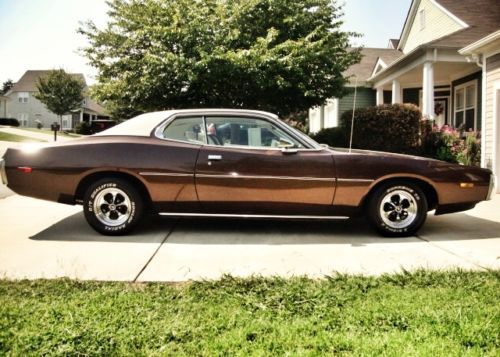

1970 Dodge Charger 500 Hardtop 2-door 6.3l on 2040-cars

Scottsdale, Arizona, United States

|

This is for an individual that is looking for an original Mopar Muscle Car as it rolled off the showroom floor.

Cast heads, fresh valve job Oct. 2013, less than 300 miles on engine work Factory intake with Edelbrock 4 barrel carb. Factory HP exhaust manifolds Whiplash Cam from Hughes Engines

This is a very high-end documented car! Original Window Sticker, Build Sheets, Build Cards, Warranty Cards and Spec Sheets from the factory, plus an Owner's Manual. Photos of Documentation will be provided to serious buyers upon request. I have all the service manuals from Chrysler that will be included. You can watch a good video of this car on YouTube by searching "1970 Dodge Charger with Hughes Whiplash Cam" posted by Roger. The video was posted in Wichita, Kansas before we moved to Scottsdale, Arizona. It still has the original Chrysler Solid State AM push button radio. We are a retired couple and have owned this car for fifteen years and have only driven it 3,000 miles. It is time to let it go to a new home. This is in very good condition for a 44 year old car because it has been well maintained and cared for. Payment with Certified funds. The car will be released after the bank clears their 7 - 10 day hold. Buyer is responsible for all shipping charges.

|

Dodge Charger for Sale

1973 dodge charger mopar all original, matching numbers 318/727

1973 dodge charger mopar all original, matching numbers 318/727 2007 dodge charger r/t sedan 4-door 5.7l(US $17,000.00)

2007 dodge charger r/t sedan 4-door 5.7l(US $17,000.00) Premium certified 2012 dodge charger r/t, 5.7l white hemi, srt rims, sbwf, 29k m(US $26,995.00)

Premium certified 2012 dodge charger r/t, 5.7l white hemi, srt rims, sbwf, 29k m(US $26,995.00) Bad to the bone ready to run !! one of kind find blk on blk very clean!!

Bad to the bone ready to run !! one of kind find blk on blk very clean!! 1969 dodge charger r/t se 440 4spd dana 60 all numbers matching real deal 69(US $50,000.00)

1969 dodge charger r/t se 440 4spd dana 60 all numbers matching real deal 69(US $50,000.00) R/t certified white 5.7l hemi mopar muscle leather warranty forever financing

R/t certified white 5.7l hemi mopar muscle leather warranty forever financing

Auto Services in Arizona

Wades Discount Muffler, Brakes & Catalytic Converters ★★★★★

Unique Auto Repair ★★★★★

Transmission Plus ★★★★★

Super Discount Transmissions ★★★★★

Suntec Auto Glass & Tinting ★★★★★

Sluder`s Garage ★★★★★

Auto blog

The Dodge Demon's massive torque wrinkles its massive tires

Thu, Feb 16 2017Horsepower doesn't mean a damn thing if a car can't properly put the power down. That's why Dodge has fitted the upcoming Demon with some of the stickiest road-legal rubber available. Those Demon-branded Nitto NT05R drag radials skirt by regulations with just the smallest of margins, and in order to maximize the potential of the 315/40R 18 size tires Dodge increased the car's torque multiplication with a higher stall speed for the torque converter and a 3.09 rear axle. The 12.6-inch-wide tires are fitted to 18x11-inch wheels at all four corners, and they're fatter than those 305-section front tires on the Camaro Z/28 that we raved about years ago. Dodge says the combination of soft, gooey rubber and the new gear ratio gives the Demon about a 15 percent larger tire contact patch, more than twice as much grip, and roughly an 18 percent increase in both converter torque and rear-axle torque multiplication. Simply put, the Dodge Demon moves. You can see the results in the teaser video above, which is titles "Multiplication" and shows the crazy wrinkling of the sidewall that results from putting that torque to the road. We wouldn't be surprised if the inner rim of the wheel needs some grip to keep the tire seated, something Chevy had to do on the last Z/28. There is something wonderful about Dodge's approach to performance cars. While the Ford Mustang and Chevrolet Camaro have moved on from their muscle car upbringings with proper track-focused models, Dodge has stayed true to its roots by developing a machine that's sole intent is traveling a quarter-mile quicker than anything else on the road. Twisty roads may be fun, but there is something wholly and deeply satisfying about going deep into the accelerator with a comical amount of power at your disposal. We can't wait. Related Video: New York Auto Show Dodge Coupe Performance dodge demon dodge hellcat dodge challenger srt demon drag strip

