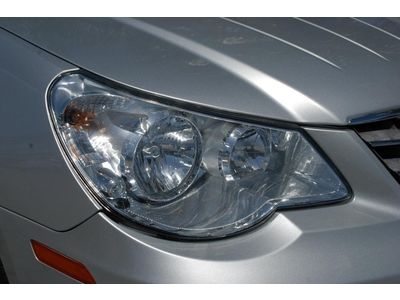

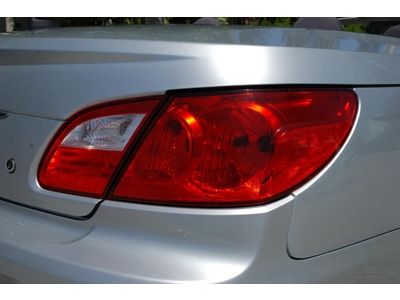

2009 Chrysler Sebring Touring Convertible 2.7l Flex V6 Auto 6-cd Power Driver on 2040-cars

Fort Myers Beach, Florida, United States

Body Type:Convertible

Vehicle Title:Clear

Fuel Type:Gasoline

For Sale By:Dealer

Number of Cylinders: 6

Make: Chrysler

Model: Sebring

Mileage: 54,170

Warranty: Vehicle does NOT have an existing warranty

Sub Model: Conv Touring

Exterior Color: Silver

Interior Color: Gray

Chrysler Sebring for Sale

1999 chrysler sebring jxi convertible 2-door 2.5l

1999 chrysler sebring jxi convertible 2-door 2.5l New vehicle: premium cloth seats, uconnect mp3 - free ship/airfare kchydodge(US $18,040.00)

New vehicle: premium cloth seats, uconnect mp3 - free ship/airfare kchydodge(US $18,040.00) (US $4,500.00)

(US $4,500.00) 2002 chrysler sebring limited convertible 2-door 2.7l(US $5,460.00)

2002 chrysler sebring limited convertible 2-door 2.7l(US $5,460.00) 2006 chrysler sebring gtc convertible 2-door 2.7l

2006 chrysler sebring gtc convertible 2-door 2.7l 1999 chrysler sebring jx convertible 2-door 2.5l(US $2,500.00)

1999 chrysler sebring jx convertible 2-door 2.5l(US $2,500.00)

Auto Services in Florida

Zip Auto Glass Repair ★★★★★

Willie`s Paint & Body Shop ★★★★★

Williamson Cadillac Buick GMC ★★★★★

We Buy Cars ★★★★★

Wayne Akers Truck Rentals ★★★★★

Valvoline Instant Oil Change ★★★★★

Auto blog

Fiat Chrysler shares get a boost after revised Stellantis merger deal with PSA

Tue, Sep 15 2020MILAN — Shares in Fiat Chrysler (FCA) rose sharply in Milan on Tuesday after the car maker and French partner PSA revised the terms of their merger deal, with FCA's shareholders getting a smaller cash payout but a stake in another business. FCA and PSA, which last year agreed to merge to give birth to Stellantis, the world's fourth largest car manufacturer, said late on Monday they had amended the accord to conserve cash and better face the COVID-19 challenge to the auto sector. Milan-listed shares in Fiat Chrysler rose almost 8% by 1000 GMT, while PSA gained 1.5%. Under the revised terms, FCA will cut from 5.5 billion euros ($6.5 billion) to 2.9 billion euros the cash portion of a special dividend its shareholders are set to receive on conclusion of the merger. However, PSA will for its part delay the planned spinoff of its 46% stake in car parts maker Faurecia until after the deal is finalized. That means all Stellantis shareholders — and not just the current PSA investors - will get shares in a company which has a market value of 5.8 billion euros. Based on Stellantis' 50-50 ownership structure, FCA and PSA respective shareholders will each receive a 23% stake in Faurecia. Analysts welcomed the 2.6 billion euros in additional liquidity for Stellantis' balance sheet as well as the increase in projected synergies to more than 5 billion euros from 3.7 billion. There was also further reassurance as the two companies confirmed they expected the deal to close by the end of the first quarter of 2021. "All told, the two players emerge as winners," broker ODDO BHF said in a note. "Of the two, FCA might be a bit more of a winner in the short term given the structure of the deal and the numerous payouts to shareholders to come in the quarters ahead (potentially close to 5 billion euros versus the current capitalization of around 16 billion euros)." The special dividend for FCA shareholders had proved contentious after Italy offered state guarantees for a 6.3 billion euro loan to the company's Italian business. "These announcements should, at last, end the debate over the financial terms of the merger, which had become a big topic and was still penalizing the two groups' share performances," ODDO BHF said. PSA and FCA said they would consider paying out 500 million euros to shareholders in each firm before closing or else a 1 billion euro payout to Stellantis shareholders afterwards, depending on market conditions and company performance and outlook.

