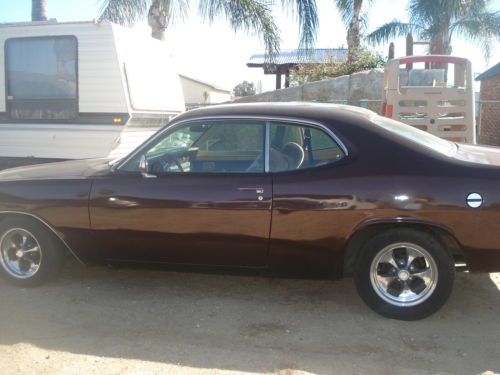

1974 Dodge Dart Sport on 2040-cars

Mira Loma, California, United States

|

Car is in descent condition has a little rust behind driver side wheel needs interior work body not bad but not perfect has a 318 with a holley four barel .

car is being sold as is. Has new radiator clutch fan water pump . |

Dodge Dart for Sale

1969 dodge dart gt. 340-v8! frame off restoration! fact a/c! stunning car!

1969 dodge dart gt. 340-v8! frame off restoration! fact a/c! stunning car! 2013 6 speed manual, power windows, locks and mirrors, cd player, xm radio, tint

2013 6 speed manual, power windows, locks and mirrors, cd player, xm radio, tint 1964 dodge dart, 2 door, anniversary edition, nice running and driving car(US $5,300.00)

1964 dodge dart, 2 door, anniversary edition, nice running and driving car(US $5,300.00) 680+hp, 472 ci hemi, viper red, 727 torqueflite, 3:55 sure-grip posi, disc brake(US $59,995.00)

680+hp, 472 ci hemi, viper red, 727 torqueflite, 3:55 sure-grip posi, disc brake(US $59,995.00) 2013 dodge dart one owner low miles

2013 dodge dart one owner low miles 1970 dodge dart completed restoration

1970 dodge dart completed restoration

Auto Services in California

Yoshi Car Specialist Inc ★★★★★

WReX Performance - Subaru Service & Repair ★★★★★

Windshield Pros ★★★★★

Western Collision Works ★★★★★

West Coast Tint and Screens ★★★★★

West Coast Auto Glass ★★★★★

Auto blog

Has Dodge stepped in it again with Scat Pack lawsuit?

Mon, 20 Oct 2014Lawsuits are an unfortunate part of doing business in just about any industry, so the latest complaint filed by a California-based aftermarket firm against Chrysler would seem to be nothing more than business as usual. But this isn't the first time the two companies have sparred over this particular issue.

According to a report from Automotive News, the dispute revolves around the Scat Pack name that Chrysler first offered on the Charger, Coronet, Dart and Super Bee starting in 1968. Scat Enterprises, a manufacturer of crankshafts and other components for Dodges and other vehicles, sued Chrysler for using its name. A few years later the Scat Pack disappeared from the Dodge catalog.

Fast forward to August 2013 when Chrysler applied to register the Scat Pack name anew. The US Patent and Trademark Office turned down Chrysler's application, but the automaker proceeded anyway, unveiling new Scat Packs for the Challenger, Charger and Dart at last year's SEMA show.

