2011 Dodge Ram 3500 Laramie Mega Diesel Drw 4x4 Nav 28k Texas Direct Auto on 2040-cars

Stafford, Texas, United States

Dodge Ram 3500 for Sale

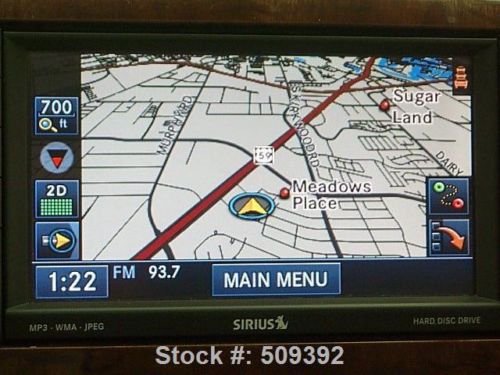

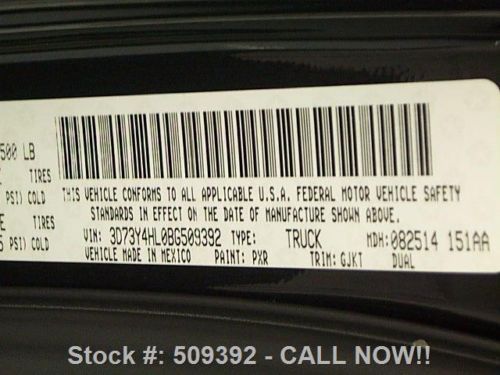

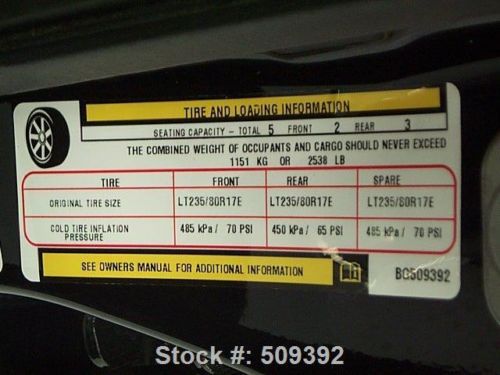

2011 dodge ram 3500 laramie crew 4x4 diesel drw nav dvd texas direct auto(US $44,980.00)

2011 dodge ram 3500 laramie crew 4x4 diesel drw nav dvd texas direct auto(US $44,980.00) 2011 dodge ram 3500 4x4 crew diesel dually flatbed 46k texas direct auto(US $35,480.00)

2011 dodge ram 3500 4x4 crew diesel dually flatbed 46k texas direct auto(US $35,480.00) 2012 dodge ram 3500 reg cab 4x4 diesel drw 6spd longbed texas direct auto(US $34,980.00)

2012 dodge ram 3500 reg cab 4x4 diesel drw 6spd longbed texas direct auto(US $34,980.00) 5.9l i6 cummins diesel 5-speed manual grill guard tow cd mp3 dually black rims

5.9l i6 cummins diesel 5-speed manual grill guard tow cd mp3 dually black rims 2008 cloth trailer hitch cummin diesel lifetime warranty we finance 57k miles

2008 cloth trailer hitch cummin diesel lifetime warranty we finance 57k miles 2003 dodge ram 3500 cummins 5.9 2wd 6-spd manual

2003 dodge ram 3500 cummins 5.9 2wd 6-spd manual

Auto Services in Texas

Yescas Brothers Auto Sales ★★★★★

Whitney Motor Cars ★★★★★

Two-Day Auto Painting & Body Shop ★★★★★

Transmission Masters ★★★★★

Top Cash for Cars & Trucks : Running or Not ★★★★★

Tommy`s Auto Service ★★★★★

Auto blog

Stellantis invests more than $100 million in California lithium project

Thu, Aug 17 2023Stellantis said it would invest more than $100 million in California's Controlled Thermal Resources, its latest bet on the direct lithium extraction (DLE) sector amid the global hunt for new sources of the electric vehicle battery metal. The investment by the Chrysler and Jeep parent announced on Thursday comes as the green energy transition and U.S. Inflation Reduction Act have fueled concerns that supplies of lithium and other materials may fall short of strong demand forecasts. DLE technologies vary, but each aims to mechanically filter lithium from salty brine deposits and thus avoid the need for open pit mines or large evaporation ponds, the two most common but environmentally challenging ways to extract the battery metal. Stellantis, which has said half of its fleet will be electric by 2030, also agreed to nearly triple the amount of lithium it will buy from Controlled Thermal, boosting a previous order to 65,000 metric tons annually for at least 10 years, starting in 2027. "This is a significant investment and goes a long way toward developing this key project," Controlled Thermal CEO Rod Colwell said in an interview. The company plans to spend more than $1 billion to separate lithium from superhot geothermal brines extracted from beneath California's Salton Sea after flashing steam off those brines to spin turbines that will produce electricity starting next year. That renewable power is expected to cut the amount of carbon emitted during lithium production. Rival Berkshire Hathaway has struggled to produce lithium from the same area given large concentrations of silica in the brine that can form glass when cooled, clogging pipes. Colwell said a $65 million facility recently installed by Controlled Thermal can remove that silica and other unwanted metals. DLE equipment licensed from Koch Industries would then remove the lithium. "We're very happy with the equipment," he said. "We're going to deliver. There's just no doubt about it." Stellantis CEO Carlos Tavares called the Controlled Thermal partnership "an important step in our care for our customers and our planet as we work to provide clean, safe and affordable mobility." Both companies declined to provide the specific investment amount. Controlled Thermal aims to obtain final permits by October and start construction of a commercial lithium plant soon thereafter, Colwell said. Goldman Sachs is leading the search for additional debt and equity financing, he added.