China's Geely says it has no plan to buy Fiat Chrysler — as FCA stock leaps

Wed, Aug 16 2017HONG KONG — Chinese carmaker Geely Automobile denied media speculation on Wednesday that it planned to make a takeover bid for Fiat Chryslerk Automobiles (FCA), the world's seventh-largest automaker. Geely was one of several Chinese carmakers cited in by Automotive News, which said representatives of "a well-known Chinese automaker" had made an offer this month for FCA, which has a market value of almost $20 billion. "We don't have such a plan at the moment," Geely executive director Gui Shengyue told reporters at an earnings briefing, when asked if Geely was interested in Fiat. He said a foreign acquisition would be complicated, but he did not elaborate. "But for other (Chinese) brands, it could be a fast track for their development," Gui added. However, a source close to the matter said FCA and Geely Automobile's parent firm, Zhejiang Geely Holding Group, had held initial talks late last year, without disclosing their nature. The source confirmed Geely was no longer interested in FCA, noting that the parent company had only three months ago announced its first push into Southeast Asia with the purchase of 49.9 percent of struggling Malaysian carmaker Proton, a deal that also included a stake in Lotus. Geel's denial failed to dent FCA's stock. The price of its Milan-based shares has jumped more than 10 percent to a 19-year high since Automotive News first reported on Monday, citing unnamed sources, that FCA had rejected the Chinese offer as too low. FCA stock on the New York Stock Exchange rose sharply on Monday from $11.60 to $12.38 and on Wednesday was trading at $12.84. FCA declined to comment on Wednesday. FCA Chief Executive Sergio Marchionne has repeatedly called for mergers as a way of sharing the costs of making cleaner, more advanced cars, but he has repeatedly failed to find a partner and retreated from his search for in April, saying FCA would stick to its business plan. He has also spoken of spinning the successful Jeep and Ram divisions off from FCA. Europe's largest carmaker, Volkswagen, and General Motors have both said they are not interested in talks with FCA. On Wednesday, Geely Automobile reported a doubling of first-half profit, above expectations, as cars designed with Sweden's Volvo won over domestic consumers. Volvo is a unit of the Zhejiang Geely group, and has recently announced it will share its technology with Geely.

2017 Chrysler Pacifica Hybrid: The 80-MPGe minivan [w/video]

Mon, Jan 11 2016As automakers rush to add hybrids and plug-ins to every type of vehicle, one popular segment has been overlooked: minivans. If the idea of a hybrid minivan makes sense to you, that's because it's a smart idea, and one that we're surprised hasn't happened yet. So kudos to Chrysler for not just making it happen, but for creating a plug-in version with an estimated 80 miles per gallon equivalent. You can read all the practical details of the 2017 Pacifica (not Town & Country) here. For the sake of this story, we'll focus on what's different with the hybrid model. Yes, Chrysler is just calling it Pacifica Hybrid, not Plug-In Hybrid, because the company's executives think that when people hear "plug" they think "range anxiety" and freak out. That's not a worry here, though, because when the 16-kWh battery runs out of juice, the 3.6-liter Pentastar V6 kicks in and the minivan functions as normal. Just don't run out of gas. With a full charge, the Pacifica Hybrid can travel up to 30 miles on electric power. And though the gas engine is the same 3.6-liter V6 found in the non-hybrid model, it's detuned to 248 horsepower and 230 pound-feet of torque. Charging the battery takes just two hours on a 240-volt plug, and Chrysler houses the battery pack underneath the floor in the middle of the van, where the wells for Stow 'N Go seating are found on gas-only models. So no, you can't get Stow 'N Go seats on the hybrid, but the third row does still fold into the floor. Powertrain aside, the Pacifica Hybrid is nearly identical to its gas-only sibling, save the addition of the charge port on the driver's side front fender. Unique wheels in 17- and 18-inch sizes can be had, and the Pacifica Hybrid only comes in Touring and Limited Platinum trims. You can read more details on the hybrid system in the release below. First hybrid powertrain in minivan segment "Due to its large footprint and multiple daily trip patterns, the minivan is ideally suited for electrification technology," said Bob Lee, Vice President and Head of Engine, Powertrain and Electrified Propulsion Systems Engineering, FCA – North America. "The all-new 2017 Chrysler Pacifica lives up to this promise and then some, with efficiency, power and refinement." Launching in second half of 2016, the Pacifica Hybrid is the industry's first electrified minivan.