07 Navigation 20" Srt Black Wheels Lnew Tires Heated Leather/suede Sunroof on 2040-cars

Mooresville, North Carolina, United States

Vehicle Title:Clear

For Sale By:Dealer

Engine:6.1L 6059CC 370Cu. In. V8 GAS OHV Naturally Aspirated

Body Type:Sedan

Fuel Type:GAS

Make: Dodge

Model: Charger

Trim: SRT8 Sedan 4-Door

Number of Doors: 4

Transmission Description: 5-SPEED AUTOMATIC TRANSMISSION W/OD

Drive Type: RWD

Drivetrain: Rear Wheel Drive

Mileage: 26,846

Sub Model: SRT8 SUPER BEE - PRISTINE CONDITION!

Number of Cylinders: 8

Exterior Color: Yellow

Interior Color: Gray

Dodge Charger for Sale

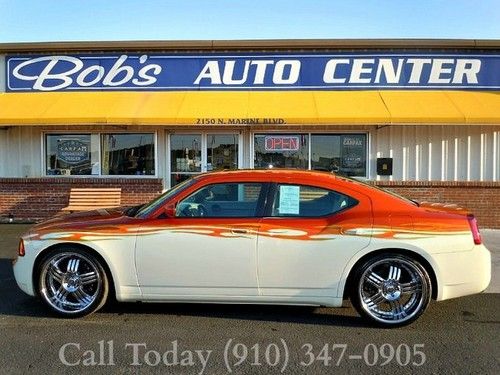

'06 custom charger rt hemi tv interior sound system(US $18,597.00)

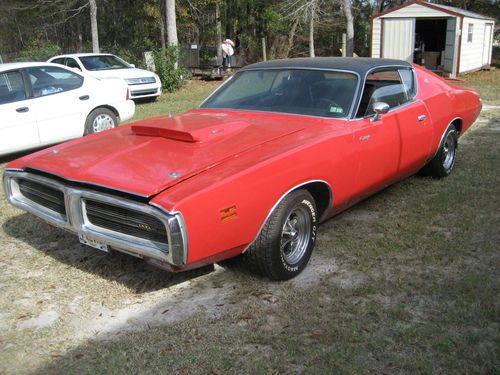

'06 custom charger rt hemi tv interior sound system(US $18,597.00) 71 dodge charger 88,000 miles 383 torqueflite excellent shape

71 dodge charger 88,000 miles 383 torqueflite excellent shape 2006 dodge charger r/t(US $11,588.00)

2006 dodge charger r/t(US $11,588.00) Sxt navigation 3.6l 292 hp keyless go one owner perfect carfax(US $24,915.00)

Sxt navigation 3.6l 292 hp keyless go one owner perfect carfax(US $24,915.00) 1971 dodge charger se(US $22,000.00)

1971 dodge charger se(US $22,000.00) No reserve!!!, charger rt, leather, nav, hid, loaded, only 11k

No reserve!!!, charger rt, leather, nav, hid, loaded, only 11k

Auto Services in North Carolina

Westside Motors ★★★★★

VIP Car Service ★★★★★

Vann York Toyota Scion ★★★★★

Skip`s Volkswagen Service ★★★★★

Sharky`s Auto Glass ★★★★★

Randy`s Automotive Repair ★★★★★

Auto blog

QB says University of Alabama offered him a Corvette to play football

Fri, 16 May 2014The University of Alabama Crimson Tide football team could be in some hot water, following a pair of posts on social media.

The first post was sure to raise a few eyebrows on its own. It's an Instagram of sophomore running back Derrick Henry standing in front of his new Dodge Challenger (we're guessing it's an R/T based on the fender stripes). Complete with a custom set of wheels, the image was enough to trigger more than a few questions about where an unemployed student-athlete came up with the money for such a purchase. Now, this could be harmless. Henry, flush with a full-ride to Bama could have convinced his parents to get him something nice with his college fund.

The second post, though, is a straight-up accusation. It comes from former West Virginia Mountaineer and current CFL quarterback Pat White, who posted the following on his Facebook page.

Best car infotainment systems: From UConnect to MBUX, these are our favorites

Sun, Jan 7 2024Declaring one infotainment system the best over any other is an inherently subjective matter. You can look at quantitative testing for things like input response time and various screen load times, but ask a room full of people that have tried all car infotainment systems what their favorite is, and you’re likely to get a lot of different responses. For the most part, the various infotainment systems available all share a similar purpose. They aim to help the driver get where they're going with navigation, play their favorite tunes via all sorts of media playback options and allow folks to stay connected with others via phone connectivity. Of course, most go way beyond the basics these days and offer features like streaming services, in-car performance data and much more. Unique features are aplenty when you start diving through menus, but how they go about their most important tasks vary widely. Some of our editors prefer systems that are exclusively touch-based and chock full of boundary-pushing features. Others may prefer a back-to-basics non-touch system that is navigable via a scroll wheel. You can compare it to the phone operating system wars. Just like some prefer Android phones over iPhones, we all have our own opinions for what makes up the best infotainment interface. All that said, our combined experience tells us that a number of infotainment systems are at least better than the rest. WeÂ’ve narrowed it down to five total systems in their own subcategories that stand out to us. Read on below to see our picks, and feel free to make your own arguments in the comments. Best infotainment overall: UConnect 5, various Stellantis products Ram 1500 Uconnect Infotainment System Review If thereÂ’s one infotainment system that all of us agree is excellent, itÂ’s UConnect. It has numerous qualities that make it great, but above all else, UConnect is simple and straightforward to use. Ease of operation is one of the most (if not the single most) vital parts of any infotainment system interface. If youÂ’re expected to be able to tap away on a touchscreen while driving and still pay attention to the road, a complex infotainment system is going to remove your attention from the number one task at hand: driving. UConnect uses a simple interface that puts all of your key functions in a clearly-represented row on the bottom of the screen. Tap any of them, and it instantly pulls up that menu.

Ford Police Interceptors dominate Michigan State Police testing

Tue, Nov 1 2016Once again, Ford Motor Company builds the fastest police vehicles. The Blue Oval touted the news in an official release following Michigan State Police and Los Angeles County Sheriff's Department testing. Ford did very well. Except for one acceleration metric – zero to 10 miles per hour – the Blue Oval's Taurus and Explorer-based cop cars were the quickest, with particular praise coming for the EcoBoost-powered models, which bested Chevrolet and Dodge's V8-powered variants. Dearborn's products also posted the fastest average times around MSP's vehicle dynamics course. But it wasn't all positive for Ford. The only four-cylinder in the contest, the 2.0-liter, EcoBoost Ford SSP Sedan, had both the lowest top speed, 120 mph, and the slowest acceleration figures. It was also the slowest in track testing. Ford's products also failed to match the braking and top speeds of its rivals from Detroit and Auburn Hills – the rear-drive Charger Pursuit posted the best braking stats of the entire test, while the V8-powered Chevrolet Caprice hit the highest top speed, at 155 mph. Ford did score a top speed award, among SUVs, but at 132 mph, the naturally aspirated Police Interceptor Utility had to share its award with the equally fast, rear-drive Chevrolet Tahoe. The LA County Sheriff's timing isn't publicly available, but according to Ford, the EcoBoost-powered police cars put on a similarly impressive show for cops on the West Coast. We've assembled a spreadsheet on Google Docs that offers an easy to browse comparison of the different stats assembled by the Michigan State Police, and divided the vehicles between standard V6-powered sedans, high-performance sedans (EcoBoost and V8 models), and SUVs. You can check it out here. Related Video: