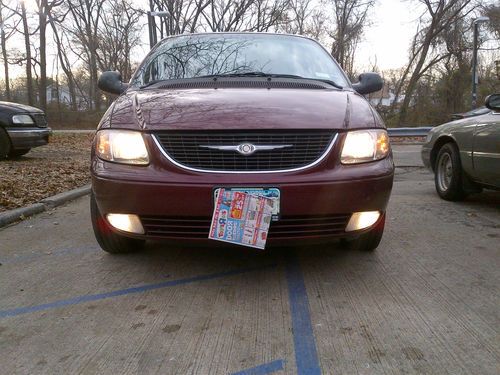

2002 Chrysler Town&country Lxi *1 Owner Female Driven*96k Fully Loaded Exc Cond. on 2040-cars

Carle Place, New York, United States

Body Type:Minivan, Van

Vehicle Title:Clear

Engine:3.8L

Fuel Type:Gasoline

For Sale By:Private Seller

Number of Cylinders: 6

Make: Chrysler

Model: Town & Country

Trim: 7 Passenger

Options: Leather Seats, CD Player

Drive Type: Front Wheel Drive

Safety Features: Anti-Lock Brakes, Driver Airbag, Passenger Airbag

Mileage: 96,789

Power Options: Air Conditioning, Cruise Control, Power Locks, Power Windows, Power Seats

Sub Model: LXi

Exterior Color: Burgundy

Interior Color: Gray

Disability Equipped: No

Chrysler Town & Country for Sale

2009 touring used 3.8l v6 12v automatic fwd premium

2009 touring used 3.8l v6 12v automatic fwd premium Arkansas 1owner, nonsmoker, quad buckets, heated seats, only 35k miles!(US $8,850.00)

Arkansas 1owner, nonsmoker, quad buckets, heated seats, only 35k miles!(US $8,850.00) 2012 chrysler town & country touring - gold - under 30k miles - leather - loaded(US $23,900.00)

2012 chrysler town & country touring - gold - under 30k miles - leather - loaded(US $23,900.00) 2013 chrysler town & country touring rear cam 21k miles texas direct auto(US $23,980.00)

2013 chrysler town & country touring rear cam 21k miles texas direct auto(US $23,980.00) 2010 chrysler town & country touring nav dual dvd 17k! texas direct auto(US $21,980.00)

2010 chrysler town & country touring nav dual dvd 17k! texas direct auto(US $21,980.00) Limited!! town & country dvd navigation heated power leather seats l@@k(US $19,985.00)

Limited!! town & country dvd navigation heated power leather seats l@@k(US $19,985.00)

Auto Services in New York

Wayne`s Auto Repair ★★★★★

Vk Auto Repair ★★★★★

Village Auto Body Works Inc ★★★★★

TOWING BROOKLYN TODAY.COM ★★★★★

Total Performance Incorporated ★★★★★

Tom & Arties Automotive Repair ★★★★★

Auto blog

Fiat Chrysler will pay $70M to settle safety disclosure suit

Thu, Dec 10 2015FCA US will pay a $70 million civil penalty to the National Highway Traffic Safety Administration for failing to submit Early Warning Report data going back to 2003. The automaker will also provide any missing data since that time, and an auditor will monitor future compliance. NHTSA says the failures to report this information "stem from problems in FCA's electronic system for monitoring and reporting safety data, including improper coding and failure to account for changes in brand names." There are no allegations of any intentional deception by the automaker. NHTSA will wrap up the latest fine with the previous consent order against FCA US earlier this year for the automaker's handling of 23 recalls. The company will know owe the safety regulator a total of $140 million in cash, and there will be possibility of $35 million more in deferred penalties if FCA doesn't comply with the agency's requests. In a statement about the fine to Autoblog, FCA US said the automaker "accepts these penalties and is revising its processes to ensure regulatory compliance." The company strongly believes that it didn't miss any safety problems over the time with this problem. Early Warning Reports include information on deaths, injuries, crashes, and other potential safety concerns, and NHTSA often uses the data in investigations for possible recalls. In September, the safety agency first announced the automaker failed to submit these documents. At the time, the regulator's administrator Mark Rosekind promised to "take appropriate action after gathering additional information on the scope and causes of this failure." FCA US also released a statement then about the lapse and said the company notified NHTSA immediately after discovering the problem. FCA US is not the first company to run afoul of NHTSA's reporting requirement. The agency fined Triumph Motorcycles and Honda this year for similar lapses. It also punished Ferrari in 2014. U.S. DOT Fines Fiat Chrysler $70 million for Failure to Provide Early Warning Report Data to NHTSA WASHINGTON – The U.S. Department of Transportation's National Highway Traffic Safety Administration has imposed a $70 million civil penalty on Fiat Chrysler Automobiles (FCA) for the auto manufacturer's failure to report legally required safety data. The penalty follows FCA's admission in September that it had failed, over several years, to provide Early Warning Report data to NHTSA as required by the TREAD Act of 2000.

Fiat and UAW back at negotiating table over Chrysler stake

Mon, 23 Dec 2013We knew there'd be no Chrysler IPO before the end of this year, but Fiat is determined to get the best run going into 2014 and is back at the poker table with the UAW. The delay was said to be Chrysler's desire to clean up a tax issue with the IRS; turns out that also bought the carmaker time to try and close a deal for the UAW's 48.5-percent stake in the company before the IPO happens.

Whereas the price Chrysler was willing to pay was once more than $1 billion under the UAW's asking price, the gap has closed to just $800 million of late. A recent valuation of the company at $10 billion - a valuation the UAW has disputed - means Fiat would be looking to pay about $4.2 billion instead of the $5 billion that the UAW seeks. But the UAW needs to hold out for the highest amount it can get because its pension obligations through the Voluntary Employee Benefit Association (VEBA) are $3.1 billion greater than the VEBA's assets, which include the Chrysler stake.

There's a clause in the agreement that Fiat can buy the VEBA shares for $6 billion, but Fiat CEO Sergio Marchionne has said that the UAW "should buy a ticket for the lottery" if they even want $5 billion. The UAW, though, has more time to wait; it's Fiat that wants access to Chrysler's $11.9-billion war chest and that would like to avoid the risk of paying the full $6 billion for the UAW share if the float really takes off. With other valuations of Chrysler as high as $19 billion, a hot IPO could make that $6 billion look like a bargain.

Ferrari to be spun off from Fiat Chrysler

Wed, 29 Oct 2014The recently merged Fiat Chrysler Automobiles empire has ambitious plans for growth, and it's going to need some big bucks in its coffers in order to enact them. Part of that cash injection is coming from the floating of its IPO on the New York Stock Exchange, but now FCA has announced a further capital campaign to be based on the enormous asset that is Ferrari.

FCA's board of directors has just approved the separation of Ferrari from the rest of the group as a separate entity. Once that separation is complete, Ferrari will put 10 percent of its shares on the stock market "in the United States and possibly a European exchange" as well.

This isn't the first time that the idea of a Ferrari IPO has been raised. Sergio Marchionne, chief executive of Chrysler, Fiat and Ferrari (pictured above), first raised the idea four years ago. Former Ferrari chairman Luca di Montezemolo nixed the idea, but now that he's been discharged, it appears there's nothing to get in the way of Marchionne's desires.