2010(10)sebring We Finance Bad Credit! Buy Here Pay Here Low Down $1199 Ez Loan on 2040-cars

Bedford, Ohio, United States

Body Type:Sedan

Vehicle Title:Salvage

Fuel Type:Gasoline

For Sale By:Dealer

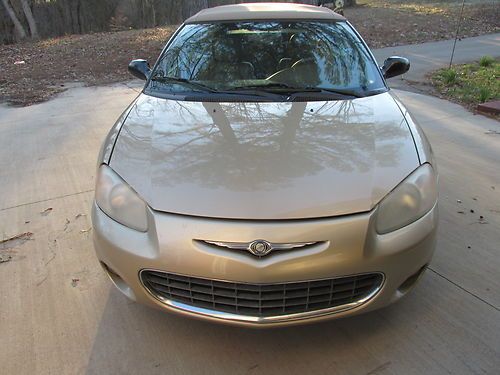

Make: Chrysler

Model: Sebring

Warranty: Vehicle does NOT have an existing warranty

Mileage: 65,077

Sub Model: 4dr Sdn Touring

Exterior Color: Black

Interior Color: Other

Doors: 4 doors

Number of Cylinders: 4

Engine Description: 2.4L L4 SFI DOHC 16V

Chrysler Sebring for Sale

2002 chrysler sebring convertible good millage fl_car norust noreserve auction(US $3,500.00)

2002 chrysler sebring convertible good millage fl_car norust noreserve auction(US $3,500.00) 1998 chrysler sebring convertible gold - with fresh new battery, plus extras

1998 chrysler sebring convertible gold - with fresh new battery, plus extras 2005 chrysler sebring sdn touring no reserve parts only

2005 chrysler sebring sdn touring no reserve parts only 2000 chrysler sebring jxi convertible 2-door 2.5l

2000 chrysler sebring jxi convertible 2-door 2.5l 1998 chrysler sebring 2dr conv jxi (cooper lanie 317-839-6541)(US $4,888.00)

1998 chrysler sebring 2dr conv jxi (cooper lanie 317-839-6541)(US $4,888.00) 2001 chrysler sebring lxi convertible 2-door 2.7l(US $3,750.00)

2001 chrysler sebring lxi convertible 2-door 2.7l(US $3,750.00)

Auto Services in Ohio

World Import Automotive Inc ★★★★★

Westerville Auto Group ★★★★★

W & W Auto Tech ★★★★★

Vendetta Towing Inc. ★★★★★

Van`s Tire ★★★★★

Tri County Tire Inc ★★★★★

Auto blog

Takata airbag recall claims 209k Chrysler, Dodge vehicles

Fri, Dec 12 2014Chrysler is expanding the scope of its front passenger side Takata airbag inflator recall yet again to include 139,115 additional vehicles for a total of 208,783 units now needing these parts replaced. The latest campaign affects the passenger side inflators of the 2003-2005 Dodge Ram 1500, 2003-2005 Dodge Ram 2500, 2003-2005 Dodge Ram 3500, 2004-2005 Durango; 2005 Dakota pickup; 2005 Dodge Magnum and 2005 Chrysler 300 (pictured above), 300C and SRT8. It's limited to vehicles purchased or ever registered in Alabama, Florida, Georgia, Hawaii, Louisiana, Mississippi, Texas and the territories of American Samoa, Guam, Puerto Rico, Saipan and the US Virgin Islands. The company expects owners to be notified by February 8. The automaker just expanded the replacement campaign last week to include passenger side inflators in 149,150 pickups from the 2003 model year. However, the parts are not the same. Chrysler says this recall is for the PSPI family of components versus SPI for the last one. The company is also not aware of any injuries or accidents in its vehicles from these potentially faulty inflators, and lab testing of 600 of them finds no issues. Despite this, Chrysler is repairing these models at the request of the National Highway Traffic Safety Administration. Scroll down to read the company's full announcement of the initiative. Statement: Air-bag Inflator (Regional Field Action Expansion) December 12, 2014 , Auburn Hills, Mich. - Chrysler Group is expanding an ongoing regional field action with a recall to replace front passenger-side air-bag inflators in an estimated 208,783 older-model vehicles originally purchased or ever registered in seven U.S. states and five territories. The vehicles are equipped with front passenger-side air-bag inflators from a product family code-named "PSPI." Chrysler Group is unaware of any injuries or accidents involving PSPI inflators of the type covered by this campaign, nor has a Chrysler Group investigation identified a defect in these components. Further, laboratory tests on nearly 600 such inflators did not result in any failures. The inflators affected by this campaign differ in design and construction from PSPI inflators used by other auto makers. They also benefited from a more robust manufacturing process. However, at the request of the National Highway Traffic Safety Administration (NHTSA), Chrysler Group is expanding its replacement action beyond its original scope of Florida, Hawaii, Puerto Rico and the U.S.

