2007 Dodge Ram 2500 Slt 5.9l Cummins Diesel 4x4 on 2040-cars

Decatur, Illinois, United States

Vehicle Title:Clear

Fuel Type:Diesel

Engine:6

For Sale By:Dealer

Transmission:Automatic

Make: Dodge

Model: Ram 2500

Mileage: 92,800

Disability Equipped: No

Sub Model: SLT

Doors: 4

Exterior Color: Black

Cab Type: Crew Cab

Interior Color: Gray

Drivetrain: Four Wheel Drive

Dodge Ram 2500 for Sale

2004 dodge ram 2500 5.9 cummins diesel auto 4x4(US $15,950.00)

2004 dodge ram 2500 5.9 cummins diesel auto 4x4(US $15,950.00) 2006 dodge ram 2500 quad cab 5.9 diesel 4x4 short bed slt we finance warranty(US $19,995.00)

2006 dodge ram 2500 quad cab 5.9 diesel 4x4 short bed slt we finance warranty(US $19,995.00) 03 dodge ram 2500hd diesel 4x4 5-speed slt quad cab texas truck(US $19,995.00)

03 dodge ram 2500hd diesel 4x4 5-speed slt quad cab texas truck(US $19,995.00) 2007 dodge ram 2500 quad cab 5.9 diesel slt 128k we finance warranty cummins(US $16,990.00)

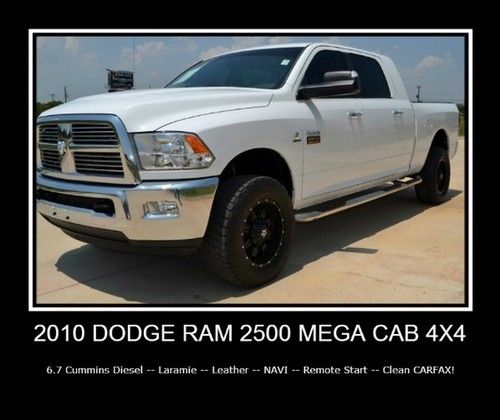

2007 dodge ram 2500 quad cab 5.9 diesel slt 128k we finance warranty cummins(US $16,990.00) 4x4 cummins diesel -- 1 owner -- navi -- leather -- remote start -- clean carfax(US $35,995.00)

4x4 cummins diesel -- 1 owner -- navi -- leather -- remote start -- clean carfax(US $35,995.00) Crew cab pickup 4x4 automatic(US $32,500.00)

Crew cab pickup 4x4 automatic(US $32,500.00)

Auto Services in Illinois

Wheels of Chicago ★★★★★

Vern`s Auto Repair ★★★★★

Transmissions To Go ★★★★★

Transmatic Transmission Specialists ★★★★★

Total Auto Glass ★★★★★

Sunderland Automotive ★★★★★

Auto blog

Dodge muscle cars, armored Jeep to star in Furious 7 [w/video]

Wed, Mar 11 2015We're less than a month away from the smorgasbord of speed, stunts and shooting that is Furious 7, and it arrives in theaters on April 3 as one of the first big films of the year. Starring Fast and Furious regulars Vin Diesel, Paul Walker and Dwayne "The Rock" Johnson, plus Jason Statham as the big villain, this entry looks to be another exciting addition to the franchise. With such a major movie that features cars as much as the actors, it shouldn't be a surprise that an automaker is getting in on the action as a promotional partner. FCA US supplied nearly 30 vehicles for the film, including prominent roles for a 2015 Dodge Charger, Challenger R/T and armored Jeep Wrangler Unlimited. To really play up the connection, the automaker has laid out a global advertising campaign featuring its models. The marketing includes a variety of unique spots with the cars appearing online and in music videos. Among them in the US is a TV ad called Flash to the Future (embedded below) for the Challenger. Hopefully, Furious 7 can live up to all its pre-release hype. This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings. Cars, Movies and Music Come Together as Dodge Partners with Universal Pictures and Atlantic Records on 'Furious 7' 'Furious 7' opens April 3 and features 2015 Dodge Challenger, Dodge Charger R/T and 'armored' Jeep® Wrangler Unlimited Dodge launches multitier marketing initiative to promote action-thriller, including 'Flash to the Future' television ads for U.S. markets and across international countries, and Furious 7 web landing page at www.dodge.com/en/furious-7 Dodge vehicles also showcased in new music videos of songs from Atlantic Records 'Furious 7: Original Motion Picture Soundtrack,' available in stores and at online retailers March 17 March 9, 2015 , Auburn Hills, Mich. - Dodge, which has been a part of the blockbuster Fast & Furious franchise since its inception, announced today a promotional partnership with Universal Pictures for "Furious 7," in theaters April 3, and a first-ever partnership with Atlantic Records on music videos that support the label's "Furious 7: Original Motion Picture Soundtrack," available March 17 and available now for pre-order at http://smarturl.it/furious7.

Dodge Challenger Scat Pack adds power and noise, with a warranty

Thu, 17 Apr 2014If you want to go fast, there's certainly nothing wrong with the Dodge Challenger SRT8. With 470 horsepower and 470 pound-feet of torque for 2014, there's certainly not much to complain about. But what if you want something more aftermarket in flavor? There's no shortage of options, but while turning to the tuner world will make your car plenty fast, that extra power won't just shred rear tires, it'll torch your warranty, as well. That's where Dodge's Scat Pack comes in.

With three stages of mods for both the 5.7 and 6.4-liter Hemi V8s Challenger (as well as the 5.7-liter Charger and, soon, the four-pot Dart), the Scat Pack cars give drivers all the power, aggression and noise of a heavily modded aftermarket car while maintaining the piece of mind provided by the Dodge warranty.

Power gets bumped up to 485 horsepower and 475 pound-feet of torque with the 6.4-liter Scat Pack, while the 5.7-liter can provide up to 58 hp and 47 lb-ft of torque to add to the stock engine's 375 horsepower and 410 pound-feet. It's the latter engine that can really get some work done, with upgrades ranging from the mundane - intake and exhaust - to the racy, like the ported heads and high-flow headers.

Junkyard Gem: 1992 Dodge Shadow America

Tue, Aug 2 2016A quarter-century ago, most Americans looking for a cheap transportation appliance went for cars like the miserably-stripped-down-but-bulletproof Toyota Tercel or the feature-laden-but-reliability-challenged Hyundai Excel. Chrysler, having just discontinued the elderly "Omnirizon" platform, took the Dodge Shadow and its Plymouth sibling, the Sundance and offered a car that was bigger, more powerful, and better-equipped than just about anything else for the price: the America! These cars depreciated hard and nearly all were crushed a decade ago, so sightings are extremely rare today. Here's one that I found in a Northern California self-service yard. This one still had windshield paperwork indicating that it was an insurance-company auction car (probably totaled in a fender-bender that caused $200 worth of damage) and that it was a runner at the time it got junked. Such is the fate of 24-year-old economy cars in rough shape. The Shadow was a member of the many-branched K-Car family tree, and the Shadow America came with the same 2.2-liter straight-4 engine that powered millions of Caravans, Daytonas, New Yorkers, and Lasers. You got more torque than the competition, plus a driver's-side airbag instead of the maddening automatic seat belts found in other low-priced cars of 1992. Of course, the paint tended to peel off within a few years and the build quality of the Shadow was hit-or-miss, but these cars were way nicer to drive than, say, a Tercel EZ or Subaru Justy. This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings. The perfect cars for an imperfect world! Related Video: Featured Gallery Junked 1992 Dodge Shadow America View 17 Photos Auto News Dodge Automotive History