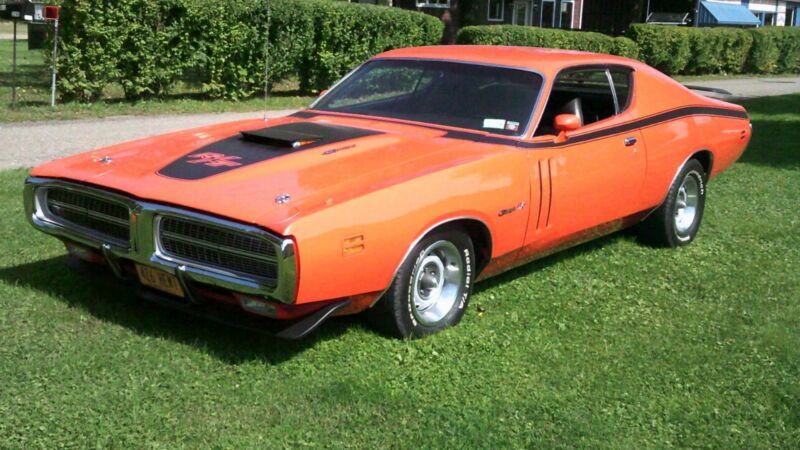

1971 Dodge Charger 426 Rt on 2040-cars

New York, New York, United States

1971 426 HEMI R/T CHARGER, CORRECT ORANGE PAINT, AUTO WITH FACTORY CONSOLE SHIFTER, RALLY DASH WITH TACH, AIR

GRABBER HOOD, FRONT CHIN SPOILER, REAR DECK SPOILER, BLACK BUCKET SEAT INTERIOR, ROTISSERIE RESTORATION, COMPLETE

NUT AND BOLT, NOTHING SPARED OR OVERLOOKED. 426 HP HEMI ENGINE, 727 TRANS, 4:10 DANA. THERE ARE RECEIPTS THAT TOTAL

WELL OVER $150K SPENT ON THE COMPLETE ROTISSERIE RESTORATION. THIS FINEST RESTORED 426 HEMI R/T CHARGER. POWER

STEERING, POWER DISC BRAKES, RALLY WHEELS WITH CHROME RINGS AND CAPS. MACHINE GUN EXHAUST TAIL PIPES. PERFECT

TRUNK, FLOORS, & FRAME. ABSOLUTELY NO RUST OR RUST REPAIR ISSUES. HIGHLY DETAILED ENGINE COMPARTMENT, INTERIOR,

TRUNK AND UNDERSIDE. RALLY DASH & GAUGE AND INSTRUMENT IS INTACT AND WORK CORRECTLY

Dodge Charger for Sale

1970 dodge charger rt(US $15,400.00)

1970 dodge charger rt(US $15,400.00) 1968 dodge charger(US $15,260.00)

1968 dodge charger(US $15,260.00) 1969 dodge charger(US $28,500.00)

1969 dodge charger(US $28,500.00) 2017 dodge charger hellcat(US $42,400.00)

2017 dodge charger hellcat(US $42,400.00) 1970 dodge charger(US $23,300.00)

1970 dodge charger(US $23,300.00) 2016 dodge charger srt hellcat(US $42,400.00)

2016 dodge charger srt hellcat(US $42,400.00)

Auto Services in New York

Wheel Fix It Corp ★★★★★

Warner`s Auto Body ★★★★★

Vision Kia of Canandaigua ★★★★★

Vision Ford New Wholesale Parts Body Shop ★★★★★

Vince Marinaro Automotive Inc ★★★★★

Valu Muffler & Brake ★★★★★

Auto blog

Dodge Challenger SRT Hellcat ringtone revs up [w/video]

Wed, 30 Jul 2014The best (or worst, depending on your views) thing about smartphones is that you're able to carry lots, and lots of useful stuff around in your pocket. That means you can always have a phone, messaging service, email, flashlight, calculator, dictionary, encyclopedia, and literally thousands of other things on your person at all times. Now, we can add one more thing for you to carry about in your little slab of aluminum, glass and plastic - a Dodge Challenger SRT Hellcat.

Now, you obviously can't carry around a 707-horsepower muscle car around in your pocket. That'd be ridiculous, impractical and uncomfortable. You can, however, carry around the noise made by said muscle car's 6.2-liter, supercharged Hemi V8, thanks to a new, free-to-download ringtone from the folks at Dodge and SRT.

We can't embed the ringtone here, so if you'd like to hear exactly how it'll sound when your phone goes off, you'll need to head over to the SRT Hellcat's page. If that's more trouble than it's worth, the same ringtone was attached to a tiny speaker on the press kit for the mighty Challenger, and was captured on video by our own Seyth Miersma (don't worry, he's already been soundly dressed down for shooting a video in portrait mode).

These Canadians somehow forgot how to drive in snow

Tue, Dec 6 2016Montreal drivers experienced a slow-motion pileup on their streets this weeks thanks to the first snow fall of the season. According to the CBC, slippery conditions caused a small pileup involving cars, buses and even a street clearing vehicle. Onlookers in neighboring office buildings watched as vehicle after vehicle slid down Cote du Beaver Hall and crashed into the scrum of waiting cars. First there was a city bus, then a white Ford F-150 work truck loaded down with ladders, then another city bus came along and sandwiched the poor F-150. A Montreal Police Charger then came down the hill backwards, hit the bus in a slow, sad crash before it was crashed into by an out of control plow truck. Since its posting yesterday, the video of the crash has gone viral. Various other vehicles–a green-topped Scion delivery truck and a couple workaday sedans–were lucky enough to escape the pileup, but still suffered through a white-knuckled slippery descent down the hill. Colin Creado, who works nearby the crash site, told the CBC although it was pretty slippery, he was surprised at all the carnage since the storm was forecast well in advance. "You would have thought ... they would have salted the area or at least cordoned it off, because that road is pretty steep," he told the station. Related Video: This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings. News Source: CBC Auto News Weird Car News Dodge Ford Driving Safety Truck Commercial Vehicles Police/Emergency Sedan snow montreal winter driving

2015 Dodge Viper price drops $15k for 2015

Mon, 08 Sep 2014We recently saw updated specs and new trims of the 2015 Viper, but it looks like the folks at Dodge were saving the biggest surprise for last. Prices on all levels of the American sports car are seeing an immediate, across-the-board price cut of $15,000; even 2014 models still remaining on dealer lots.

The new MSRP for the 2015 Viper in its base SRT trim now starts at $84,995, and when the TA and GTS come to the lineup later next year, they start at $100,995 and $107,995, respectively. The move seems like a swing for the fences that might help to quell slow sales.

Obviously, current Viper owners might be somewhat peeved that their investment was just re-priced by the company. However, to assuage some of their concerns, Dodge is giving all fifth-gen owners a certificate worth $15,000 towards the purchase of a new one, which comes in addition to the price reduction.