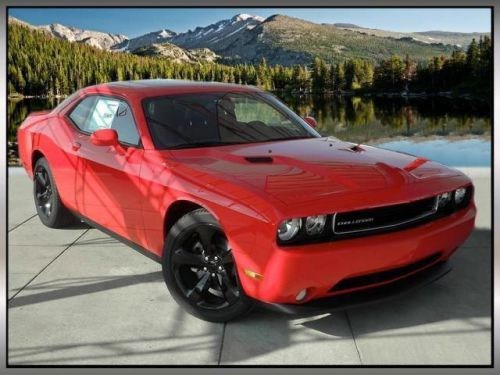

2014 Dodge Challenger Sxt on 2040-cars

4505 W. 96th St, Indianapolis, Indiana, United States

Engine:3.6L V6 24V MPFI DOHC

Transmission:5-Speed Automatic

VIN (Vehicle Identification Number): 2C3CDYAG1EH133434

Stock Num: 457013

Make: Dodge

Model: Challenger SXT

Year: 2014

Exterior Color: Toreador Red

Interior Color: Dark Slate Gray

Options: Drive Type: RWD

Number of Doors: 2 Doors

***Pricing Incentives structure good through 6/30/14******#1 Sales Advocacy Indiana 3 Month Rolling Average 95.1%, 100% month of May (Source: Chrysler CEI - Customer experience initiative report***GLBC Chrysler Capital Commercial Bonus GLCEZ $750Bonus cash for Type B/E sales. Customer must finance through Chrysler Capital. GLBC Consumer Cash $1,000.Challenger (excluding SRT8) GLCEA. Great Lakes 2014 Bonus Cash GLCEA $1,000. Bonus cash for Type 1/B and L/E sales. Challenger (excluding SRT8) 38CEA1 2014 Conquest Lease to Retail/Lease 38CEA1 $1,000 Bonus cash for Type 1/B and L/E sales to consumers currently leasing a competitive vehicle. No turn-in required. NOT COMPATIBLE WITH EMPLOYEE PURCHASE OR CERTAIN DESIGNATED INDIVIDUAL (CDI) PURCHASES.Total Available $3,000Dk Slate Gry Lth Med Bkt. Dodge FEVER! At Champion Chrysler Jeep Dodge, YOU'RE #1! Want to stretch your purchasing power? Well take a look at this fantastic 2014 Dodge Challenger. Don't be surprised when you take this great Dodge Challenger down the road and find yourself enamored with its handling and falling in love with REAL driving all over again. Please call 877-512-8665 to schedule an appointment or PRINT THIS AD and bring it in with you.

Dodge Challenger for Sale

2014 dodge challenger sxt(US $28,506.00)

2014 dodge challenger sxt(US $28,506.00) 2014 dodge challenger sxt(US $28,526.00)

2014 dodge challenger sxt(US $28,526.00) 2014 dodge challenger sxt(US $28,931.00)

2014 dodge challenger sxt(US $28,931.00) 2014 dodge challenger sxt(US $28,931.00)

2014 dodge challenger sxt(US $28,931.00) 2014 dodge challenger sxt(US $28,931.00)

2014 dodge challenger sxt(US $28,931.00) 2014 dodge challenger sxt(US $29,995.00)

2014 dodge challenger sxt(US $29,995.00)

Auto Services in Indiana

Wolski`s Auto Repair ★★★★★

Wheels Auto Sales ★★★★★

Tony Kinser Body Shop ★★★★★

Tilley`s Hilltop ★★★★★

Standard Auto Sales ★★★★★

Schepper`s Tires & Batteries ★★★★★

Auto blog

Dodge Challenger Hellcat X is 805-hp worth of charity [w/video]

Mon, Jul 20 2015Donating to charity is good for the soul. You feel good and help out those in need, and while you should donate out of the goodness of your heart, there's nothing wrong with getting something in return. That's doubly true if that something (or somethings) happen to run on gasoline... a lot of gasoline. For just $3 (plus $40,000 in taxes), you could park not one, but two high-powered Mopars in your driveway. The big item, of course, is the world's most powerful Dodge Challenger Hellcat. Dubbed the Hellcat X after the XF6F, a twin-charged US Navy prototype that evolved into the Hellcat fighter from World War II. Its 6.2-liter, supercharged V8 has been supplemented by a turbocharger, boosting output to 805 horsepower. Because, you know, 707 just wasn't quite enough. It should be noted that the Hellcat X isn't a production model – Fiat Chrysler isn't going to be putting a twin-charged Hemi into production – but that it's a one-off job built for the 2015 Chrysler Nationals at Carlisle. Joining the Hellcat X is a handsome, black 1970 Challenger 440 R/T. Complete with a four-barrel carburetor (yeah, we were hoping for a Six Pack, as well), a pistol-grip shifter, and menacing black paint, this exact car was the star of 2012's "Revolution Reborn" television spot. And if this car's on-air claim to fame isn't enough, rest easy knowing you're the owner of just one of 100 black 440 R/Ts produced in 1970. Now, single tickets do start at $3, although there are larger bundles available, including a $5,000, 6,000-ticket package. Proceeds from the drawing, which is being put on by Dream Giveaway, will go towards New Beginning Children's Home charity, which issues grants to everything from the National Guard Educational Foundation to Mothers Against Drunk Driving. You can check out more on the Hellcat X in the video, below. This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings.

