1970 Citroen Mehari on 2040-cars

Fuel Type:Gasoline

For Sale By:Private Seller

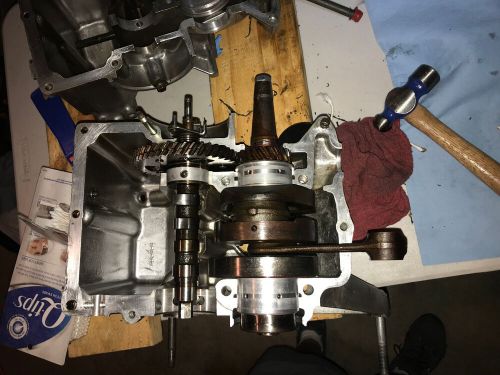

Engine:602cc 28hp boxer 2

Body Type:SUV

Vehicle Title:Clean

VIN (Vehicle Identification Number): CA2808

Mileage: 73000

Make: Citroen

Interior Color: Black

Previously Registered Overseas: No

Number of Seats: 4

Number of Previous Owners: 2

Drive Side: Left-Hand Drive

Horse Power: Less Than 44 kW (58.96 hp)

Independent Vehicle Inspection: No

Engine Size: 0.6 L

Exterior Color: Green

Car Type: Classic Cars

Number of Doors: 2

Features: Power Locks

Number of Cylinders: 2

Drive Type: 2WD

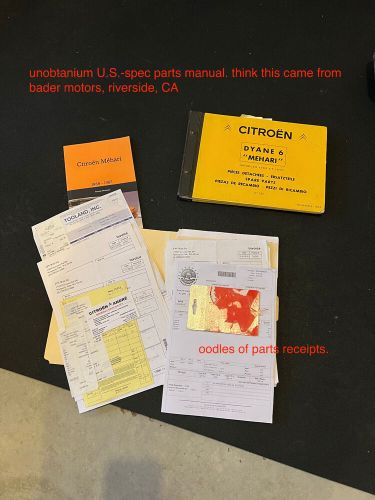

Service History Available: Partial

Safety Features: Chains so you dont fall out, Folding windshield, Seat belts

Date of 1st Registration: 19700101

Model: Mehari

Country/Region of Manufacture: France

Citroen Mehari for Sale

1977 citroen mehari(US $29,977.00)

1977 citroen mehari(US $29,977.00) 1977 citroen mehari mehari soft top! see video(US $20,000.00)

1977 citroen mehari mehari soft top! see video(US $20,000.00)

Auto blog

10 cool cars from Peugeot's lineup we'd love to see in the U.S.

Thu, Oct 31 2019FCA and PSA are merging: The mega-alliance will not just bring a desperately needed technology boost to Fiat Chrysler, it will also open up potential U.S. sales venues to brands that have long been absent here. Citroen left in the 1970s, Peugeot deserted us 20 years later; Citroen's DS spinoff is a complete unknown in the States. Moreover, there's Opel, formerly a part of General Motors, with its UK-based Vauxhall attachment. As a brand, Opel was last seen here around 1970, its models sold through the Buick sales channel. Even though Opel is now part of the PSA empire, there is still significant overlap with Buick: The Buick Encore is an Opel Mokka, the Regal is an Insignia, and though this is its last model year in the States, the Cascada had been shared as well. But in Europe, the replacement of GM-shared platforms with PSA-Opel models is well under way, We have assembled 10 of the most interesting cars currently offered under the Citroen, DS, Peugeot and Opel/Vauxhall monikers. Should they be offered in the U.S.? We certainly think they deserve consideration. Citroen C4 Cactus Purist architecture in automotive form: The polarizing C4 Cactus is shaped by geometric lines, although it has recently been toned down and assumed a somewhat crossover-like stance that was absent before the facelift. Also lost is the funky full-width front bench that you could initially choose. Still, the C4 Cactus shuns conventional notions of aggressive and prestige-oriented design, opting for functionality and a product-design-like attitude. Sadly, it won't survive past its current generation. Citroen C5 Aircross Bigger and taller than the C4 Cactus, the C5 Aircross features even more of an SUV look, though it comes with front-wheel drive only. Controls and instruments have a reduced, product-design-like look, and the seat patterns offer a retrofuturistic interpretation of 1970s design. The "Advanced Comfort" chassis emphasizes ride quality, but the C5 Aircross is still surprisingly agile. No wonder, as Citroen has a proud rally heritage. DS 3 Crossback This compact crossover oozes technology and luxury: Fitted with diesel or gasoline engines or with a fully electric powertrain, the DS 3 Crossback can be specified with a plethora of premium options. The cockpit plays with upscale patterns and materials; some dashboard versions are actually inspired by stucco veneziano. The diesel, our favorite engine option for this vehicle, is incredibly efficient and surprisingly torquey.

