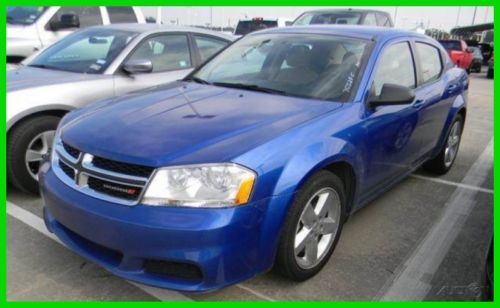

2010 R/t Used Cpo Certified 2.4l I4 16v Automatic Front Wheel Drive Sedan on 2040-cars

Spring, Texas, United States

Body Type:Sedan

Vehicle Title:Clear

Fuel Type:Gasoline

For Sale By:Dealer

Year: 2010

Number of Cylinders: 4

Make: Dodge

Model: Avenger

Drive Type: Front Wheel Drive

Warranty: Yes

Mileage: 50,350

Sub Model: 2010 DODGE AVENGER R/T CPO Certified Warranty 2.4L

Exterior Color: White

Interior Color: Black

Number of Doors: 4 Doors

Dodge Avenger for Sale

2008 dodge avenger r/t sedan 4-door 3.5l(US $9,750.00)

2008 dodge avenger r/t sedan 4-door 3.5l(US $9,750.00) Beautiful red dodge avenger r/t low miles, fast and fun!!!

Beautiful red dodge avenger r/t low miles, fast and fun!!! 2013 se used cpo certified 2.4l i4 16v automatic front wheel drive sedan premium(US $15,991.00)

2013 se used cpo certified 2.4l i4 16v automatic front wheel drive sedan premium(US $15,991.00) 2012 se used 2.4l i4 16v automatic sedan premium(US $14,700.00)

2012 se used 2.4l i4 16v automatic sedan premium(US $14,700.00) 1998 dodge avenger, no reserve

1998 dodge avenger, no reserve 2012 dodge avenger se, low miles, well-kept(US $12,900.00)

2012 dodge avenger se, low miles, well-kept(US $12,900.00)

Auto Services in Texas

Whatley Motors ★★★★★

Westside Chevrolet ★★★★★

Westpark Auto ★★★★★

WE BUY CARS ★★★★★

Waco Hyundai ★★★★★

Victorymotorcars ★★★★★

Auto blog

Stellantis reports $15B profit in first year of merger

Wed, Feb 23 2022FRANKFURT, Germany — Automaker Stellantis said Wednesday that it made 13.4 billion euros ($15.2 billion) in its first year after it was formed from the merger of Fiat Chrysler Automobiles and PSA Group. The earnings nearly tripled profits compared with its pre-merger existence as two separate companies, as the maker of Jeep, Opel and Peugeot vehicles exploited cost efficiencies from combining the businesses. The result compared to a combined 4.79 billion euros for the separate companies in 2020 before the merger, which took effect on Jan. 17, 2021. Revenue for the combined business rose 14%, to 152 billion euros. CEO Carlos Tavares said the results “prove that Stellantis is well positioned to deliver strong performance" and had overcome “intense headwinds” during the year. Automakers have struggled with shortages of key parts such as semiconductor electronic components and rising costs for raw materials as the global rebound from the worst of the coronavirus pandemic brings more demand. The company said the benefits of the merger were worth some 3.2 billion euros during the year. Mergers can lead to streamlined costs as companies combine functions and spread fixed costs over a larger revenue base. The company accelerated its rollout of battery-powered vehicles, with sales of low-emission vehicles reaching 388,000 — an increase of 160%. Stricter environmental regulations in Europe and China are pushing automakers to roll out more electric vehicles with longer range. Stellantis started production of a hydrogen fuel cell commercial van under its Opel brand in December. Stellantis' other brands include Chrysler, Citroen, DS, Fiat, Maserati, Ram and Vauxhall. Related video: Earnings/Financials Chrysler Dodge Ferrari Fiat Jeep RAM Citroen Opel Peugeot Vauxhall

Tech of the Year special, plus we drive the hydrogen Mirai and more | Autoblog Podcast #809