Stellantis lays off salaried workers, cites uncertainty in EV transition

Sat, Mar 23 2024DETROIT — Jeep maker Stellantis is laying off about 400 white-collar workers in the U.S. as it deals with the transition from combustion engines to electric vehicles. The company formed in the 2021 merger between PSA Peugeot and Fiat Chrysler said the workers are mainly in engineering, technology and software at the headquarters and technical center in Auburn Hills, Michigan, north of Detroit. Affected workers were notified starting Friday morning. “As the auto industry continues to face unprecedented uncertainties and heightened competitive pressures around the world, Stellantis continues to make the appropriate structural decisions across the enterprise to improve efficiency and optimize our cost structure,” the company said in a prepared statement Friday. The cuts, effective March 31, amount to about 2% of Stellantis' U.S. workforce in engineering, technology and software, the statement said. Workers will get a separation package and transition help, the company said. “While we understand this is difficult news, these actions will better align resources while preserving the critical skills needed to protect our competitive advantage as we remain laser focused on implementing our EV product offensive,” the statement said. CEO Carlos Tavares repeatedly has said that electric vehicles cost 40% more to make than those that run on gasoline, and that the company will have to cut costs to make EVs affordable for the middle class. He has said the company is continually looking for ways to be more efficient. U.S. electric vehicle sales grew 47% last year to a record 1.19 million as EV market share rose from 5.8% in 2022 to 7.6%. But sales growth slowed toward the end of the year. In December, they rose 34%. Stellantis plans to launch 18 new electric vehicles this year, eight of those in North America, increasing its global EV offerings by 60%. But Tavares told reporters during earnings calls last month that “the job is not done” until prices on electric vehicles come down to the level of combustion engines — something that Chinese manufacturers are already able to achieve through lower labor costs. “The Chinese offensive is possibly the biggest risk that companies like Tesla and ourselves are facing right now,Â’Â’ Tavares told reporters. “We have to work very, very hard to make sure that we bring out consumers better offerings than the Chinese.

Stellantis announces ‘Circular Economy’ business to drive revenue, decarbonization

Tue, Oct 11 2022Stellantis has already announced its plans to reach net-zero carbon emissions by 2038. Today, the automaker has announced a new business unit to help it reach that goal while generating 2 billion euros per year in revenue by 2030. The “Circular Economy” business will help make revenue less dependent on finite, rare and ecologically problematic materials. The Circular Economy model features what Stellantis calls a “4R” strategy, comprising remanufacturing, repair, reuse and recycling. The goal is to make materials last as long as they can, reducing reliance on the acquisition of those precious new materials in the future by returning them to the business loop when theyÂ’ve reached the end of their first life. Through these processes, Stellantis says it can save up to 80% raw material and 50% energy compared to manufacturing a new part. Remanufacturing, or “reman” in Stellantis shorthand, means dismantling, cleaning and rebuilding parts to OEM spec. Nearly 12,000 remanufactured parts are available for customers to purchase. Some remanufacturing is done in-house, and some with partners and through joint ventures. Repair is pretty obvious — fixing parts to put back into vehicles. This also consists of reconditioning, to make a vehicle feel like new. Stellantis boasts 21 “e-repair” centers for repairing electric vehicle batteries. Reuse refers to parts still in good condition from end-of-life vehicles sold as-is. Stellantis says it has 4.5 million multi-brand parts in inventory. These are sold in 155 countries through the B-Parts e-commerce platform. Reuse also refers second-life options, such as using batteries outside of automotive purposes. Recycling involves dismantling parts and scraps back into raw material form that is then looped back into the manufacturing process. Stellantis says it has collected 1 million parts for recycling in the past six months. Recycling doesnÂ’t get counted in that aforementioned 2 billion euros of revenue, but it does save the company money on acquisition of raw materials. As for batteries, specifically, Stellantis expects this recycling business to ramp up after 2030, when the packs currently in service begin to reach the end of their lifecycle. Stellantis will use its new “SUSTAINera” label to denote parts that are offered as part of its Circular Economy business.