2013 Chrysler Town & Country Touring on 2040-cars

500 N Shadeland Ave., Indianapolis, Indiana, United States

Engine:3.6L V6 24V MPFI DOHC

Transmission:Automatic

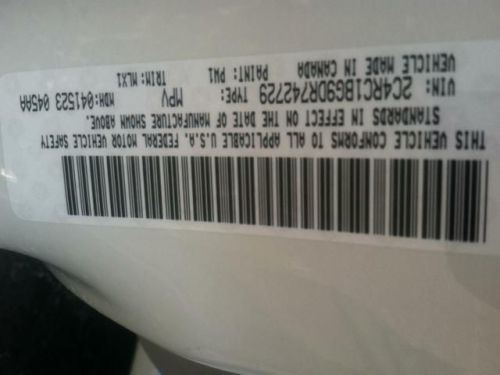

VIN (Vehicle Identification Number): 2C4RC1BG9DR742729

Stock Num: 1400247P

Make: Chrysler

Model: Town & Country Touring

Year: 2013

Exterior Color: White

Options: Drive Type: FWD

Number of Doors: 4 Doors

Mileage: 24376

Nice van! Get ready to ENJOY! Imagine yourself behind the wheel of this terrific 2013 Chrysler Town Country. Score this fantastic Town Country at an outstanding price that you can easily afford! Doing Business in the area for over 35 years. Call Greg Robertson for details on this vehicle. "Eastgate Chrysler Jeep Dodge Ram"

Chrysler Town & Country for Sale

2011 chrysler town & country touring-l(US $23,600.00)

2011 chrysler town & country touring-l(US $23,600.00) 2014 chrysler town & country touring(US $25,866.00)

2014 chrysler town & country touring(US $25,866.00) 2013 chrysler town & country touring-l(US $26,969.00)

2013 chrysler town & country touring-l(US $26,969.00) 2014 chrysler town & country touring(US $29,214.00)

2014 chrysler town & country touring(US $29,214.00) 2014 chrysler town & country touring(US $29,214.00)

2014 chrysler town & country touring(US $29,214.00) 2014 chrysler town & country touring(US $28,892.00)

2014 chrysler town & country touring(US $28,892.00)

Auto Services in Indiana

World Wide Automotive Service ★★★★★

World Hyundai of Matteson ★★★★★

William`s Service Center ★★★★★

Twin City Collision Repair Inc ★★★★★

Trevino`s Auto Sales ★★★★★

Tom Cherry Muffler ★★★★★

Auto blog

Ford F-150 bumps Camry from top of Cars.com American Made Index

Tue, 25 Jun 2013With July 4th just around the corner, what better time could there be for Cars.com to announce that the Ford F-150 is the Most American car of 2013? This may be especially true since it was the Toyota Camry, a car produced by a company based in Japan, that had held the top spot from 2009 to 2012.

Cars.com compiles its Most American list by considering the amount of parts each vehicle uses that come from America, where it's final assembly takes place and how many units per year are sold. "While the assembly point and domestic parts content of the F-150 didn't change from 2012-2013, vehicle sales are responsible for bumping the F-150 to the top spot," according to Patrick Olsen, Editor-in-Chief of Cars.com.

As far as automakers go (as opposed to individual models), Toyota retains the top spot it held in 2012, with General Motors, Chrysler, Ford and Honda (in that order) rounding out the list. The motivation behind this list each year, according to Olsen, is "to help car shoppers understand that 'American-Made' extends beyond just the Detroit three" and because "a study we conducted in 2012 indicated that 25 percent of shoppers surveyed preferred to buy American."

FCA posts $716m profit in 2014, has big plans for 2015

Fri, Jan 30 2015In practically every metric, Fiat Chrysler Automobiles announced growing worldwide earnings for 2014 in its latest financial release. The automaker sold 4.608 million vehicles globally for the year, a 6-percent jump, and total revenue grew 11 percent to 96.090 billion euros ($109 billion). Profits before taxes also increased by 161 million euros ($182 million) from last year to 1.176 billion euros ($1.3 billion). However, net profits did tumble by 1.319 billion euros ($1.5 billion) to a total of 632 million euros ($716 million). These figures put FCA slightly ahead of what some analysts expected. According to Automotive News, the company's adjusted earnings before taxes and interest of 3.651 billion euros ($4.1 billion) beat a forecast figure of 3.4 billion euros ($3.9 billion). Regionally, Europe is showing signs of a comeback. FCA lost 109 million euros ($123 million) there in 2014, but that was almost a triumph compared to the 506 million euro ($573 million) loss in 2013. According to Automotive News, North America played a major role in the company's success, accounting for 55 percent of its revenue. While these annual figures show growth, FCA is even more optimistic about its prospects in 2015. The company is forecasting shipments of between 4.8 and 5 million vehicles worldwide next year. It also estimates earnings before interest and taxes to reach 4.1 billion and 4.5 billion euros ($4.6 billion – $5.1 billion). You can read FCA's full results in PDF format, here. While this release focuses on worldwide figures, FCA US, previously known as Chrysler Group, announces its US results on February 3. News Source: Fiat Chrysler Automobiles, Automotive News - sub. req. Earnings/Financials Chrysler Fiat FCA fiat chrysler automobiles

Fiat Chrysler recalls 1.33 million vehicles over fire, air bag risks

Fri, Jul 14 2017WASHINGTON - Fiat Chrysler Automobiles NV said on Friday it is recalling 1.33 million vehicles worldwide in two separate campaigns for potential fire risks and inadvertent airbag deployments. The Italian-American automaker said it is recalling about 770,000 sport utility vehicles because of a wiring issue that may lead to inadvertent deployment of the driver-side air bag and is linked to reports of five related minor injuries, but no crashes. The company said wiring could chafe against pieces of steering-wheel trim, potentially causing a short-circuit and ultimately leading to an inadvertent air bag deployment. The issue could also cause unintended windshield wiper operation or inoperable switches. The recall covers 538,000 2011-2015 Dodge Journey vehicles in North America and 233,000 2011-2015 Fiat Freemont crossovers sold elsewhere. Dealers will inspect and replace the wiring, as needed and equip it with additional protective covering. The automaker is also recalling 565,000 vehicles to replace their alternators because of fire risks. The company said hot ambient temperatures could lead to premature diode wear, may result in a burning odor or smoke, could impact the anti-lock braking system or lead to engine stalls. The company said it is aware of two potentially related accidents but no injuries. The recall covers 2011-2014 model year Chrysler 300, Dodge Charger and Dodge Challenger cars and Dodge Durango SUVs and 2012-2014 Jeep Grand Cherokee SUVs. In October, Fiat Chrysler recalled about 86,000 Ram 2500 and 3500 pickup trucks, 3500, 4500 and 5500 chassis cabs from the 2007-2013 model years and 2011-2014 Dodge Charger Pursuit sedans for the same alternator issue. Fiat Chrysler said at the time one minor injury was related to the recall. Dealers will replace the alternators. By David ShepardsonRelated Video: Auto News Chrysler Fiat RAM Safety Coupe SUV Sedan FCA dodge journey fiat chrysler automobiles fiat freemont