Autoblog Podcast #380

Tue, May 13 2014Episode #380 of the Autoblog podcast is here, and this week, Dan Roth, Chris Paukert and Seyth Miersma talk about the Fiat-Chrysler five-year plan, the seeming demise of the Nissan Cube, and proposed legislation to require speed limiters with a 68-mph maximum on America's tractor trailers. We start with what's in the garage and finish up with some of your questions, and for those of you who hung with us live on our UStream channel, thanks for taking the time. Check out the new rundown below with times for topics, and you can follow along down below with our Q&A. Thanks for listening! Autoblog Podcast #380: Topics: Fiat-Chrysler five-year plan Nissan Cube on the way out? Big rig speed limiters coming? In the Autoblog Garage: 2015 Mercedes-Benz S63 AMG 2014 Chevrolet Sonic RS Sedan 2014 Honda Odyssey Touring Elite Hosts: Dan Roth, Chris Paukert, Seyth Miersma Runtime: 01:44:17 Rundown: Intro and Garage - 00:00 Fiat Chrysler Plan - 29:40 Nissan Cube - 01:07:33 Semi Speed Limiters - 01:17:33 Q&A - 01:27:35 Get the podcast: [UStream] Listen live on Mondays at 10 PM Eastern at UStream [iTunes] Subscribe to the Autoblog Podcast in iTunes [RSS] Add the Autoblog Podcast feed to your RSS aggregator [MP3] Download the MP3 directly Feedback: Email: Podcast at Autoblog dot com Review the show in iTunes Auto News Earnings/Financials Plants/Manufacturing Podcasts Rumormill Chevrolet Chrysler Dodge Fiat Jeep Nissan nissan cube speed limiters

China-FCA merger could be a win-win for everyone but politicians

Tue, Aug 15 2017NEW YORK — Fiat Chrysler boss Sergio Marchionne has said the car industry needs to come together, cut costs and stop incinerating capital. So far, his words have mostly fallen on deaf ears among competitors in Europe and North America. But it appears Marchionne has finally found a receptive audience — in China. FCA shares soared Monday after trade publication Automotive News reported the $18 billion Italian-American conglomerate controlled by the Agnelli family rebuffed a takeover from an unidentified carmaker from the Chinese mainland. As ugly as the politics of such a combination may appear at first blush, a transaction could stack up industrially, and perhaps even financially. A Sino-U.S.-European merger would create the first truly global auto group. That could push consolidation to the next level elsewhere. Moreover, China is the world's top market for the SUVs that Jeep effectively invented, so it might benefit FCA financially. A combo would certainly help upgrade the domestic manufacturer; Chinese carmakers have gotten better at making cars, but struggle to build global brands, and they need to develop export markets. Though frivolous overseas shopping excursions by Chinese enterprises are being reined in by Beijing, acquisitions that support the modernization and transformation of strategic industries still receive support, and the government considers the automotive industry to be strategic. A purchase of FCA by Guangzhou Automobile, Great Wall or Dongfeng Motors would probably get the same stamp of approval ChemChina was given for its $43 billion takeover of Syngenta. What's standing in the way? Apart from price (Automotive News said FCA's board deemed the offer insufficient) there's the not-insignificant matter of politics. Even as FCA shares soared, President Donald Trump interrupted his vacation to instruct the U.S. Trade Representative to look into whether to investigate China's trade policies on intellectual property. Seeing storied Detroit brands like Jeep, Chrysler, Ram and Dodge handed off to a Chinese company would provoke howls among Trump's economic-nationalist supporters. It might not play well in Italy, either, to see Alfa Romeo and Maserati answering to Wuhan instead of Turin — though Automotive News said they might be spun off separately. Yet, as Morgan Stanley observes, "cars don't ship across oceans easily," and political considerations increasingly demand local manufacture of valuable products.