2014 Chrysler Town & Country Touring on 2040-cars

18311 Us Hwy 441, Mount Dora, Florida, United States

Engine:3.6L V6 24V MPFI DOHC

Transmission:Automatic

VIN (Vehicle Identification Number): 2C4RC1BG9ER229384

Stock Num: 14Q260

Make: Chrysler

Model: Town & Country Touring

Year: 2014

Exterior Color: Bright White

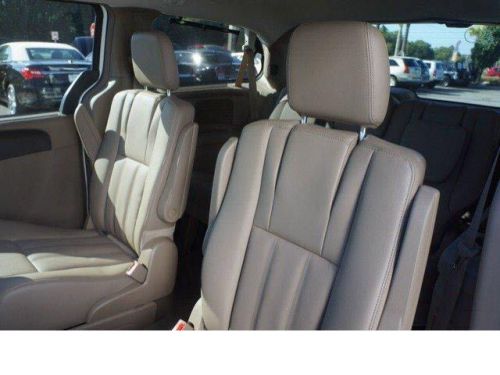

Interior Color: Dark Frost Beige / Medium Frost Bei

Options: Drive Type: FWD

Number of Doors: 4 Doors

Discerning drivers will appreciate the 2014 Chrysler Town Country! An American Icon. All of the premium features expected of a Chrysler are offered, including: adjustable headrests in all seating positions, a power rear cargo door, and leather upholstery. Under the hood you'll find a 6 cylinder engine with more than 270 horsepower, and for added security, dynamic Stability Control supplements the drivetrain. We'd also be happy to help you arrange financing for your vehicle. Stop by our dealership or give us a call for more information. "We Go the Extra Mile"! For more information please contact Casey Mills at 877-253-8644

Chrysler Town & Country for Sale

2014 chrysler town & country touring(US $32,109.00)

2014 chrysler town & country touring(US $32,109.00) 2014 chrysler town & country touring-l(US $35,184.00)

2014 chrysler town & country touring-l(US $35,184.00) 2013 chrysler town & country touring(US $24,787.00)

2013 chrysler town & country touring(US $24,787.00) 2014 chrysler town & country touring(US $32,109.00)

2014 chrysler town & country touring(US $32,109.00) 2014 chrysler town & country touring(US $32,109.00)

2014 chrysler town & country touring(US $32,109.00) 2014 chrysler town & country touring-l(US $37,855.00)

2014 chrysler town & country touring-l(US $37,855.00)

Auto Services in Florida

Yokley`s Acdelco Car Care Ctr ★★★★★

Wing Motors Inc ★★★★★

Whitt Rentals ★★★★★

Weston Towing Co ★★★★★

VIP Car Wash ★★★★★

Vargas Tire Super Center ★★★★★

Auto blog

Ram 1500 mule caught sporting Mega Cab configuration

Mon, Aug 1 2016Our intrepid spy photographers have once again captured an unusual test mule out in the wild. This time we have a Ram 1500 that looks a little lengthy in the middle. We're pretty certain this is a 1500 and not a heavy duty model judging from the grille and hood. That said, FCA clearly went to great lengths to hide the cab. It's still clear that the rear section is longer than your typical quad cab, leading us to believe that the Mega Cab option will return to the 1500 line. Other interesting details are the covered tailgate and the Chrysler steering wheel in the interior. We're not entirely sure why it's covered up, as it doesn't appear to have a different function, but there could be some styling tweaks for a new trim level. The one part we can see is the tailgate handle, which may reveal some updated camera abilities as the normal location shows a differently shaped camera lens. There are also two small spots that could be cameras, but it's tough to say for sure. Will we see 360-degree imaging on the next Ram? The steering wheel is an unusual inclusion as well. Our photographer suggests that it could be necessary for using the latest UConnect infotainment system. Other than the wheel though, the interior looks identical to the current model. This updated cab option also leaves us wondering about the future of the Ram line. We have documentation that shows FCA plans to launch some type of refreshed Ram for the 2018 model year. So it's possible we're looking at an early test mule for that updated model, and the new cab option could be launched at the same time. In many ways, this Ram brings up more questions than answers. Related Video:

Fiat Chrysler and Peugeot boards meet to finalize merger

Tue, Dec 17 2019MILAN/PARIS — The boards of Fiat Chrysler Automobiles and Peugeot will meet separately on Tuesday to discuss finalizing an initial agreement for a $50 billion merger to create the world's number four carmaker, sources said. A source close to FCA said the two companies could announce the signing of a binding memorandum early on Wednesday, followed by a conference call to explain further details later in the day. The two mid-sized carmakers announced plans six weeks ago for a tie-up to help them deal with big challenges in the industry, including a global demand downturn and the need to develop costly cleaner cars to meet looming anti-pollution rules. Ahead of the meetings, entities representing the Peugeot family, Etablissements Peugeot Freres (EPF) and FFP, unanimously approved a proposed memorandum of understanding for the planned merger, a source familiar with the situation said. FCA and PSA have said they would seek to finalize a deal by year-end to create a group with 8.7 million in annual vehicle sales. That would put it fourth globally behind Volkswagen, Toyota and the Renault-Nissan alliance. PSA's Carlos Tavares will be chief executive and FCA's John Elkann — the scion of Italy's Agnelli family, which controls FCA through their holding company Exor — chairman of the combined company. The group will include the Fiat, Jeep, Dodge, Ram, Chrysler, Alfa Romeo, Maserati, Peugeot, DS, Opel and Vauxhall brands, allowing it to serve mass and premium passenger car markets as well as those for trucks and light commercial vehicles. Related Video:    Chrysler Dodge Fiat Jeep RAM Citroen Peugeot

FCA registers 'Cuda' trademark, but we wouldn't get our hopes up

Fri, Jun 23 2017It seems Chrysler has submitted a trademark with the US Patent and Trademark Office for the name "Cuda," as first reported by Motor1. Fans of Mopar will instantly recognize this as the abbreviated name of Plymouth's classic Barracuda muscle car, which occasionally bared the shortened nomenclature. Though this might seem like a sign that FCA is considering a revival of the beloved machine, we wouldn't get our hopes up. See, rumors of a 'Cuda or Barracuda revival have circulated pretty much since the moment Dodge showed the modern Challenger and when it went on sale. And some of those rumors have involved the re-registering of the 'Cuda trademark, even as far back as 2010. Over the years, each rumor died a quiet death as time went on and no 'Cudas appeared on dealer lots. There is one rumor that's recent enough to still have a slim chance of realization, circa 2015 to be exact. It predicts a smaller Challenger-based car called Barracuda that could appear as a Dodge in both coupe and drop-top versions. However, we doubt it will come true, since FCA doesn't exactly have a large development budget, and we're not sure what the company would have to gain by making another sports car to sell below the Challenger. Odds are, it would cannibalize sales from the older, completely developed, and thus more profitable Challenger. Really, this trademark filing is probably just a defensive move for Chrysler. It will ensure that no one else can slip in and snag the name for their own vehicle. It should also help ensure that Chrysler has the rights to use the name on other products such as memorabilia. Sorry to crush your dreams. Related Video: News Source: US Patent and Trademark Office via Motor1Image Credit: Chrysler Rumormill Chrysler Dodge Coupe Performance hemi cuda