1964 Dodge Dart Gt/ Southern Car/ All Original/ Only 92k/ Runs Great/ Jfk? on 2040-cars

Chesterfield, Virginia, United States

Body Type:Coupe

Vehicle Title:Clear

Engine:225 Cu. In. Slant Six

Fuel Type:Gasoline

For Sale By:Private Seller

Make: Dodge

Model: Dart

Trim: GT

Options: CD Player

Drive Type: Rear

Mileage: 92,500

Warranty: Vehicle does NOT have an existing warranty

Exterior Color: White

Number of Cylinders: 6

Interior Color: Red

I have six antique cars and I have decided to downsize. This is the most reliable and original, so I thought I would list it first. I have owned it for about 1 and 1/2 years.

Vehicle History:

The original owner, Mrs. Helen Booker, purchased this car on Friday, November 22nd, 1963. That was also the the day that JFK was shot. Because the original Virginia title has that date on it, the VA DMV considered the original title a historic document, and let it transfer with the car. It is included in the sale.

This is an all original 1964 Dodge GT. Everything works except the lighter. The original stereo was replaced with a modern CD player prior to my ownership. The car always starts right up and can be driven anywhere. The original mileage is approximately 92000.00. To pass Virginia inspection, I had the manifold gasket replaced. Everything else is in good order. This has always been a Richmond car, so it has a rust free frame and floors. The body has minor surface rust and a few dings. The interior is all original and very nice. I have the original owner's manual and the Dodge Dart piggy bank that the dealer provided. (Picture to follow)

The car is available for inspection in the Richmond area prior to bidding. Please do not bid if you do not plan on following through with the sale. Thanks for looking.

Dodge Dart for Sale

Auto Services in Virginia

Wilson`s Auto Repair ★★★★★

Wicomico Auto Body ★★★★★

Valley Collision Repair Inc ★★★★★

Toyota of Stafford ★★★★★

Tire City New & Used tires & Affordable Auto Repair ★★★★★

The Brake Squad - Mobile Brake Repair Service ★★★★★

Auto blog

Dodge Journey gets new $24,895* SE V6 AWD model

Wed, 12 Mar 2014While the Dodge Journey crossover remains largely unchanged for the 2014 model year, there are two new flavors of the seven-passenger CUV on offer: the butch-looking Crossroad, and the SE V6 AWD, pictured right, which makes its debut today. As its name suggests, this new Journey model features the automaker's 3.6-liter Pentastar V6, and offers all-wheel drive, which, with a starting price of $24,895 (*excluding $995 for destination), reduces the cost-of-entry for an AWD-equipped Journey by $1,800 versus the SXT AWD model. Scroll down for the official press blast.

Dodge whips covers off 2013 Blacktop series

Thu, 10 Jan 2013Dodge introduced us to its Blacktop model lineup a year ago with the 2012 Charger and followed up with more recently with the 2013 Challenger and 2013 Avenger. Now the automaker will be applying this ominous-looking treatment to the Durango, Grand Caravan and Journey models for 2013 as well. These models will be unveiled next week at the Detroit Auto Show, but Dodge has released most of the details for these new products including pricing and availability.

If the Grand Caravan R/T (aka, the Man Van) wasn't aggressive enough for you or its $30,000 starting price was a little too pricey, then the 2013 Grand Caravan Blacktop could be the ticket. Starting with the SXT trim level (which stickers at $19,995), the Blacktop package costs only $595, and adds unique features such as blacked-out headlights, grille and fog lights bezels and an all-black interior. The van rides on black-accented, 17-inch aluminum wheels. The Grand Caravan Blacktop is only available in monochromatic paint schemes limited to Billet Silver, Brilliant Black, Maximum Steel, Redline Red and Stone White

Likewise, the 2013 Journey Blacktop is offered only on the SXT model (starting at $18,995) with all of the crossover's normal options such as four- and six-cylinder engines, five- or seven-passenger seating and front- or all-wheel drive. The Blacktop package adds $995 to the Journey SXT's price and features many of the same black accents as the Grand Caravan like the headlights, grille, door mirrors and lower fascia. Exterior colors are limited to Bright Silver, Bright Red, Brilliant Black, Brilliant Red Tri-Coat, White, Pearl White Tri-Coat and Storm Grey, and the package's 19-inch wheels come in Gloss Black. Inside, the Journey Blacktop comes standard with black cloth seats and Chrysler's 8.4-inch Uconnect touch screen, but black leather is also available as an option.

470,000 Jeep Liberty, Chrysler 200, and Dodge Avenger models recalled for restraint defect

Sat, Oct 14 2017Fiat Chrysler Automobiles said on Friday it is recalling 470,000 vehicles worldwide to replace a component that may inhibit deployment of the vehicles' active head restraints in the event of a crash. Around 414,000 of those vehicles were sold in the United States. Apparently, "a component common to the modules of certain vehicles may degrade after extensive vehicle use." The recall covers 2012 Jeep Liberty sport utility vehicles and 2012-13 Chrysler 200 and Dodge Avenger midsize cars. FCA says a warning light may alert owners to the problem. The Italian-American automaker said it is unaware of any injuries or accidents related to the recall. The U.S. National Highway Traffic Safety Administration opened an investigation into the issue in June. (Reporting by David Shepardson; Editing by Steve Orlofsky) Related Video:

1964 dodge dart gt

1964 dodge dart gt 1975 dodge dart great winter project no reserve !!!!

1975 dodge dart great winter project no reserve !!!! Dodge dart 1965

Dodge dart 1965 1965 dodge dart gt convertible~225h.o.super6cyl~auto~rustfree~a/c~pwrtop~runsgrt

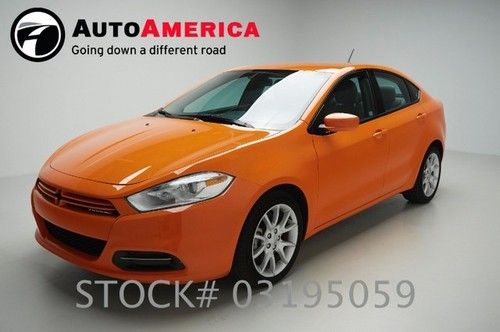

1965 dodge dart gt convertible~225h.o.super6cyl~auto~rustfree~a/c~pwrtop~runsgrt 16k low miles dodge dart header orange 17 inch wheels one 1 owner

16k low miles dodge dart header orange 17 inch wheels one 1 owner 2013 se/aero new 2l i4 16v fwd sedan

2013 se/aero new 2l i4 16v fwd sedan