Stellantis earnings rise along with EV sales

Wed, Feb 22 2023AMSTERDAM — Automaker Stellantis on Wednesday reported its earnings grew in 2022 from a year earlier and said its push into electric vehicles led to a jump in sales even as it faces growing competition from an industrywide shift to more climate-friendly offerings. Stellantis, formed in 2021 from the merger of Fiat Chrysler and FranceÂ’s PSA Peugeot, said net revenue of 179.6 billion euros ($191 billion) was up 18% from 2021, citing strong pricing and its mix of vehicles. It reported net profit of 16.8 billion euros, up 26% from 2021. Stellantis plans to convert all of its European sales and half of its U.S. sales to battery-electric vehicles by 2030. It said the strategy led to a 41% increase in battery EV sales in 2022, to 288,000 vehicles, compared with the year earlier. The company has “demonstrated the effectiveness of our electrification strategy in Europe,” CEO Carlos Tavares said in a statement. “We now have the technology, the products, the raw materials and the full battery ecosystem to lead that same transformative journey in North America, starting with our first fully electric Ram vehicles from 2023 and Jeep from 2024.” The automaker is competing in an increasingly crowded field for a share of the electric vehicle market. Companies are scrambling to roll out environmentally friendly models as they look to hit goals of cutting climate-changing emissions, driven by government pressure. The transformation has gotten a boost from a U.S. law that is rolling out big subsidies for clean technology like EVs but has European governments calling out the harm that they say the funding poses to homegrown industry across the Atlantic. Stellantis' Jeep brand will start selling two fully electric SUVs in North America and another one in Europe over the next two years. It says its Ram brand will roll out an electric pickup truck this year, joining a rush of EV competitors looking to claim a piece of the full-size truck market. The company plans to bring 25 battery-electric models to the U.S. by 2030. As part of that push, it has said it would build two EV battery factories in North America. A $2.5 billion joint venture with Samsung will bring one of those facilities to Indiana, which is expected to employ up to 1,400 workers. The other factory will be in Windsor, Ontario, a collaboration with South KoreaÂ’s LG Energy Solution that aims to create about 2,500 jobs. The EV push comes amid a slowdown in U.S.

Citro"en bringing Wild Rubis concept to Shanghai

Thu, 11 Apr 2013Citroën announced that it will be bringing the "latest expression" of its DS lineup to the Shanghai Motor Show next week, with this aubergine-hued concept called Wild Rubis. For the record, "Rubis" is French for "Ruby" and alludes to that purple/red paint, as far as we can make out.

The French automaker tells us that the Wild Rubis foreshadows an upcoming DS SUV. The concept is going to be "full-hybrid, plug-in technology," beyond that, however, details are quite sparse. We expect that we'll receive a lot more in the way of detail about the Wild Rubis when Citroën rolls it out on the stage in China.

What the press release lacks in detail, however, Citroën has certainly made up for in imagery. It seems that before shipping the concept to Shanghai, the Wild Rubis was photographed extensively at the Cheval Blanc wine-growing estate in the Saint-Emilion area of France. The result is a massive image gallery for you to explore and enjoy.