2005 Chrysler Town And Country Stow And Go Touring on 2040-cars

Kelowna, British Columbia, Canada

|

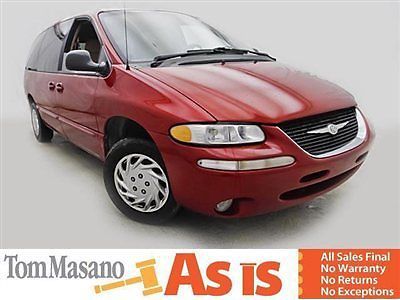

I have a 2005 Chrysler Town and Country Stow and Go for sale.

Characteristics of the van: * 3.8L Engine * 315000 Kms * Power windows * Power Seats * Heated Seats * Leather Seats * 6 Disc DVD Player (with RCA connections - I connected my Wii and it worked great) * Tow package * Power read side doors * Power trunk door * Over head storage compartment * Rear tinted windows * Central computer (next service, average MPG, distance until empty, temperature, direction, etc) * Air conditioner works great. Please keep in mind that this is a used van with normal wear and tear. Problems: * A few dents * Some rust (especially on the back door due to a dent) * Driver side power door is not working. Have to be open and close manually * Driver side mirror is loose. It won't affect the driving, but just so you know. * Cd player is acting out. Not sure what is going on. DVD player works great. * I have children that spent some time in long trips inside the van so naturally you will find some stains in the interior. * Aside from normal service done to the van the major repairs that the van has needed were a new radiator and fans. On the over all this van has been a great car for us. For some time it was our first car and it performed very well on long trips. We are selling it only because the van is not strong enough to tow our new travel trailer, other wise we would keep it. Yes it has some issues, and yes it has many kms. But we never really had any problems with the transmission or any major part of the car. If you can get by with the minor issues, then you will get a great car. Asking $3,500.00 |

Chrysler Town & Country for Sale

2005 chrysler town & country handicap wheelchair accessible van(US $8,500.00)

2005 chrysler town & country handicap wheelchair accessible van(US $8,500.00) 2001 chrysler town & country lxi 80+photos see description wow must see!!

2001 chrysler town & country lxi 80+photos see description wow must see!! 2003 chrysler town & country leather 3rd row video system 1 owner & clean carfax

2003 chrysler town & country leather 3rd row video system 1 owner & clean carfax 2011 chrysler town & country touring l~htd leather~immaculate luxury minivan!!(US $17,988.00)

2011 chrysler town & country touring l~htd leather~immaculate luxury minivan!!(US $17,988.00) 2000 chrysler town & country lx (f9659a) ~ absolute sale ~ no reserve ~

2000 chrysler town & country lx (f9659a) ~ absolute sale ~ no reserve ~ 3.3l~cd~goodyear tires~24 mpg's~wife's demo~florida van~monochromatic accents(US $6,988.00)

3.3l~cd~goodyear tires~24 mpg's~wife's demo~florida van~monochromatic accents(US $6,988.00)

Auto blog

Ram trucks lead 2021 J.D. Power Initial Quality Study

Tue, Aug 31 2021For the first time ever, Ram leads in J.D. Power's annual Initial Quality Study with a score of 128 PP100, or problems experienced per 100 vehicles in the first 90 days of ownership. Ram was in third place in last year's rankings. Coming in second place is Dodge (139 PP100), a sister division to Ram under the Stellantis umbrella, followed by Lexus (144 PP100), this year's highest-ranked premium automaker, in third. These findings reinforce an overall trend over the last few decades where mass-market brands have outperformed premium brands that tend to introduce bleeding-edge technologies that can confuse owners or fail to work entirely. Genesis (148 PP100) is the only other premium automaker to perform better than average. At the bottom of the official rankings is Chrysler (251 PP100), which seems to make little sense considering most of its technologies are shared with Dodge and many with Ram until you consider that Chrysler only offers two platforms and one of them is the Pacifica/Voyager minivan twins that are unique to the brand. The next worst are Audi (240 PP100) and Volkswagen (213 PP100). Tesla would fall in between VW and Audi with its score of 231PP100, but because the electric car manufacturer doesn't provide access to J.D. Power in every state, it's not officially included. Interestingly, J.D. Power said on a followup call that the problems that Tesla owners report most often are more traditional issues, such as panel fitment, interior noises or paint problems instead of problems with the car's electronics. According to J.D. Power, the industry averaged a score of 162 PP100. That is four points higher than the overall score in 2020, and 20 of 32 brands improved their quality scores over the last year. That's a two percent increase in quality in 2021, which is good but slightly lower than the average rate of improvement over the last decade. On a car-by-car basis, the Nissan Maxima leads the overall field with a score of 85 PP100. Issues with infotainment systems — and in particular problems pairing smartphones with in-car technologies — continue to be the top-reported problems. Headaches connecting Apple CarPlay and Android Auto dominate the complaints. "Owners want wireless connectivity, and the industry has responded," according to Dave Sargent, vice president of automotive quality at J.D. Power. "However, this has created a bigger technical challenge for both automakers and tech companies.

