2023 Dodge Challenger Srt Hellcat on 2040-cars

Pottstown, Pennsylvania, United States

Fuel Type:Gasoline

For Sale By:Private Seller

Vehicle Title:Clean

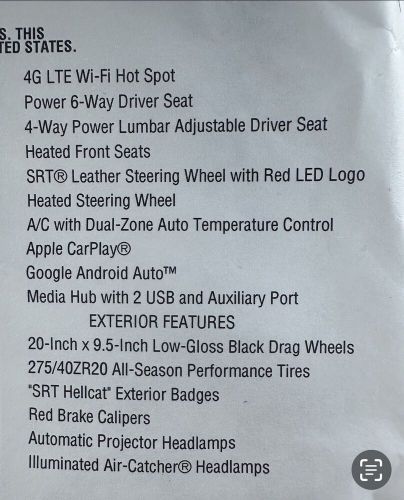

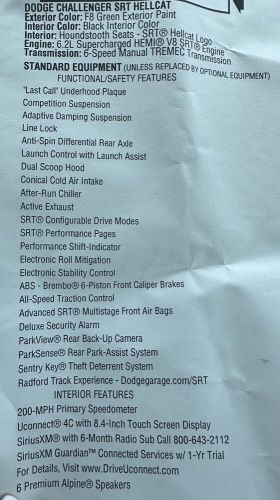

Engine:6.2L Gas V8

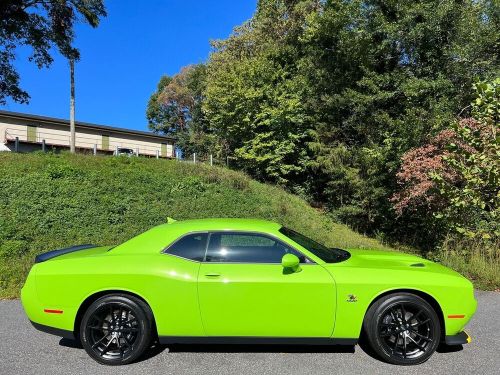

Year: 2023

VIN (Vehicle Identification Number): 2C3CDZC92PH684379

Mileage: 550

Trim: SRT HELLCAT

Number of Cylinders: 8

Make: Dodge

Drive Type: RWD

Model: Challenger

Exterior Color: Green

Dodge Challenger for Sale

2023 dodge challenger srt demon 170(US $174,995.00)

2023 dodge challenger srt demon 170(US $174,995.00) 2023 dodge challenger r/t(US $23,713.90)

2023 dodge challenger r/t(US $23,713.90) 2012 dodge challenger srt 50th anniversary mr. norms gss see video(US $47,900.00)

2012 dodge challenger srt 50th anniversary mr. norms gss see video(US $47,900.00) 2023 dodge challenger r/t scat pack(US $51,999.00)

2023 dodge challenger r/t scat pack(US $51,999.00) 1973 dodge challenger rallye(US $5,000.00)

1973 dodge challenger rallye(US $5,000.00) 2010 dodge challenger r/t(US $9,975.00)

2010 dodge challenger r/t(US $9,975.00)

