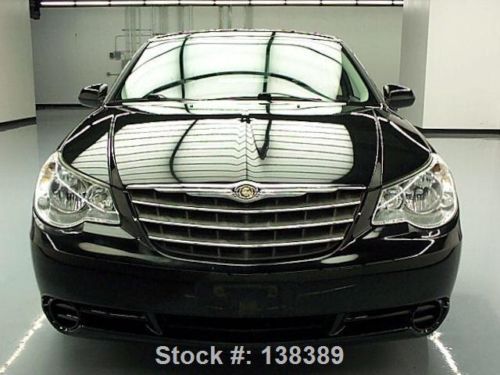

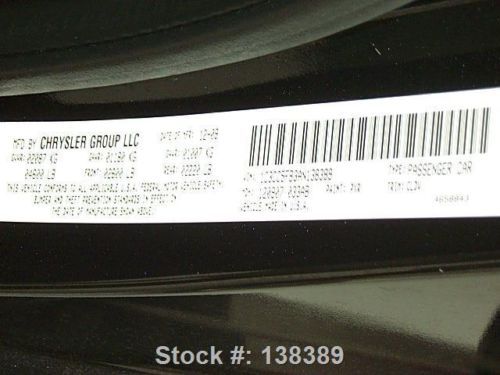

2010 Chrysler Sebring Ltd Htd Leather Alloy Wheels 52k Texas Direct Auto on 2040-cars

Stafford, Texas, United States

Chrysler Sebring for Sale

2002 chrysler sebring limited convertible 2-door 2.7l(US $4,500.00)

2002 chrysler sebring limited convertible 2-door 2.7l(US $4,500.00) Touring - clean - runs great - leather - non smoker

Touring - clean - runs great - leather - non smoker 2000 chrysler sebring jxi convertible 2-door 2.5l

2000 chrysler sebring jxi convertible 2-door 2.5l 1999 chrysler sebring jxi convertable

1999 chrysler sebring jxi convertable 2001 chrysler sebring lxi convertible non smoker super low 38k miles no reserve!

2001 chrysler sebring lxi convertible non smoker super low 38k miles no reserve! Chrysler sebring limited convertible black(US $5,800.00)

Chrysler sebring limited convertible black(US $5,800.00)

Auto Services in Texas

Woodway Car Center ★★★★★

Woods Paint & Body ★★★★★

Wilson Paint & Body Shop ★★★★★

WHITAKERS Auto Body & Paint ★★★★★

Westerly Tire & Automotive Inc ★★★★★

VIP Engine Installation ★★★★★

Auto blog

Fiat seeking $10B in financing to buy Chrysler

Thu, 30 May 2013As Fiat looks to become the full owner of Chrysler, all it has standing in its way is the retiree trust of the United Auto Workers, which currently holds the remaining 41.5 percent of the company as the result of the Pentastar's bankruptcy deal. The Detroit News is reporting that that Fiat is currently talking to numerous banks in an attempt to raise around $10 billion to fund the purchase of Chrysler's remaining stake with enough left over to refinance the debt of both companies. We've known that Fiat has been working to obtain the capital to buy out Chrysler for some time now, but this is the first time we've seen Fiat tip its hand about how much cash it thinks it will need to close the deal.

The first order of business is a legal dispute over the value of the UAW's stake in Chrysler, which the report indicates could cost Fiat around $3.5 billion. The acquisition of remaining shares could happen by this summer, but it sounds like CEO Sergio Marchionne (above) might not be ready for a full merger until next year.

Marchionne on Alfa's US return, Dodge Dart's powertrain weakness and minivan plans

Fri, 18 Jan 2013As a reporter covering an auto show, the one opportunity you never want to miss is going to the Sergio Marchionne press briefing.

"This undertaking to bring Alfa back is a one-shot deal... We are not going to do this twice."

There just aren't that many real characters left in the auto industry. Marchionne, who sits atop both Chrysler and Fiat, is not only one of the smartest execs in the business, but also the most frank. Herein, a sample of the quotable always-sweatered executive:

PSA shares rise following FCA's breakup with Renault

Thu, Jun 6 2019Shares in Groupe PSA, parent company of automakers Peugeot, Citroen and the DS brand, rose on Thursday as analysts considered the possibility that Fiat Chrysler could turn back to PSA after withdrawing its $35 billion merger offer for Renault. "Both parties have acknowledged the need for scale or [mergers and acquisitions] and may pursue other opportunities. If Nissan was an obstacle (to an FCA-Renault deal) PSA-FCA discussions could resume," wrote brokerage Jefferies. Back in March at the Geneva Motor Show, rumors started swirling that PSA was interested in a potential merger with FCA. Mike Manley, who took over at the helm of Fiat Chrysler following the death of Sergio Marchionne, had indicated a willingness to look into potential partnership options. Of course, that was all before FCA proposed a merger with Renault — with that deal now off the table, attention naturally turns back to PSA, which is also based in France. "We expect both shares to react negatively but see FCA having wider strategic options and Renault shares more downside risk near-term," said Jefferies. According to Reuters, PSA shares were up 1.5% at the time this was published, making it the top-performing stock on France's benchmark CAC-40 Index. Renault saw its shares slump 7%. Shares for FCA fell 3% in early trading on the Milan Stock Exchange. Considering that FCA said in its statement confirming the withdraw of its merger offer with Renault that "political conditions in France do not currently exist for such a combination to proceed successfully," we have to wonder how keen the company is to begin negotiations with another French automaker like PSA. Those thoughts were similarly voiced by Bernstein Research analyst Max Warburton, who said (via Forbes), "Expect PSA to rise on unrealistic hopes it may be FCA's next date." Earnings/Financials Chrysler Fiat Mitsubishi Nissan Citroen Peugeot Renault FCA renault-nissan