Chrysler develops fix for Pacifica PHEV minivan fires

Tue, Oct 18 2022In February, Stellantis recalled 19,808 examples of the 2017 and 2018 Chrysler Pacifica plug-in hybrid minivan due to reports of fires in 12 vehicles. The minivans were manufactured between August 12, 2016, and August 7, 2018. All were parked and turned off when they caught fire; eight of them were plugged in and charging. While engineers worked to isolate the source of the fires, Chrysler advised what's become standard practice in the case of electrical-related fire risks: For owners to park outside away from other objects that could catch on fire. Since then, there have been two more fires in Pacifica PHEVs and the first report of a minor injury because of a fire. Chrysler says it's developed a solution to return the minivan to normal operation and is notifying owners now. The fix is a trip to the dealer to have upgraded software installed for the High Voltage Battery Pack Control Module (BPCM) that manages the 16-kWh lithium-ion battery. Dealers will also inspect the battery pack and replace it if necessary. Of note, Chrysler says it hasn't definitively pinned down the cause of the fires, but it understands the conditions that can lead to the fires. The software's been updated to address these preconditions, the automaker telling Green Car Reports it "has validated its remedy." Owners should continue to park outside and away from structures and refrain from plug-in charging until their vans are fixed, after which they can "resume vehicle operation as outlined in their owners’ manuals." The repair will take from 1.5 to two days; a rental or courtesy car will be provided free of charge. Stellantis has already begun sending letters to owners. Those with questions can contact their Chrysler dealerships, or get in touch with Chrysler customer service at 800-853-1403 and refer to recall number Z11. They can also call the National Highway Traffic Safety Association (NHTSA) Vehicle Safety Hotline at 888-327-4236 (TTY 1-800-424-9153) and mention campaign number 22V077. Â

Almost 70 percent of FCA-PSA Groupe models to ride on two PSA platforms

Sun, Dec 22 2019With the merger between PSA Groupe and Fiat Chrysler having been officially announced this week, we still don't know where everything will settle once the process concludes. We covered the catalog of models herded by the combined company's 12 brands, all of which will remain for now. Profound changes must be afoot somewhere, though, else there'd be no reason for the tie-up. Automotive News has a report on one of the big moves, writing that "more than two-thirds of [PSA-FCA] production would be concentrated on just two platforms." Around 2.6 million cars built by the combined company would sit on PSA's Common Modular Platform, also known as the EMP1, for B-segment city cars, entry-level and mid-range C-segment sedans, and compact crossovers. Three million vehicles would ride on the EMP2 architecture intended for C- and D-segment cars and higher-end crossovers. Those figures account for around 5.6 of the 8.7 million vehicles the combined company expects to sell annually. AN didn't mention the Giorgio platform that's already spread throughout the FCA kingdom to support numerous current and future offerings like the next-gen Jeep Grand Cherokee, but did write that "larger Jeep models will continue to use FCA underpinnings." The body-on-frame chassis' under Ram trucks and the Jeep Wrangler and Gladiator should hold pat. We'll wait for word on the fate of the Compact U.S. Wide platform carrying the Chrysler Voyager and Pacifica and Jeep Cherokee. Dodge products with questionable futures are anyone's guess; we've heard the Dodge Durango, still built on a Mercedes-derived platform it shares with the current Grand Cherokee, could go body-on-frame for the next generation, or die and have the Giorgio-based, three-row Jeep Grand Cherokee take its place. More mystery comes with the long-lived LA and LD platforms in the big sedan and coupe trio Chrysler and Dodge still milk quite successfully. And if there were ever a time for the Dodge Journey – last reported as a Giorgio recipient – to modernize or die, we don't know when that time is. Although FCA platforms have been designed with alternative powertrains in mind, AN says the PSA Groupe architectures "are more modern than FCA's equivalent platforms." After PSA acquired GM's Opel/Vauxhall division, the French company didn't waste time moving the Anglo-German products to in-house platforms, helping to put the formerly money-losing operations into the black in just 18 months.