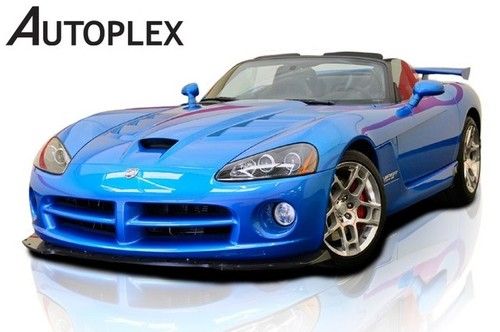

2003 Dodge Viper Srt Convertable No Reserve Selling For Less Waythan Rough Book on 2040-cars

Key West, Florida, United States

Body Type:Convertible

Vehicle Title:Clear

Engine:500 horse power

Fuel Type:Gasoline

For Sale By:Private Seller

Number of Cylinders: 10

Make: Dodge

Model: Viper

Trim: SRT-10 Convertible 2-Door

Options: Leather Seats, CD Player, Convertible

Drive Type: RWD

Safety Features: Anti-Lock Brakes, Driver Airbag, Passenger Airbag

Mileage: 69,400

Power Options: Cruise Control, Power Locks, Power Windows

Exterior Color: Red

Interior Color: Black

RED 2003 viper selling over 6000 plus under rough book value for quick sale

http://youtu.be/76ZWhLm5d0A check out this video

NADA http://www.nadaguides.com/Cars/2003/Dodge/SRT-10/2-Door-Roadster/Values

yes to the eye a 2010 viper worth one hundred thousand ,everyone will look google take picturesa rare ride such a bad boy selling cheap ,guarenteed to make girls squeel with pleasure while in passenger seat a true american rocket ship

its a 10 yr old car has a few minor quricks ,drove it today I love it ,but love flying more,yes selling ten thousand under rough book wow, this is not a peice of junk corvette that looses control at 104 mph I know have been there

Dodge Viper for Sale

Venom red metallic 1 owner only 1k miles mint condition like brand new(US $69,900.00)

Venom red metallic 1 owner only 1k miles mint condition like brand new(US $69,900.00) Viper convertible! 1 of 4! aero pkg rear spoiler! low miles! srt-10!(US $69,991.00)

Viper convertible! 1 of 4! aero pkg rear spoiler! low miles! srt-10!(US $69,991.00) 2008 dodge viper srt-10 acr coupe only 210 miles! coupe black carbon spoiler(US $88,900.00)

2008 dodge viper srt-10 acr coupe only 210 miles! coupe black carbon spoiler(US $88,900.00) Dodge viper first edition 4k miles super clean(US $64,995.00)

Dodge viper first edition 4k miles super clean(US $64,995.00) 2010 dodge viper srt 10 blue and white coupe 500 miles(US $94,500.00)

2010 dodge viper srt 10 blue and white coupe 500 miles(US $94,500.00) 2008 dodge viper srt 10 street serpent wide body kit(US $79,995.00)

2008 dodge viper srt 10 street serpent wide body kit(US $79,995.00)

