All Original 1966 Dodge Coronet 440 on 2040-cars

Shawsville, Virginia, United States

Body Type:Coupe

Engine:318 Poly

Vehicle Title:Clear

Fuel Type:Gasoline

For Sale By:Private Seller

Number of Cylinders: 8

Make: Dodge

Model: Coronet

Trim: 440

Warranty: Vehicle does NOT have an existing warranty

Drive Type: 2 wheel

Mileage: 999,999

Exterior Color: White

Disability Equipped: No

Interior Color: Red

Number of Doors: 2

Here is a very nice all original 66 Coronet with 50,000 plus miles that runs and drives

very well. It has the 319 poly engine with automatic transmission that shifts as it should,

has the cerdicard and owners manual, new wheels and tires, dual exhaust with flomaster

knock off mufflers, power steering, manual brakes and the interior is in very nice condition.

This little baby is ready to cruise, with the 318 engine it gets good fuel milage and we all

know how important that is with todays high fuel prices!!!

For more imformation call 540-392 7918

Dodge Coronet for Sale

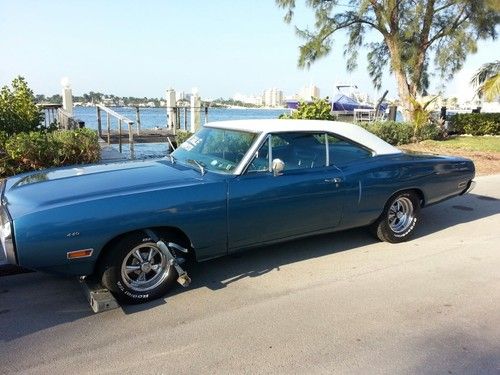

1970 440 coronet

1970 440 coronet 1967 dodge coronet

1967 dodge coronet 1969 1/2 a12 lift off hood superbee 440 six pack rare a4 platnium 1 of 153 made

1969 1/2 a12 lift off hood superbee 440 six pack rare a4 platnium 1 of 153 made 1969 dodge superbee 512 cubic inch stroker 525 h.p.

1969 dodge superbee 512 cubic inch stroker 525 h.p. 1966 dodge coronet 440.. 383 cid v8.. numbers match.. 1 awesome mopar ..

1966 dodge coronet 440.. 383 cid v8.. numbers match.. 1 awesome mopar .. 1965 dodge coronet 440 2 door hardtop running project with clear ga registration(US $3,800.00)

1965 dodge coronet 440 2 door hardtop running project with clear ga registration(US $3,800.00)

Auto Services in Virginia

Xtensive Body & Paint ★★★★★

Tread Quarters Discount Tire ★★★★★

Taylor`s Automotive ★★★★★

Sterling Transmission ★★★★★

Staples Automotive ★★★★★

Stanton`s Towing ★★★★★

Auto blog

Stellantis not looking for further mergers, including with Renault

Mon, Feb 5 2024MILAN ó Stellantis Chairman John Elkann on Monday denied the carmaker was hatching merger plans, responding to press speculation about a possible French-led tie-up with rival Renault. Elkann said that the Peugeot owner, the world's third largest carmaker by sales, was focused on the execution of its long-term business plan. "There is no plan under consideration regarding merger operations with other manufacturers," said Elkann, who also heads Exor, the Agnelli family holding company that is the largest single shareholder in Stellantis. After abandoning the Russian market, at the time its second largest after France, and reducing the scope of its global cooperation with Nissan, Renault has been seen as a potential M&A target. Speculation intensified after an electric vehicle market slowdown forced it last week to cancel IPO plans for its EV and software unit Ampere. Its market cap remains stubbornly low at little over 10 billion euros ($10.8 billion) despite a financial recovery over the past few years. Stellantis, the product of a 2021 merger between France's PSA and Fiat Chrysler and one of the most profitable groups in the industry, has a market cap of more than 85 billion euros when unlisted shares are factored in. It has a 14 brand portfolio also including Citroen, Jeep, Opel and Alfa Romeo. NEWSPAPER REPORT Italian daily Il Messaggero had said on Sunday that the French government, which is Renault's largest shareholder and also has a stake in Stellantis, was studying plans for a merger between the two groups. A spokeswoman for Renault said on Monday the group did not comment on rumors. France's Finance Ministry had declined to comment on Sunday. Stellantis has crossed swords with the Italian government, which has accused it of acting against the national interest on occasions. Industry Minister Adolfo Urso last week raised the prospect of the Italian government taking a stake in Stellantis to help to balance the French influence. Renault shares pared gains after Elkann's comments to stand 1.2% higher by 1220 GMT, having initially risen more than 4%. Stellantis CEO Carlos Tavares, a Portuguese-national, last week said in an interview with Bloomberg that the group was "ready for any kind of consolidation" and that its job was to make sure that it would be "one of the winners". Analysts, however, question the rationale of a Stellantis-Renault merger, which would also expand the group's excess capacity in Europe.

