver's side. Among these, 4,066,732 are in the US, 374,508 are in Canada, and the rest are in other countries. The models are: 2005-2009 Dodge Ram 2500 Pickup 2004-2008 Dodge Ram 1500 Pickup 2006-2009 Dodge Ram 3500 Pickup 2007-2009 Dodge Ram 3500 Cab Chassis 2008-2010 Dodge Ram 4500/5500 Cab Chassis 2008-2009 Sterling 4500/5500 Cab Chassis 2004-2008 Dodge Durango 2007-2008 Chrysler Aspen 2005-2010 Chrysler 300/300C/SRT8 2005-2010 Dodge Charger/Magnum 2005-2011 Dodge Dakota 2006-2010 Mitsubishi Raider Also, there are 438,156 vehicles in the US, according to the NHTSA documents, that need their front passenger's side inflators replaced in the expansion of an earlier regional recall: 2003 Dodge Ram 1500 2003 Dodge Ram 2500 2003 Dodge Ram 3500 The total number of vehicles from Ford now covered under these campaigns stands at 1,509,535 worldwide. Of this total, there are 1,380,604 in the United States, 93,207 in Canada and 16,953 in Mexico.