Only in Japan: Dodge van one-make racing series is a thing

Wed, Jul 15 2015Japan seems willing to embrace a level of automotive insanity that many other places lack. Whether it's 1,200-horsepower Nissan GT-Rs blasting through tight, tree-lined mountain roads or advertisements with dances for the Toyota Prius Plug-in, the country definitely has a unique way of expressing a love for autos. The D-Van Grand Prix might be one of our favorite examples yet of crazy Japanese car culture, because the annual, one-make race at the Ebisu Circuit is exclusively for heavily customized Dodge vans. Like many great things, this wonderfully crazy idea came from a little rule breaking. D-Van Grand Prix organizer Takuro Abe was at a track event for a motorcycle racing school, and vans were used to haul the bikes around. During lunch someone came up with the idea for a race. Ignoring that the big machines weren't actually allowed on the circuit, the drivers headed out. The popularity has just grown since then. These days, the racing vans absolutely aren't the stock machines from the event's inspiration. In addition to stripped interiors and track rubber that you might expect, the list of mods for them is a mile long. For every possible advantage, the racers fit them with things like Brembo brakes, cross-drilled rotors, heavy-duty transmissions, and much more. Seeing vans lumbering around the track is very weird at first, but the racers take the competition very seriously. These folks even employ all sorts of little tricks to coax the most from the machines. This is a fascinating motorsports story, but be sure to turn on the subtitles to understand the interviews with the competitors.

Dodge adds fire-breathing Durango SRT for 2018

Tue, Feb 7 2017The playbook for Dodge right now is pretty simple. Wring as much power out of as many things as humanly possible. Now comes the 2018 Dodge Durango SRT. Packing 475 horsepower and 470 pound-feet of torque, this seven-seat school bus will scoot to 60 miles per hour in just 4.4 seconds. Since the latest Durango launched for 2014, Dodge has unabashedly called it a three-row Charger. This beefy SUV makes that aggressive claim even more legit. "It does all the things we want a performance car to do," says Mark Trostle, head of performance, passenger, and utility vehicle exterior design. "It really is our three-row Charger." The 6.4-liter (392 cubic inches) Hemi V8 is considerably stronger than the already-potent 5.7-liter Hemi V8, which is rated at 360 hp and 390 lb-ft in the most powerful Durango available now. The SRT powertrain includes the TorqueFlight eight-speed automatic transmission used in the lesser Durango models (and many other FCA US vehicles), though it's calibrated specifically to the sportier demeanor of the SRT model. A similarly retuned full-time all-wheel-drive system rounds out the powertrain. Despite the fact this is a hot-rod SUV, it can still tow 8,600 pounds with a trailer, 1,200 pounds more than the most capable 2017 Durango (the rear-wheel 5.7-liter variant). View 9 Photos The Durango SRT is an obvious move for Dodge. The Jeep Grand Cherokee, which is built on the same platform in the same factory in Detroit, already has an SRT model. With rumors of a Hellcat-powered Grand Cherokee swirling and another Demonic Challenger on the way, the Durango was overdue for an engine upgrade. "When we launched the Durango in 2014, this is the one we really wanted," says Tim Kuniskis, head of FCA US' passenger car brands. There's no doubt this is an enthusiast-oriented SUV. Dodge even went to the trouble of certifying the Durango SRT's 12.9-second quarter-mile time with the NHRA and tested it a Virginia International Raceway. Buy a Durango SRT, and you get a full day at the Bob Bondurant School of High Performance Driving. When's the last time anyone did all of that with a three-row ute? It certainly looks the part. The hood bulges with new air-ducts to help keep the big Hemi chilled appropriately. There's a new front fascia with more air vents and LED fog lamps. Plus, the grille takes on a menacing new glare with a mesh pattern, and the body gets wider wheel flares. Click through the gallery, it really does look like a Charger from some angles.