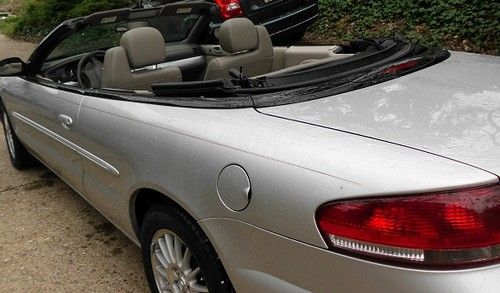

2010 Sebring Touring 56k No Reserve Salvage Rebuildable Easy Fix on 2040-cars

Utica, New York, United States

Vehicle Title:Salvage

Fuel Type:Gasoline

Transmission:Automatic

For Sale By:Dealer

Make: Chrysler

Warranty: Vehicle does NOT have an existing warranty

Model: Sebring

Mileage: 56,377

Options: CD Player

Sub Model: 4dr Sdn LX

Safety Features: Anti-Lock Brakes

Exterior Color: Black

Power Options: Power Locks

Interior Color: Gray

Chrysler Sebring for Sale

No reserve convertible project

No reserve convertible project We finance 2005 chrysler sebring limited conv clean carfax lthrhtdsts cd wrrnty(US $5,000.00)

We finance 2005 chrysler sebring limited conv clean carfax lthrhtdsts cd wrrnty(US $5,000.00) 2001 chrysler sebring lxi convertible 2-door 2.7l

2001 chrysler sebring lxi convertible 2-door 2.7l 08 convertible touring white mwk wheels leather wood grain clean chrysler fwd

08 convertible touring white mwk wheels leather wood grain clean chrysler fwd 2005 chrysler sebring touring 2d convertible 2.7l 2700cc 167cu. in. v6 gas dohc(US $4,750.00)

2005 chrysler sebring touring 2d convertible 2.7l 2700cc 167cu. in. v6 gas dohc(US $4,750.00) 2004 chrysler sebring gtc convertible 2-door 2.7l

2004 chrysler sebring gtc convertible 2-door 2.7l

Auto Services in New York

Willowdale Body & Fender Repair ★★★★★

Vision Automotive Group ★★★★★

Vern`s Auto Body & Sales Inc ★★★★★

Valvoline Instant Oil Change ★★★★★

Valanca Auto Concepts ★★★★★

V & F Auto Body Of Keyport ★★★★★

Auto blog

Ferrari officially files SEC paperwork to register future IPO

Thu, Jul 23 2015Late last year FCA announced plans to spin off Ferrari into a separate company, and after a long wait that process has finally become official. The Prancing Horse has now filed the necessary prospectus and other documents with the Securities and Exchange Commission to hold an initial public offering on The New York Stock Exchange. The paperwork doesn't mention a specific date for the Italian sportscar maker's IPO, but it's expected sometime in October. At this point, the documents also don't include some other vital data about the IPO. Ferrari lists neither the number of shares being offered nor their price. The company also doesn't have a stock symbol yet. UBS, BofA Merrill Lynch and Santander are acting as joint book runners for the deal. As part of the IPO, FCA initially intends to sell 10 percent of Ferrari's shares on the stock market. Another 10 percent of the company still belongs to Piero Ferrari. FCA is holding onto the remaining 80 percent in the short term for financial reasons but intends to distribute them to shareholders in early 2016. After the spin-off, about 24 percent of Ferrari would be owned by Exor, 10 percent by Piero Ferrari, and 66 percent by public shareholders, according to the SEC documents. FCA boss Sergio Marchionne believes that Ferrari could be worth over $11 billion. Although, his estimate might be slightly high. According to Reuters, Wall Street is actually putting the value somewhere between $5.5 billion and $11 billion. If you're thinking about investing in the company or just want to read the nitty-gritty about the brand's financial health, the entire SEC filing can be read here. Ferrari Files for Initial Public Offering LONDON, July 23, 2015 /PRNewswire/ -- Fiat Chrysler Automobiles N.V. ("FCA") announced today that its subsidiary, New Business Netherlands N.V. (to be renamed Ferrari N.V.), has filed a registration statement on Form F-1 with the U.S. Securities and Exchange Commission ("SEC") for a proposed initial public offering of common shares currently held by FCA. The number of common shares to be offered and the price range for the proposed offering have not yet been determined, although the proposed offering is not expected to exceed 10% of the outstanding common shares. In connection with the initial public offering, Ferrari intends to apply to list its common shares on the New York Stock Exchange.

