2014(14)chager Black/black Fact W-ty Only 5k Miles Keyless Cruise Start Save!! on 2040-cars

Bedford, Ohio, United States

Dodge Charger for Sale

2012 dodge charger srt8 superbee,6.4l, low miles only 11k!!!

2012 dodge charger srt8 superbee,6.4l, low miles only 11k!!! Red dodge charger, 22inch rims, super clean interior exterior. great buy!!!(US $7,700.00)

Red dodge charger, 22inch rims, super clean interior exterior. great buy!!!(US $7,700.00) Srt8 superbe certified 6.4l cd 6 speakers am/fm radio mp3 decoder power steering

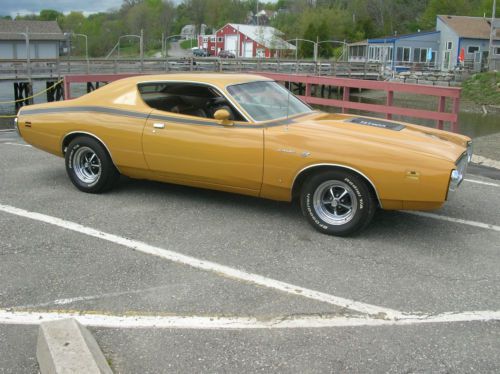

Srt8 superbe certified 6.4l cd 6 speakers am/fm radio mp3 decoder power steering 383 4bbl. hi impact butterscotch. 1 of 69. original drivetrain & body panels. ex

383 4bbl. hi impact butterscotch. 1 of 69. original drivetrain & body panels. ex 2011 dodge charger se cruise control alloy wheels 44k!! texas direct auto(US $18,980.00)

2011 dodge charger se cruise control alloy wheels 44k!! texas direct auto(US $18,980.00) 2007 charger srt(US $17,500.00)

2007 charger srt(US $17,500.00)

Auto Services in Ohio

Walt`s Auto Inc ★★★★★

Verity Auto & Cycle Repair ★★★★★

Vaughn`s Auto Svc ★★★★★

Truechoice ★★★★★

The Mobile Mechanic of Cleveland ★★★★★

The Car Guy ★★★★★

Auto blog

All-Wheel Drive Dodge Challenger | Autoblog Minute

Wed, Dec 7 2016The all-wheel drive 2017 Dodge Challenger GT will be on display at the Detroit Auto Show in January. Dodge Autoblog Minute Videos Original Video autos challenger dodge challenger gt

Consumer Reports says Ram 1500 tops fuel economy fight [w/video]

Wed, Aug 27 2014Consumer Reports takes its independent vehicle testing procedures seriously. In an era when we have to question the EPA's official ratings thanks to recent re-evaluations from Ford and Hyundai, an independent voice is important. So, when CR says something is the best, it's worth paying attention to. The Ram 1500 EcoDiesel has "about the same fuel-economy numbers that we typically see in a midsized SUV." – Jake Fisher In this case, CR took a look at the fuel economy of the 2014 Ram 1500 EcoDiesel and found that it came out on top of the fullsize pickup truck pack. The Ram did so with 20 miles per gallon overall and 27 mpg on the highway. CR gave the truck a total road test score of 82. The EPA says that the EcoDiesel 1500 gets 28 mpg on the highway, 20 mpg city and 23 mpg combined. Comparing official EPA numbers, the Ram is also the best among trucks in its class. It's nice when people agree on something. As we know from first-hand, long-distance experience, you can push the 1500 EcoDiesel to 38 mpg. CR found in its own testing that the truck had, "about the same fuel-economy numbers that we typically see in a midsized SUV," said Jake Fisher, CR's director of automotive testing, in a statement. Speaking of midsized SUVs, CR also announced this week that the new Toyota Highlander Hybrid got the top spot in CR's ratings in that category. CR liked pretty much everything about the SUV, saying that the "transitions between electric power and the gas engine are seamless" and that, "the new Highlander also handles better, with a steadier ride and reduced body lean in corners." You can find more at the CR website, in the October print issue of Consumer Reports or in the video and press release below. This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings. RAM ECODIESEL 1500 TOPS CONSUMER REPORTS FULL-SIZE PICKUP TRUCK RATINGS Redesigned Toyota Highlander Hybrid Climbs to Top of Midsized SUV List Yonkers, N.Y.- The Ram 1500 EcoDiesel climbed to the top of Consumer Reports' full-size pickup truck ratings with an impressive performance in the organization's fuel economy tests. The EcoDiesel (82 point overall road test score) turned in a best-in-class fuel economy of 20 mpg overall and 27 mpg on the highway, to help it score better than the previously tested Ram 1500 V8 (81) regular gas version and Chevrolet Silverado 1500 LT (80).

Chrysler Group moves around execs in wake of recent departure

Tue, 16 Apr 2013Chrysler is busy shuffling executives around in the wake of Ram head Fred Diaz's departure. The automaker has named Reid Bigland (pictured, right) as Diaz's successor in the role of president and CEO of Ram, though Bigland will continue his duties as the head of US sales and the president and CEO of Chrysler Canada. Bigland first came to Chrysler in 2006 from Freightliner Custom Chassis Corporation, so the guy knows a thing or two about trucks.

Meanwhile, Timothy Kuniskis will take over as president and CEO of Dodge. Previously, he served as the head of Fiat in North America and has been with Chrysler in one capacity or another since 1992. His old title now falls to Jason Stoicevich, who will also continue to work as the director of the automaker's California Business Center. Finally, Bruno Cattori will take over as the president and CEO of Chrysler Mexico.

Diaz left his position to take over as a divisional vice president of sales and marketing with Nissan. You can read the full press release on the Chrysler personnel changes below for more information.