Limited Ethanol - Ffv 3.6l Nav Cd Front Wheel Drive Power Steering Abs Fog Lamps on 2040-cars

Aberdeen, South Dakota, United States

Vehicle Title:Clear

Fuel Type:Ethanol - FFV

For Sale By:Dealer

Transmission:Automatic

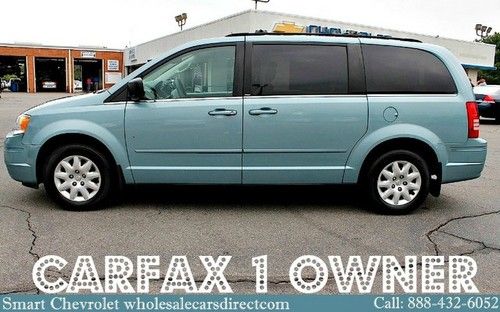

Make: Chrysler

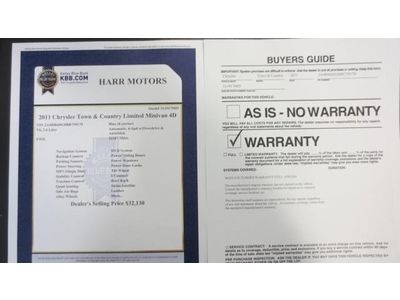

Warranty: Unspecified

Model: Town & Country

Mileage: 22,287

Options: Leather Seats

Sub Model: Limited

Power Options: Power Windows

Exterior Color: Blue

Number of Cylinders: 6

Chrysler Town & Country for Sale

2012 chrysler town & country touring ed

2012 chrysler town & country touring ed Used chrysler town & country minivan 7 passenger vans we finance dodge autos 4dr

Used chrysler town & country minivan 7 passenger vans we finance dodge autos 4dr Limited-1 owner-bruno disability seat-every option-new tires-lthr-dual pwr seats(US $5,350.00)

Limited-1 owner-bruno disability seat-every option-new tires-lthr-dual pwr seats(US $5,350.00) 2013 chrysler town & country(US $25,987.00)

2013 chrysler town & country(US $25,987.00) Wheelchair accessible 2007 chrysler town & country(US $23,000.00)

Wheelchair accessible 2007 chrysler town & country(US $23,000.00) Garage kept

Garage kept

Auto Services in South Dakota

White`s Canyon Motors ★★★★★

Tri-State Tire Factory ★★★★★

Treadwright ★★★★★

Toyota Of The Black Hills ★★★★★

The Glass Shop ★★★★★

Dales A-1 Transmission Service ★★★★★

Auto blog

Buick Wildcat and Electra concepts, Ford Maverick | Autoblog Podcast #732

Fri, Jun 3 2022In this episode of the Autoblog Podcast, Editor-in-Chief Greg Migliore is joined by Road Test Editor Zac Palmer. They lead off with a discussion of the news. This section touches on the DeLorean Alpha5, Buick Wildcat EV Concept reveal, revival of the Buick Electra name, production reveal of the Mercedes-AMG One and some scuttle about Volkswagen's recently-bought Scout brand. After that, they move on to the cars they've been driving, including the Ford Maverick and Chrysler Pacifica Hybrid. After the pair finish with what they've been driving, the podcast transitions to an interview between Greg Migliore and former Car and Driver Editor-in-Chief Eddie Alterman. Finally, Greg and Zac wrap things up with some more spring and summer beer recommendations. Send us your questions for the Mailbag and Spend My Money at: Podcast@Autoblog.com. Autoblog Podcast #732 Get The Podcast Apple Podcasts – Subscribe to the Autoblog Podcast in iTunes Spotify – Subscribe to the Autoblog Podcast on Spotify RSS – Add the Autoblog Podcast feed to your RSS aggregator MP3 – Download the MP3 directly Rundown News Delorean Alpha5 reveal Buick Wildcat EV Concept reveal Revival of the Buick Electra name Production reveal of the Mercedes-AMG One Volkswagen's recently-bought Scout brand controversy Cars we're driving 2022 Ford Maverick EcoBoost 2022 Chrysler Pacifica Hybrid Pinnacle Interview with Eddie Alterman Feedback Email – Podcast@Autoblog.com Review the show on Apple Podcasts Autoblog is now live on your smart speakers and voice assistants with the audio Autoblog Daily Digest. Say “Hey Google, play the news from Autoblog” or "Alexa, open Autoblog" to get your favorite car website in audio form every day. A narrator will take you through the biggest stories or break down one of our comprehensive test drives. Related video: Green Podcasts Buick Chrysler Ford Mercedes-Benz Volkswagen Truck Coupe Minivan/Van SUV Concept Cars Electric Future Vehicles Luxury Off-Road Vehicles Performance Supercars Sedan

Ford barely edges surging Chrysler for Canadian sales crown in best year ever

Thu, Jan 8 2015The auto industry in the US showed strong results through much of 2014 with sales regularly growing year-over-year for many brands. That same trend carried over in the Great White North, as well. Canada posted its best numbers ever with 1.85 million units sold, up about 100,000 vehicles over 2013. The country nearly had a new market leader, too. The big winner among our neighbors to the north in 2014 was Ford with 291,951 vehicles sold, up 3 percent from 2013, according to Reuters. That success also handed the company the sales crown for the fifth consecutive year. In large part, the strong result came from the company's popular trucks, which represented about 80 percent of overall sales. "Ford moved into the number one position in September and didn't look back," said a note to clients by DesRosiers Automotive Consultants quoted by Reuters. However, the Blue Oval didn't exactly take an overwhelming lead for the year. The company nearly had to hand over the sales trophy to FCA after the company rallied in the latter part of the year. The Italian-American conglomerate had its best results ever to nip at the Ford's heels and move 290,004 units for 2014, a 12-percent improvement from last year. Jeep especially helped the bottom line with over 50-percent growth, according to Reuters. Only two other brands were able to break the 200,000-vehicle barrier in Canada for 2014. General Motors came in third place overall with 249,800 sales, up 6.3 percent. The combined Toyota and Lexus also barely jumped the hurdle with 200,851 units moved, a 2.8 percent improvement.

Fiat Chrysler global HQ lands in London's ultra-posh West End

Thu, 18 Sep 2014It seems Fiat is bent on bolstering its image as a global automaker, as word has leaked out that the Italian/American conglomerate has chosen to locate its global headquarters in a rather swanky neighborhood in London. According to Bloomberg, the rental location on St. James Street in London's West End is a 10-minute walk from Buckingham Palace, and Fiat Chrysler Automobiles will fill up three complete floors of an office building that also houses The Economist magazine.

As a neutral location between Italy and the United States, the London-based headquarters makes sense, though, at $277 per square foot, this area is said to be the most expensive office space in the world. There's no mention of what FCA has actually agreed to pay for renting the space, but we're certain it isn't coming cheap.

Not surprisingly, Bloomberg also cites research indicating that the largest number of immigrants moving into London from January through August of this year hail from Italy, which makes sense considering the number of Italian executives and workers we'd expect would have to relocate to the UK in order to work at Fiat's new home. The company reportedly plans to be in place in London by the time it holds its next round of board meetings in October.