Stellantis not looking for further mergers, including with Renault

Mon, Feb 5 2024MILAN — Stellantis Chairman John Elkann on Monday denied the carmaker was hatching merger plans, responding to press speculation about a possible French-led tie-up with rival Renault. Elkann said that the Peugeot owner, the world's third largest carmaker by sales, was focused on the execution of its long-term business plan. "There is no plan under consideration regarding merger operations with other manufacturers," said Elkann, who also heads Exor, the Agnelli family holding company that is the largest single shareholder in Stellantis. After abandoning the Russian market, at the time its second largest after France, and reducing the scope of its global cooperation with Nissan, Renault has been seen as a potential M&A target. Speculation intensified after an electric vehicle market slowdown forced it last week to cancel IPO plans for its EV and software unit Ampere. Its market cap remains stubbornly low at little over 10 billion euros ($10.8 billion) despite a financial recovery over the past few years. Stellantis, the product of a 2021 merger between France's PSA and Fiat Chrysler and one of the most profitable groups in the industry, has a market cap of more than 85 billion euros when unlisted shares are factored in. It has a 14 brand portfolio also including Citroen, Jeep, Opel and Alfa Romeo. NEWSPAPER REPORT Italian daily Il Messaggero had said on Sunday that the French government, which is Renault's largest shareholder and also has a stake in Stellantis, was studying plans for a merger between the two groups. A spokeswoman for Renault said on Monday the group did not comment on rumors. France's Finance Ministry had declined to comment on Sunday. Stellantis has crossed swords with the Italian government, which has accused it of acting against the national interest on occasions. Industry Minister Adolfo Urso last week raised the prospect of the Italian government taking a stake in Stellantis to help to balance the French influence. Renault shares pared gains after Elkann's comments to stand 1.2% higher by 1220 GMT, having initially risen more than 4%. Stellantis CEO Carlos Tavares, a Portuguese-national, last week said in an interview with Bloomberg that the group was "ready for any kind of consolidation" and that its job was to make sure that it would be "one of the winners". Analysts, however, question the rationale of a Stellantis-Renault merger, which would also expand the group's excess capacity in Europe.

FCA-Renault merger talks: France wants job guarantees and Nissan on board

Tue, May 28 2019PARIS — France will seek protection of local jobs and other guarantees in exchange for supporting a merger between carmakers Renault and Fiat Chrysler, its finance minister said on Tuesday, underscoring the challenges facing the plan. Renault Chairman Jean-Dominique Senard arrived in Japan to discuss the proposed tie-up with the French company's existing partner Nissan — another potential obstacle to the $35 billion-plus merger of equals. Renault and Italian-American rival Fiat Chrysler Automobiles (FCA) are in talks to tackle the costs of far-reaching technological and regulatory changes by creating the world's third-biggest automaker. Nissan found out about Renault's merger talks with Fiat Chrysler only days before they became public, four sources told Reuters, stoking fears at the Japanese carmaker that a deal could further weaken its position in a 20-year alliance with Renault. A deal between Renault and FCA would create a player ranked behind only Japan's Toyota and Germany's Volkswagen and target 5 billion euros ($5.6 billion) a year in savings. Some analysts, however, say the companies face a challenge to win over powerful stakeholders ranging from the French and Italian governments to trade unions and Nissan. Patrick Pelata, a former Renault chief operating officer, also criticized the deal plan for undervaluing Renault and threatening to overstretch its engineering resources. By valuing Renault at its market price, the all-share offer attributes a negative 6 billion euro value to Renault operations after deduction of its 43.4% stake in Nissan and 3.1% Daimler holding, Pelata told BFM radio. "That's hardly reasonable," he said. "And I think that shareholders, including the French state, are bound to take issue with this sooner or later." Pelata added: "FCA has big problem because they haven't invested for the future — they have no electric vehicle platform and they've done nothing in autonomous cars." French finance minister Bruno Le Maire told RTL radio on Tuesday that the plan was a good opportunity for both Renault and the European car industry, which has been struggling for years with overcapacity and subdued demand. France sets conditions Le Maire also said the French government would seek four guarantees in exchange for backing a deal that would reduce its 15% stake in Renault to 7.5% of the combined entity. "The first: industrial jobs and industrial sites.