Historic race cars highlight the RM Sotheby's 2023 Le Mans sale

Sat, Jun 3 2023Auction house RM Sotheby's is celebrating 100 years of the 24 Hours of Le Mans by organizing a big sale on the day before the race. The cars scheduled to cross the auction block have all spent time on the track, and the catalog shows how racers have evolved since the 1930s. Browsing through RM's auction catalog is like taking a five-minute course in the history of racing. The oldest car is a 1932 Aston Martin Le Mans 'LM8' that's had a remarkable life. It was developed and built for competition and entered in the 1932 24 Hours of Le Mans by the Aston Martin factory team, where it finished seventh. It was ultimately sold to a private owner but it survived, which shouldn't be taken for granted: teams often destroyed obsolete race cars, and the list of special vehicles that didn't survive World War II is longer than you'd think. Paul Sykes bought the car in 1955 and used it as his daily driver. Imagine walking out of a shop in a British village in the 1960s and finding a 1932 race car parked next to your Mini. Sykes ultimately bought another daily driver, but he kept the Aston Martin for a total of 55 years. The second-oldest car is a 1936 Delahaye 135 S with a body by coach builder Pourtout. RM notes that this is one of the most significant pre-war competition Delahaye models and adds that it finished second in the 1938 edition of the 24 Hours of Le Mans. It continued racing until 1956 and then spent several decades hidden in storage. It was fully restored in 2005, and it's now eligible to compete in historic races such as the Mille Miglia and the Le Mans Classic. Restoring it was easier said than done: the car was rebodied twice before being tucked away. None of the cars crossing the block were built in the 1940s, so we skip ahead to the 1950s with a 1954 OSCA MT4 by Morelli. It's one of 72 built, according to RM, and only 19 of those were fitted with the twin-cam, 1.5-liter 2AD engine. It raced at Le Mans in 1954 but ended up disqualified following an accident. Another highlight from the 1950s is a 1958 Lister-Jaguar 'Knobbly' finished in yellow and green. We said that all of the cars crossing the block have spent time on the track, but that doesn't mean they were built to race. The 1963 Ferrari 250 GTE 2+2 Series III is a street-legal model, yet it's included in the auction because it was used as a safety car during the 1963 edition of the race.

2019 Dodge Challenger R/T Scat Pack 1320 gets race-focused upgrades

Thu, Jul 19 2018The Dodge Challenger SRT Demon is one hell of a machine. It's a single-minded 840-horsepower jackhammer, meant solely to burn rubber and win drag races. It's packed with all sorts of goodies like a transbrake, line lock, and a torque reserve mode. Still, it was an extremely limited-production model. It's also sold out. What do you do if you want some fun on the drag strip and you can't find our don't need the power of a Demon? Buy the new 2019 Dodge Challenger R/T Scat Pack 1320. You can really think of the Scat Pack 1320 as a Demon without the wide bodywork and the supercharged 6.2-liter V8. Instead, you'll find Dodge's tried-and-true 6.4-liter naturally-aspirated V8 under the hood making 485 horsepower and 475 pound-feet of torque. The TorqueFlite 8HP70 eight-speed automatic is the only available transmission. It's required equipment to use the TransBrake and Torque Reserve system. All-four wheels are wrapped in Nexen SUR4G Drag Spec 275/40R20 street-legal drag radial tires. The 1320 names comes from the length of a quarter-mile drag strip — 1,320 feet. The Scat Pack 1320 can run the quarter-mile in 11.7 seconds at 115 mph and hits 60 mph in just 3.8 seconds. Of course, that's in its lightest configuration. Like the Demon, the Scat Pack 1320 only comes with a driver's seat. The passenger and rear seats are each $1 options. The goal was to give grassroots racers a bare-bones performance car at a relatively reasonable price. You don't need passengers if you're only racing. You also shave 114 pounds from the car's curb weight. Other upgrades include an SRT-tuned suspension, a 3.09 rear axle ratio, 41-spline rear half-shafts, 20 x 9.5-inch aluminum-forged wheels with knurled bead seats (to keep the tires from slipping on the rim) and upgraded Brembo brakes with four-piston calipers. The Challenger R/T Scat Pack 1320 joins a number of other upgraded 2019 Dodge models. That includes the Challenger SRT Hellcat Redeye and the upgraded 2019 Charger SRT Hellcat. The Scat Pack 1320 adds $3,995 to the Challenger R/T Scat Pack's base MSRP. That's not the whole story. Since the automatic is mandatory, you need to tack on another $1,595. Add in destination, and the Scat Pack 1320 will set you back at least $45,980. Cars will hit dealer lots early next year. Related Video: This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings.