B&m Flexplate 10236 For Externally Balanced Engines 71-92 To Tf 727 on 2040-cars

Fairfield, California, United States

Vehicle Title:Clear

Engine:360

Make: Dodge

Model: Dart

Trim: GT

Mileage: 9,999

Drive Type: REAR

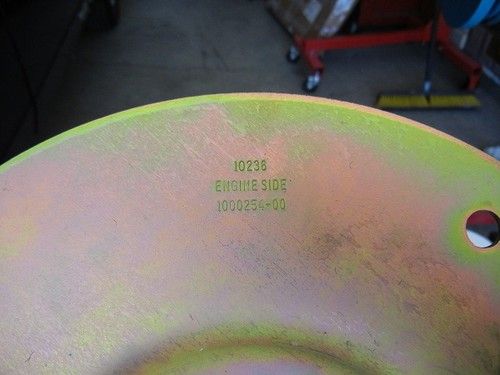

UP FOR SALE IS A B&M 10236 FLEXPLATE FOR USE WITH 1971-1992 EXTERNALLY BALANCED ENGINE TO TF 727. HAS DUAL BOLT PATTERN. WAS NEVER INSTALLED AND IS READY TO GO.

Dodge Dart for Sale

Auto Services in California

Zenith Wire Wheel Co ★★★★★

Yucca Auto Body ★★★★★

World Famous 4x4 ★★★★★

Woody`s & Auto Body ★★★★★

Williams Auto Care Center ★★★★★

Wheels N Motion ★★★★★

Auto blog

Fiat/PSA's dominance in small vans hangs up EU's merger approval

Mon, Jun 8 2020BRUSSELS — EU antitrust regulators are concerned about Fiat Chrysler and Peugeot / PSA's combined high market share in small vans and may require concessions to clear their $50 billion merger, people familiar with the matter said. The companies, which are seeking to create the world's fourth biggest carmaker, were told of the European Commission's concerns last week. If Fiat and PSA fail to dispel the European Commission's doubts in the next two days and subsequently decline to offer concessions by Wednesday, the deadline for doing so, the deal would face a four-month-long investigation. The EU competition enforcer, which has set a June 17 deadline for its preliminary review, declined to comment. Fiat was not immediately available for comment while PSA had no immediate comment. Hiving off overlapping businesses, usually a regulatory demand to ensure more competition, could prove tricky for the carmakers because of the technicalities. Fiat and PSA are looking to merge to help offset slowing demand and shoulder the cost of making cleaner vehicles to meet tougher emissions regulations. The deal puts under one roof the Italian carmaker's brands such as Fiat, Jeep, Dodge, Ram, Maserati and the French company's Peugeot, Opel and DS. Related Video: Government/Legal Chrysler Dodge Fiat Jeep Maserati RAM Citroen Opel Peugeot

Stellantis reports surprising 2020 results, is 'off to a flying start'

