2004 Dodge Viper Srt10 Black Mamba 8.3l V10 Manual Rwd Convertible Rebuilt on 2040-cars

Brooklyn, New York, United States

Dodge Viper for Sale

Srt-10 convertible, 8.3l v10 505hp, leather loaded, salvage repairable damaged(US $21,900.00)

Srt-10 convertible, 8.3l v10 505hp, leather loaded, salvage repairable damaged(US $21,900.00) 1995 dodge viper 2-dr. open top manual transmission clean vehicle history(US $37,995.00)

1995 dodge viper 2-dr. open top manual transmission clean vehicle history(US $37,995.00) 2006 dodge viper srt-10 convertible 2-door 8.3l(US $57,000.00)

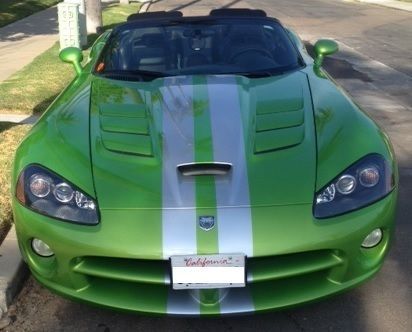

2006 dodge viper srt-10 convertible 2-door 8.3l(US $57,000.00) 2008 dodge viper convertible - snake skin green w/ silver stripes - 600hp !!!(US $61,500.00)

2008 dodge viper convertible - snake skin green w/ silver stripes - 600hp !!!(US $61,500.00) 1996 dodge viper gts coupe. sell or trade for fleetwood revolution dp(US $48,500.00)

1996 dodge viper gts coupe. sell or trade for fleetwood revolution dp(US $48,500.00) Rare 2001 dodge viper r/t10 15k miles red/champagne orig owner, excellent con(US $42,500.00)

Rare 2001 dodge viper r/t10 15k miles red/champagne orig owner, excellent con(US $42,500.00)

Auto Services in New York

Vogel`s Collision ★★★★★

Vinnies Truck & Auto Service ★★★★★

Triangle Auto Repair ★★★★★

Transmission Giant Inc ★★★★★

Town Line Auto ★★★★★

Tony`s Service Center ★★★★★

Auto blog

NHTSA, IIHS, and 20 automakers to make auto braking standard by 2022

Thu, Mar 17 2016The National Highway Traffic Safety Administration, the Insurance Institute for Highway Safety and virtually every automaker in the US domestic market have announced a pact to make automatic emergency braking standard by 2022. Here's the full rundown of companies involved: BMW, Fiat Chrysler Automobiles, Ford, General Motors, Honda, Hyundai, Jaguar Land Rover, Kia, Mazda, Mercedes-Benz, Mitsubishi, Nissan, Subaru, Tesla, Toyota, Volkswagen, and Volvo (not to mention the brands that fall under each automaker's respective umbrella). Like we reported yesterday, AEB will be as ubiquitous in the future as traction and stability control are today. But the thing to note here is that this is not a governmental mandate. It's truly an agreement between automakers and the government, a fact that NHTSA claims will lead to widespread adoption three years sooner than a formal rule. That fact in itself should prevent up to 28,000 crashes and 12,000 injuries. The agreement will come into effect in two waves. For the majority of vehicles on the road – those with gross vehicle weights below 8,500 pounds – AEB will need to be standard equipment by September 1, 2022. Vehicles between 8,501 and 10,000 pounds will have an extra three years to offer AEB. "It's an exciting time for vehicle safety. By proactively making emergency braking systems standard equipment on their vehicles, these 20 automakers will help prevent thousands of crashes and save lives," said Secretary of Transportation Anthony Foxx said in an official statement. "It's a win for safety and a win for consumers." Read on for the official press release from NHTSA. Related Video: U.S. DOT and IIHS announce historic commitment of 20 automakers to make automatic emergency braking standard on new vehicles McLEAN, Va. – The U.S. Department of Transportation's National Highway Traffic Safety Administration and the Insurance Institute for Highway Safety announced today a historic commitment by 20 automakers representing more than 99 percent of the U.S. auto market to make automatic emergency braking a standard feature on virtually all new cars no later than NHTSA's 2022 reporting year, which begins Sept 1, 2022. Automakers making the commitment are Audi, BMW, FCA US LLC, Ford, General Motors, Honda, Hyundai, Jaguar Land Rover, Kia, Maserati, Mazda, Mercedes-Benz, Mitsubishi Motors, Nissan, Porsche, Subaru, Tesla Motors Inc., Toyota, Volkswagen and Volvo Car USA.

Edmunds ranks the best used cars for 2013

Sun, 15 Sep 2013When people ask us what car we would recommend for them, it's usually not easy to answer. To make a useful recommendation we must consider which of the numerous vehicle segments fits their needs best, and then choose one of the many vehicles offered in each segment. For some people, new cars don't meet their expectations of value, because they lose so much of it the moment they are purchased and driven off the dealer lot. For them, there's always the used-car market, where great deals can be found, but cars' histories of reliability and maintenance records - and perhaps that Certified Pre-Owned warranty - become ever-important factors playing into purchase choice.

To help out, Edmunds has done us the favor of assembling a list of the best used vehicles money can buy, covering model years 2006-2011, according to what it considers the most important criteria when shopping for used autos: reliability, safety, value and availability. That means unreliable, unsafe, super-expensive or limited-edition models don't appear on the list, but instead cars from each segment that are more likely to satisfy the general population.

There are some real goodies on the list, including but not limited to vehicles such as the capable Honda Fit, the cultish Honda Accord coupe (which can be had with a 240-horsepower V6 and a six-speed manual transmission some years), and the powerful Chevrolet Corvette. While Edmunds' choice of the Volvo C70 for best used convertible baffled us at first (not that it's a bad car), it redeemed itself by stating that the Mazda MX-5 still is an unofficial top choice if you don't require more than two seats.

2016 Dodge Challenger and Charger Hellcats see doubled production

Mon, Jul 27 2015The launch of the Hellcat supercharged V8 in the Dodge Challenger and Charger for the 2015 model year was a massive success. The one-two punch of muscle cars probably grabbed the brand more headlines than it had seen in ages by offering a world-beating 707 horsepower from the growling engine under the hood. The only real wrench in the works was keeping up with all of the orders. For 2016, Dodge might have fixed that little problem with plans to make more than twice as many of these mean machines Despite production seeing a massive boost, a few customers with orders for 2015 examples will need to wait just a little longer to experience those 707 ponies. The automaker will cancel any unscheduled, sold orders for the current model, but those buyers will receive a discount on the 2016. Similar to last year, dealers will earn their allocation of the muscle cars based on Dodge sales and how long the Hellcats stay on their lots. There are some very tiny changes for any buyers who are holding out for the 2016 Hellcats, too. Mechanically, they are identical to the 2015s with a 6.2-liter supercharged V8 and eight-speed automatic. The interiors see some improvements, though. Both the Challenger and Charger now receive standard Laguna Leather upholstery and an improved 8.4-inch Uconnect system with navigation, an HD radio, and five years of SiriusXM Travel Link and Traffic. Orders for both open in the second week of August, and production actually begins in September in Brampton, Ontario, Canada.