2023 J.D. Power Initial Quality Study shows there's less quality than last year

Thu, Jun 22 2023Vehicle inventory, vehicle pricing, and the supply chain are finally showing improvement. Vehicle quality, on the other hand, is still going the wrong way. That's the takeaway from the 2023 J.D. Power Initial Quality Study that found overall problems exceeded last year's record high. The study surveyed owners of 2022-model-year vehicles to assess the average rate of problems per 100 vehicles (PP100) during the first 90 days of ownership. The average figure for the¬†32 ranked manufacturers in 2020¬†was about 166 problems per 100 vehicles. In¬†the 2021 IQS, that dropped to an average of 162. For 2022, the average jumped to 180 problems. For 2023, the PP100 is up to an industry average of 192 ó an increase of 30 problems per 100 vehicles in just two years. Let's get to the good news first: Dodge reclaimed the crown of having the lowest number of problems per 100 vehicles at 140. Buick won last year with 139 PP100, falling to third this year. Dodge was the first American automaker to top the IQS in 2021. Its return as the least problematic gives parent company Stellantis three wins in four years after Ram was crowned in 2021. It also gives U.S. brands a four-peat after Buick topped the chart in 2022 by having owners report the fewest problems. This year's top 10 is Dodge, Ram, Alfa Romeo, Buick, Chevrolet, GMC, Porsche, Cadillac, Kia, and Lexus. Stellantis gathered a few feathers for its cap, in fact. Maserati showed the largest improvement year-on-year, followed by Alfa Romeo, and Alfa Romeo posted the lowest PP100 among the premium class, beating Porsche and Cadillac. Alfa Romeo has been vocal about working to improve quality, mentioning Lexus as a target. Last year the Japanese brand finished sixth, the Italians finished near the bottom, between Jaguar and Mitsubishi. This year Alfa jumped to third, Lexus dropped to tenth. Ram was the third-best on the list of improvers from 2022 to 2023.¬†¬† The individual model with the lowest PP100 is the Nissan Maxima. Now for the troublesome bits. In the words of¬†Frank Hanley, senior director of auto benchmarking at J.D. Power, "The industry is at a major crossroad and the path each manufacturer chooses is paramount for its future.

Stellantis sees vehicle loan durations extended amid banking turmoil

Tue, Apr 4 2023Stellantis is seeing clients seeking longer-term financing and leasing deals for their vehicles as a consequence of higher global interest rates, the carmaker's head for the business said. Chief Affiliates Officer Philippe de Rovira said loans which normally had a three-year maturity were now increasingly moved to four years. "This allows customers to get a car for a monthly instalment that is similar to that they had before," he said. The world's third largest carmaker by sales on Tuesday announced it had completed a plan announced in late 2021 to reshuffle and simplify its leasing and financing operations in Europe. Under its terms, Stellantis created a 50-50 single long term multi-brand leasing company named Leasys with Credit Agricole Consumer Finance. It also set up local joint ventures in European countries for its new Stellantis Financial Services unit, formerly Banque PSA Finance, with BNP Paribas Personal Finance and Santander Consumer Finance. "These banks have always had better funding conditions than those we can have as an automaker," de Rovira said. Benefits of the plan included cutting the number of financing and leasing entities the group runs in each country and the number of IT systems it uses, with expected savings exceeding 30% in this particular area, he added. De Rovira said the group had a huge portfolio of orders it had not yet delivered due to supply chain shortages impacting production. "Demand is not our main issue. The issue is to deliver as fast as we can cars that are in our order portfolio, which is still at record levels," he said. The group aims to expand its corporate leased vehicle fleet to more than one million units in 2026 and to double net income from its so-called banking activities to 5.8 billion euros ($6.3 billion) by 2030. De Rovira said Stellantis was not seeing a downward trend in vehicle pricing. "Probably the significant price increases we have seen in 2021 and 2022 will not be repeated because the context is changing, but for the moment we don't see decreases, we see stabilisation". ($1 = 0.9188 euros) (Reporting by Giulio Piovaccari and Gilles Guillaume; Editing by Jan Harvey) Earnings/Financials Plants/Manufacturing Alfa Romeo Chrysler Dodge Jeep RAM