Auto Services in Pennsylvania

Witmer`s Auto Salvage ★★★★★

West End Sales & Service ★★★★★

Walter`s Auto Wrecking ★★★★★

Tony`s Towing ★★★★★

T S E`s Vehicle Acces Inc ★★★★★

Supreme Auto Body Works, Inc ★★★★★

Auto blog

Buyer says Dodge dealer gave him wrong Charger, failed to notice for 2 months

Wed, Dec 31 2014Mistakes happen, and they happen all the time. But when that mistake means a customer doesn't get what he or she paid for, something's gotta give. That's what one Dodge Charger buyer claims he is trying to sort out with his local dealership. Two months after taking delivery, the owner (going by the user name Dakrbouncer4689 on Reddit) says he got a call from his local Dodge dealership reporting a little problem. He had ordered and paid for the Charger SXT (pictured above on the dealer lot), but was given a Charger SE instead. The SE being the lower trim level, this presented one set of problems – namely a $2,000 discrepancy in equipment, like a five-speed automatic versus an eight-speed, a 4.3-inch infotainment display instead of 8.4, heated seats, leather steering wheel, premium audio, remote starter and so on. The second set of issues is that the VIN number on the paperwork (including the registration and insurance papers) of course doesn't match that of the car itself. The dealer, having obviously made a rather large mistake, apparently called the owner in to sort out the mess, but according to the customer's account, things didn't go as smoothly. Instead of immediately working to address the problem, the salesman kept the owner waiting, acted like it was no big deal, and offered only to swap the cars with no compensation for the trouble. Fortunately, the manager proved more sympathetic and apologetic, and offered the customer three options: he could swap the cars (re-doing the tinted windows on the SXT that the customer had done on the SE and throwing in leather seats for free), he could keep the SE (with the dealership handling the paperwork, throwing in the leather seats, adjusting the price and refunding an extra $400), or they could cancel everything, return the car and part company. As we go to press, the Charger owner had yet to make (or at least share) his decision. But while the principle of caveat emptor makes us wonder how he managed to take home a different car from the one he paid for, clearly the salesman and the dealership made a pretty large mistake by presenting him with the wrong set of keys and letting him off the lot without double checking it all. News Source: Darkbouncer4689 via Reddit, World Car Fans Dodge Car Buying Car Dealers Economy Cars Sedan

Bull leads Texas police on four hour chase

Thu, May 12 2016A bull leading police on a chase through a Texas town may sound like something out of a country music song, but police in Arlington, Texas recently had just such a situation on their hands. According to WFAA, on the afternoon of May 9, a young bull got loose from his pen and decided to take a stroll through the streets of Arlington. "There was a cow walking down the neighborhood," said Arlington resident Jillyan Nance. "It trotted down my home and cut across our yard into the neighbor's yard." Arlington police were alerted to the escaped bull and, in a scene more Texas than Steve Earle drinking a Shiner at the Alamo, they attempted to chase it down with police cruisers. For the next four hours, police engaged the creature in a sedate, low-speed chase through Arlington, Dalworthington Gardens, and other neighboring towns. The bull, for his part, largely ignored his pursuers and the throngs of people coming out of their houses to watch the strange scene and post pictures to Facebook and Instagram. With numerous police cruisers in not-quite-hot pursuit, the bull ambled along the shady streets, stopping here and there to munch on some grass and take in the views. Eventually, a friendly local rancher showed up and lassoed the bull in Dalworthington Gardens just before 9:00 p.m. Police have not released the name of the bull's owner or any motive for its escape. Perhaps, like the unicorn that escaped into a California orchard back in February, it decided that it had had enough of working for a living and was looking for something else. Related Video: News Source: WFAA Humor Weird Car News Dodge Police/Emergency Videos Sedan police chase cow bull

2014 Dodge Durango priced from $29,795*

Wed, 14 Aug 2013With all the new updates the Dodge Durango is getting for 2014, one thing that Dodge isn't changing on its big SUV is the starting price. Just like the current model year, the 2014 Dodge Durango will be priced from $29,795 (*not including $995 for destination).

This price is for the base SXT model, but the 2014 Durango is also offered in a new Limited trim level (replacing the Crew) as well as the sporty R/T and the luxurious Citadel. The Durango Limited starts at $35,995 (an increase of $800 over the 2013 Crew), while the R/T now starts at $38,995 (up $2,500). The top-of-the-line Durango Citadel will start at $40,995 - an increase of $1,000.

The many improvements made to the 2014 Durango include revised exterior styling, added in-cabin tech and an eight-speed automatic transmission (expected to return better fuel economy). Dodge is saying that the V6 models will get 25 miles per gallon on the highway while V8 models are expected to score 23-mpg highway, but there are no official EPA numbers to report yet. Scroll down for the full press release.