Fri, Dec 1 2023In this episode of the Autoblog Podcast, Editor-in-Chief Greg Migliore is joined by Senior Editor James Riswick and Road Test Editor Zac Palmer. They kick the discussion off by talking about what they've been driving as of late, including the Toyota Mirai, Dodge Hornet, Alfa Romeo Tonale and a trio of subcompact SUVs. After that, they dive into a discussion about the 2023 Autoblog Technology of the Year award winner, which is Mercedes-Benz's Dolby Atmos Spatial Audio. Once they wrap up that segment, we get to hear the crew's latest Cybertruck takes from before the big reveal. Finally, the show wraps up with a fun Spend My Money segment. Send us your questions for the Mailbag and Spend My Money at: Podcast@Autoblog.com. Autoblog Podcast #809 Get The Podcast Apple Podcasts – Subscribe to the Autoblog Podcast in iTunes Spotify – Subscribe to the Autoblog Podcast on Spotify RSS – Add the Autoblog Podcast feed to your RSS aggregator MP3 – Download the MP3 directly Rundown What we're driving 2023 Toyota Mirai 2023 Dodge Hornet 2024 Alfa Romeo Tonale 2024 Chevy Trax 2024 Kia Seltos 2024 Mazda CX-30 Turbo Technology of the Year winner and breakdown News Cybertruck preview Spend My Money Feedback Email – Podcast@Autoblog.com Review the show on Apple Podcasts Autoblog is now live on your smart speakers and voice assistants with the audio Autoblog Daily Digest. Say “Hey Google, play the news from Autoblog” or "Alexa, open Autoblog" to get your favorite car website in audio form every day. A narrator will take you through the biggest stories or break down one of our comprehensive test drives. Related video: Green Podcasts Alfa Romeo Chevrolet Dodge Kia Mazda Mercedes-Benz Toyota Technology Infotainment Technology of the Year Crossover SUV Electric Luxury Performance Sedan Podcasts

China's Geely says it has no plan to buy Fiat Chrysler — as FCA stock leaps

Wed, Aug 16 2017HONG KONG — Chinese carmaker Geely Automobile denied media speculation on Wednesday that it planned to make a takeover bid for Fiat Chryslerk Automobiles (FCA), the world's seventh-largest automaker. Geely was one of several Chinese carmakers cited in by Automotive News, which said representatives of "a well-known Chinese automaker" had made an offer this month for FCA, which has a market value of almost $20 billion. "We don't have such a plan at the moment," Geely executive director Gui Shengyue told reporters at an earnings briefing, when asked if Geely was interested in Fiat. He said a foreign acquisition would be complicated, but he did not elaborate. "But for other (Chinese) brands, it could be a fast track for their development," Gui added. However, a source close to the matter said FCA and Geely Automobile's parent firm, Zhejiang Geely Holding Group, had held initial talks late last year, without disclosing their nature. The source confirmed Geely was no longer interested in FCA, noting that the parent company had only three months ago announced its first push into Southeast Asia with the purchase of 49.9 percent of struggling Malaysian carmaker Proton, a deal that also included a stake in Lotus. Geel's denial failed to dent FCA's stock. The price of its Milan-based shares has jumped more than 10 percent to a 19-year high since Automotive News first reported on Monday, citing unnamed sources, that FCA had rejected the Chinese offer as too low. FCA stock on the New York Stock Exchange rose sharply on Monday from $11.60 to $12.38 and on Wednesday was trading at $12.84. FCA declined to comment on Wednesday. FCA Chief Executive Sergio Marchionne has repeatedly called for mergers as a way of sharing the costs of making cleaner, more advanced cars, but he has repeatedly failed to find a partner and retreated from his search for in April, saying FCA would stick to its business plan. He has also spoken of spinning the successful Jeep and Ram divisions off from FCA. Europe's largest carmaker, Volkswagen, and General Motors have both said they are not interested in talks with FCA. On Wednesday, Geely Automobile reported a doubling of first-half profit, above expectations, as cars designed with Sweden's Volvo won over domestic consumers. Volvo is a unit of the Zhejiang Geely group, and has recently announced it will share its technology with Geely.

2040Cars.com © 2012-2025. All Rights Reserved.

Designated trademarks and brands are the property of their respective owners.

Use of this Web site constitutes acceptance of the 2040Cars User Agreement and Privacy Policy.

0.06 s, 7971 u