Auto Services in Florida

Z Tech ★★★★★

Vu Auto Body ★★★★★

Vertex Automotive ★★★★★

Velocity Factor ★★★★★

USA Automotive ★★★★★

Tropic Tint 3M Window Tinting ★★★★★

Auto blog

Germany threatens to ban FCA vehicles over diesel emissions dispute

Tue, May 24 2016Germany is threatening to ban sales of FCA products over diesel emissions. According to the newspaper Bild Am Sonntag, Germany's Federal Motor Transport Authority found evidence of a so-called defeat device that shuts down certain emissions controls after running for 22 minutes. A standard diesel emissions test in the European Union reportedly takes 20 minutes to complete. FCA denies the allegations. "We believe all our vehicles respect EU emissions standards and we believe Italian regulators are the competent authority to evaluate this," the company said in a statement. The latter part of that statement drew ire from German authorities, especially after FCA declined to meet with German transport minister Alexander Dobrindt to discuss the issue. Graziano Delrio, the Italian Minister of Infrastructure and Transport, vowed to work with German authorities on behalf of FCA. According to EU law, FCA is required to homologate its vehicles in Italy because that's where its regional operations are based. When will the diesel-scented soap opera end? We wish we knew, but our Magic 8 Ball is covered in soot. Related Video: News Source: Financial TimesImage Credit: Giuseppe Aresu/Bloomberg via Getty Government/Legal Green Chrysler Dodge Fiat Jeep RAM Emissions Diesel Vehicles FCA

Killing the Dart and 200 might lower FCA's fuel economy burden

Tue, Feb 9 2016Killing the Dodge Dart and Chrysler 200 could allow FCA US to take advantage of an intriguing quirk in the next decade's fuel economy regulations. By increasing its ratio of trucks versus cars, the automaker might not need to worry so much about hitting the more stringent efficiency rules. At first thought, it might seem harder for an automaker with a ton of trucks to meet the government's mandated 54.5 mile per gallon corporate average fuel economy for 2025. However, every company doesn't need to hit that lofty figure, according to The Detroit Free Press. The exact target varies by the product mix between trucks and cars. "While passenger car and light truck categories have separate CAFE targets, it's still true that more trucks versus cars in a company lineup means a lower combined CAFE target," Brandon Schoettle, Project Manager Sustainable Worldwide Transportation at the University of Michigan Transportation Research Institute, told Autoblog. "While passenger car and light truck categories have separate CAFE targets, it's still true that more trucks versus cars in a company lineup means a lower combined CAFE target." FCA US' current product blend has 80 percent pickups and CUVs, which means the company stands to benefit from a lower fuel economy target. It might not seem entirely fair environmentally, but this is a great move from a business perspective. The new CAFE rules aren't set in stone, according to The Detroit Free Press, but potentially taking advantage of the regulation is just one more reason to cut the Dart and 200. Modern crossovers also aren't gas guzzlers like older SUVs, which could make it easier to hit the fuel economy target. "Utilities offer practicality and versatility that cars do not, and now, built on car architectures, they do not penalize consumers on fuel economy as they once did," AutoTrader Senior Analyst Michelle Krebs told Autoblog. Schoettle warns that FCA is still making a gamble by killing the small sedans. "Depending on the previous sales volumes and how much these vehicles might have exceeded their specific CAFE targets, it's possible that these cars helped earn CAFE credits for FCA that they could bank for future use," he said. "Future sales breakdowns [car vs.

The Dodge Demon sheds some weight in pursuit of speed

Thu, Jan 19 2017The Dodge Demon teaser train isn't stopping until it hits New York City. In case you need a reminder, the upcoming Demon is the more pedestrian Hellcat's stripped-down and hopped-up sibling that promises to be built for the sole purpose of traveling a quarter-mile mile quicker than any of its rivals. The weekly video rollout on www.ifyouknowyouknow.com continues with the latest sneak peak, "Reduction." While there were early rumors that the Demon may pack an all-wheel-drive system and in turn gain enough grip to rotate the Earth underneath it, Dodge and SRT look to be going down a simpler route. The press release reveals the Demon is 200 pounds lighter than the standard Hellcat. It's unclear where all that weight is coming from, but at nearly 4,500 pounds, the Challenger Hellcat could stand to go on a bit of a diet. The video hints at adjustments to the wheels, steering, suspension, and brakes, as well as some modifications to the car's interior. Don't be surprised if the Demon is a bare bones stripper model with no back seat, no A/C, and no radio. Who needs music when you have 2.4-liter supercharger and a 6.2-liter Hemi V8 making sweet love under the hood? Related Video: Image Credit: FCA Design/Style Marketing/Advertising New York Auto Show Dodge Coupe Future Vehicles Special and Limited Editions Performance dodge demon dodge hellcat