2008 Dodge Charger on 2040-cars

Laredo, Texas, United States

|

White 2008 Dodge Charger SE in Great running conditions 80,000 Miles Tires 75% of tread left Title is color blue(Rebuilt ) Vehicle runs straight and has good working airbags. Vehicle has NO history of water damage nor suspension damage. It is in GREAT running conditions.

If you have any questions or would like more specific photos, please don't hesitate to call Hector @Nine56.Two35.thirtyseven83.

|

Dodge Charger for Sale

2007 dodge r/t charger 5.7l-ride deep for cheap-clean carfax(US $12,900.00)

2007 dodge r/t charger 5.7l-ride deep for cheap-clean carfax(US $12,900.00) 2013 dodge charger srt8 6.4 hemi sunroof nav xenon 10k texas direct auto(US $42,480.00)

2013 dodge charger srt8 6.4 hemi sunroof nav xenon 10k texas direct auto(US $42,480.00) 2011 dodge charger fully loaded financing available

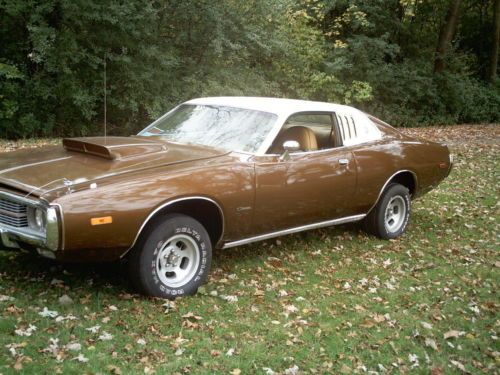

2011 dodge charger fully loaded financing available 1973 dodge charger base coupe 2-door 5.2l(US $8,900.00)

1973 dodge charger base coupe 2-door 5.2l(US $8,900.00) Srt8 6.4l nav cd 1st row lcd monitors: 1 4 wheel disc brakes abs brakes compass

Srt8 6.4l nav cd 1st row lcd monitors: 1 4 wheel disc brakes abs brakes compass 1973 dodge charger special edition hardtop 2-door 6.6l

1973 dodge charger special edition hardtop 2-door 6.6l

Auto Services in Texas

Zeke`s Inspections Plus ★★★★★

Value Import ★★★★★

USA Car Care ★★★★★

USA Auto ★★★★★

Uresti Jesse Camper Sales ★★★★★

Universal Village Auto Inc ★★★★★

Auto blog

2014 Dodge Dart Blacktop glosses over performance

Tue, 14 Jan 2014The Dodge Dart is a decent little car. It's honest, basic transportation, and many of us at Autoblog are genuinely fond of the Alfa Romeo-based compact sedan. For 2014, not a whole lot changes in the Dart world, save the addition of this new Blacktop edition that makes its debut here at the Detroit Auto Show.

It's all very simple, this Blacktop package, and doesn't actually alter performance in any way. Instead, buyers are treated to blacked-out exterior bits like 18-inch wheels, the crosshair grille and headlamp bezels. Inside, black/tungsten or black/red cloth seats are available, with red contrast stitching throughout the cabin.

Adding the Blacktop pack to your Dart SXT with the Rallye Appearance Group will set you back a scant $295, and while it's just an appearance package, it all looks pretty nice to us.

California Highway Patrol powers up with Charger Pursuits

Fri, Jul 22 2016Residents of California, you'll want to adjust your rear-view mirrors and remain vigilant for the menacing maw of the Dodge Charger. The California Highway Patrol (CHP) ordered 580 Dodge Charger Pursuit cars to start replacing the organization's oldest vehicles. According to the CHP's director of communications, Fran Clader, these old cars are patrol versions of the Ford Crown Victoria, Ford Explorer and Dodge Charger. The cars will be delivered over the next two years with the majority equipped with Fiat Chrysler's 3.6-liter V6 engine. The unit makes 292 horsepower in the Charger and is found in everything from the Jeep Wrangler to the Chrysler 200. There will be a handful of Chargers with the 5.7-liter V8 found in the Charger R/T, but Dodge and Clader said they will just be used for training. Bick Pratt, head of FCA US government sales and operations, said the order represents a move back toward four-door police cars. "The CHP is ordering our Charger Pursuit vehicle to reintroduce the sedan into their patrol vehicle fleet," Pratt said. "That's important to us because it reflects a shift back to sedans by a progressive agency like the CHP." Chargers may show up in local law enforcement fleets. Pratt said departments will have the opportunity to also order Charger Pursuits through the CHP's contract. So wherever you are in California, if you see that famous crosshair grille in your rear-view mirror, be ready to pull over. Related video:

Aficionauto drives Vin Diesel's fast and furious 1970 Dodge Charger

Mon, 15 Sep 2014The Aficionauto host Christopher Rutkowski has a real passion for original and replica cars from movies and television, whether they are from James Bond, Jurassic Park, or incredibly obscure Japanese shows. However, he might have outdone himself this time because he hopped into one of the biggest automotive stars of contemporary cinema. This 1970 Dodge Charger appeared in Fast & Furious and came back in Fast Five, where Paul Walker actually drove it. The menacing, black muscle car will make its return to the franchise in the seventh film, too.

The Fast and Furious Charger is a real beast no matter how you look at it. The interior is nothing more than two seats and a roll cage, and as the video shows, this thing vibrates constantly like a coiled mass of muscle ready to strike. The camera can barely stay in place most of the time. Also, Dom's Dodge is more than happy to do a smoky burnout and leave the driver partially deaf afterward from its wonderful, ear-splitting engine roar.

The Aficionauto also interviews the man who controls the keys to this beast. Bob Hartwig was once an F-15 pilot, but he also loved Hollywood vehicles. Now, he's a partner at Picture Car Warehouse, a company with about 850 cars that supplies vehicles to film studios. This Charger definitely seems to be Hartwig's favorite in the collection, as it should be.