Wed, Mar 3 2021MILAN — Low global car inventories and cost cuts should boost Stellantis's profit margins this year, though a shortage of semiconductors and investments in electric vehicles could weigh on results, the newly-formed automaker said on Wednesday. The forecast came as Stellantis, created by the January merger of Peugeot-maker PSA and Fiat Chrysler (FCA), reported better-than-expected results for 2020 that sent its shares up around 3% in morning trading. "Stellantis gets off to a flying start and is fully focused on achieving the full promised synergies (from the merger)," Chief Executive Carlos Tavares said in a statement. Stellantis is the world's fourth largest carmaker, with 14 brands including Fiat, Peugeot, Opel, Jeep, Ram and Maserati. It said 2021 results should be helped by three new high-margin Jeep vehicles in North America and a strong pricing environment there. The U.S. market has driven profits for years at FCA and starts off as the strongest part of Stellantis. The group's guidance assumes no more significant lockdowns caused by the global COVID-19 pandemic, which shuttered auto plants around the world last spring. Stellantis should also get a lift as its starts to implement a plan aimed at delivering over 5 billion euros a year in savings, without closing any plants. Tavares has also pledged not to cut jobs. But a pandemic-related global shortage of semiconductors, used for everything from maximizing engine fuel economy to driver-assistance features, could hurt business. Auto industry executives have said the shortage should ease by the second half of 2021. Stellantis said its "electrification offensive" could also weigh on results this year. Automakers are racing to develop electric vehicles to meet tighter CO2 emissions targets in Europe and this week Volvo joined a growing number of carmakers aiming for a fully-electric line-up by 2030. Stellantis plans to have fully-electric or hybrid versions of all of its vehicles available in Europe by 2025, broadly in line with plans at top rivals such as Volkswagen and Renault-Nissan, although Stellantis has further to go to meet that goal. The carmaker is targeting an adjusted operating profit margin of 5.5%-7.5% this year. That compares with a 5.3% aggregated margin last year: 4.3% at FCA and 7.1% at PSA excluding a controlling stake in parts maker Faurecia, which is set to be spun-off from Stellantis shortly.

China's Great Wall confirms its interest — in Jeep, or all of FCA

Tue, Aug 22 2017HONG KONG/SHANGHAI — Chinese automaker Great Wall Motor reiterated its interest in Fiat Chrysler Automobiles NV on Tuesday, but said it had not held talks or signed a deal with executives at the Italian-American automaker. China's largest sport utility vehicle manufacturer made a direct overture to Fiat Chrysler on Monday, with an official saying the company was interested in all or part of FCA, owner of the Jeep and Ram truck brands. Automotive News first reported the news, quoting Great Wall Motor President Wang Fengying as saying she planned to contact FCA to discuss acquiring the Jeep brand specifically. Those comments sent FCA shares higher but also raised questions over the ability of China's seventh-largest automaker by sales to buy larger Western rival FCA, or even Jeep, which some analysts value at as much as one-and-a-half times FCA. Great Wall sought to dampen speculation on Tuesday. It confirmed it had studied Fiat Chrysler, but said there was "no concrete progress so far" and "substantial uncertainty" over whether it would eventually bid. "The company has not built any relationship with the directors of FCA nor has the company entered into any discussion or signed any agreements with any officer of FCA so far," the company said in an English-language stock exchange filing. It did not give further detail. Fiat Chrysler stock dipped on the statement on Tuesday. Great Wall said trading in its Shanghai-listed shares would resume on Wednesday after having been suspended. Fiat Chrysler declined to comment on Great Wall's statement. On Monday, it said it had not been approached and was fully committed to implementing its current business plan. FLUSHING OUT RIVALS? Great Wall Motor, which was early to spot China's love of SUVs, had revenue of $14.8 billion last year and sold 1.07 million vehicles - but that compares with FCA's 2016 revenue of 111 billion euros ($130.6 billion). Analysts said Great Wall would need to raise both debt and equity to complete any deal, meaning its chairman Wei Jianjun could lose majority control. One possible scenario, according to analysts at Jefferies, would see Wei keeping a roughly 30 percent stake, while Great Wall would raise $10-$14 billion in debt and $10 billion in equity - hefty for a group currently worth just $16 billion. Ultimately, politics could be the clincher.

1970 dodge dart swinger hardtop 2-door 5.6l

1970 dodge dart swinger hardtop 2-door 5.6l 1968 hurst super stock hemi dart clone

1968 hurst super stock hemi dart clone 1972 dodge dart, 340, auto trans, rear air shocks, very good condition

1972 dodge dart, 340, auto trans, rear air shocks, very good condition 1969 dodge dart gt 2 door ht

1969 dodge dart gt 2 door ht 1967 dodge dart gt ---------> no reserve

1967 dodge dart gt ---------> no reserve 1972 dodge dart swinger 440

1972 dodge dart swinger 440