What will Detroit do with the abandoned AMC headquarters?

Mon, Dec 28 2015As with so many other industrial and residential properties in Detroit, the former headquarters for the American Motors Corporation is having a hard time finding a reputable buyer. In October the Wayne County Treasurer held a tax foreclosure auction of 25,000 properties that included the AMC building, the starting bid being $500. Nicholas Casab won the building for $500, but the county voided the sale when Casab didn't pay the $232,000 in back property taxes. Detroit authorities haven't commented on the failed sale, but the city has until January 4 to decide if it wants to keep the building. If it doesn't want to hold onto it, the 1.5-million-square-foot property on 57 acres might be ceded to the Wayne County Land Bank Corporation. No matter who holds the deed come January 5, all anyone really wants is for someone to take possession of the building who will actually turn it into something useful and viable. The property opened in 1927 as a factory for the Kelvinator Corporation. Over the following decades, Kelvinator merged with the Nash Motor Company, and that merged entity merged with Hudson Motor Car Co, becoming American Motors. Chrysler took over the building in 1987 when it bought AMC, then shuttered it in 2009. The complex has produced refrigerators, Sikorsky helicopters, Jeeps, AMCs, and was used as an engineering center for Jeeps and other Chrysler products. Having been through several hands in the past six years, it is cited as part of the cycle of abandonment plaguing Detroit. Related Video: News Source: Detroit Free Press Government/Legal Chrysler Jeep Auctions Detroit amc

Peugeot's American future looks dead, but Stellantis intends to keep all brands alive

Fri, Feb 12 2021The years-old promise of a Peugeot return in the U.S. is looking bleaker by the second. Peugeot said the French brand would come back to sell cars in the U.S. five years ago, but now that FCA and PSA have transitioned to one Stellantis, that promise is looking a lot shakier. This news comes via a report from Car and Driver. When queried about Peugeot, Carlos Tavares, Stellantic CEO, offered this in response: “For the time being, I don't think that is part of the things that we want to prioritize for the next time window," Tavares said. "I think it's better that we funnel the talent, the capital, and the engineering capability of our Stellantis company to the existing brands to improve what needs to be improved and to accelerate where we need to accelerate, because we already have a very strong presence in this market." Tavares hasnÂ’t ruled it out entirely, but any kind of a Peugeot American renaissance is being pushed onto the backburner. In good news for American brands, though, Tavares expressed great interest in keeping them all. Chrysler was the most worrisome of the bunch, as it only sells the aging 300 sedan and Pacifica minivan variants. Nevertheless, Tavares sees Chrysler as one of the “three historical pillars of Stellantis” and is eager “to give this brand a future.” Specifically, Tavares sees a high-tech future for the once-great American car company. Motor Trend reported on what Tavares spoke about in a call with the media. "It needs to rebound,” Tavares said. “We could think about what could be the next technologies in the automotive industry.” The obvious hint here is electrification and greater autonomy. Chrysler could theoretically become StellantisÂ’ electric showcase brand. ItÂ’s partway there with the Pacifica Hybrid PHEV minivan, but thereÂ’s still a long way to go for it to become the conglomerate's tech pillar. And then thereÂ’s Dodge and its powerful but emissions-heavy lineup. "We have the technology to deliver the torque, dynamics, and acceleration feeling, while also dramatically reducing the emissions," Tavares said. The Hellcat canÂ’t have a window-shattering 6.2-liter supercharged V8 forever, but it looks like Stellantis is at least committed to keeping the performance of DodgeÂ’s current lineup. Related video: