2008 (08) Silver Lx $3500 Down!!!! Convirtible In House Financing Bad Credit Ok on 2040-cars

Cleveland, Ohio, United States

Vehicle Title:Clear

For Sale By:Dealer

Engine:2.4L 2360CC 144Cu. In. l4 GAS DOHC Naturally Aspirated

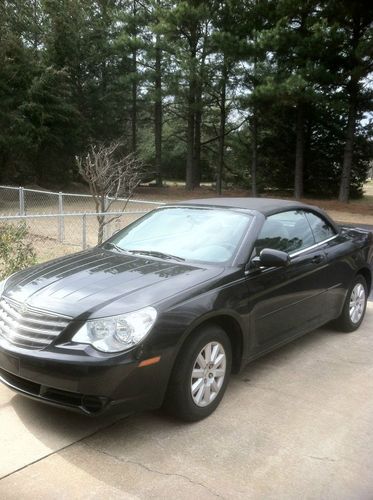

Body Type:Convertible

Fuel Type:GAS

Make: Chrysler

Model: Sebring

Trim: LX Convertible 2-Door

Number of Doors: 2

Transmission Description: 4-SPEED AUTOMATIC VLP TRANSMISSION

Drive Type: FWD

Drivetrain: Front Wheel Drive

Mileage: 90,910

Sub Model: LX $3500 Down!!! 2.4L 4 CYL. WE FINANCE

Number of Cylinders: 4

Exterior Color: Silver

Interior Color: Gray

Chrysler Sebring for Sale

2007 (07) blue $3500 down !!!! ez loans bad credit no credit ok(US $11,995.00)

2007 (07) blue $3500 down !!!! ez loans bad credit no credit ok(US $11,995.00) 2008 chrysler sebring convertible, black, 60k miles(US $9,950.00)

2008 chrysler sebring convertible, black, 60k miles(US $9,950.00) 2002 chrysler sebring convertible(US $1,200.00)

2002 chrysler sebring convertible(US $1,200.00) Chrysler sebring limited convertible only 52,000 miles(US $6,200.00)

Chrysler sebring limited convertible only 52,000 miles(US $6,200.00) 2002 chrysler sebring lx sedan 4-door, 89k miles!!!

2002 chrysler sebring lx sedan 4-door, 89k miles!!! 2009 chrysler sebring touring hardtop convertible 35k!! texas direct auto(US $14,980.00)

2009 chrysler sebring touring hardtop convertible 35k!! texas direct auto(US $14,980.00)

Auto Services in Ohio

Williams Norwalk Tire & Alignment ★★★★★

White-Allen European Auto Grp ★★★★★

Welch`s Golf Cart Inc ★★★★★

Vehicles Unlimited Inc ★★★★★

Tom`s Tire & Auto Service ★★★★★

Smith`s Automotive ★★★★★

Auto blog

2013 Dodge Dart gets all Moparized

Fri, 08 Feb 2013Last year, Chrysler announced it would be offering more than 150 Mopar parts and accessories on the 2013 Dodge Dart, and we got a look at some of these parts firsthand at the Chicago Auto Show. Showing off all the optional parts at once would surely create a gaudy monstrosity, so Chrysler chose to equip this particular Dart GT with just a handful of Mopar goodies, which still gave the car a nice and tasteful custom look that is available straight from the dealership (and with a full warranty, too).

Decked out in a factory color called Header Orange Clear Coat - also a very appropriate show car hue - this car added exterior styling parts such as the vented, carbon fiber hood, the bolt-on front chin spoiler and a matte black decklid spoiler. Looking inside the car, you'd think the red-accented interior is part of the Mopar parts bin, too, but this is actually what the standard Dart GT cabin will look like when it goes on sale.

2017 North American Car, Truck, and Utility Vehicle of the Year finalists revealed

Tue, Nov 15 2016The finalists for the 2017 North American Car, Truck, and Utility Vehicle of the Year were announced Tuesday at AutoMobility LA ahead of the 2016 LA Auto Show. Approximately 60 judges, including Autoblog's editor-in-chief Mike Austin, evaluated over 40 vehicles and named three models as the finalists in each category. The award for the Utility Vehicle of the Year is new for 2017 and separates SUVs, crossovers, and minivans from pickup trucks. The finalists are: Car of the Year: Chevrolet Bolt Genesis G90 Volvo S90 Truck of the Year: Ford F-Series Super Duty Honda Ridgeline Nissan Titan Utility Vehicle of the Year Chrysler Pacifica Jaguar F-Pace Mazda CX-9 The winners for the 24th annual NACTOY awards will be named on January 9 at the Detroit Auto Show. Related Video: Chevrolet Chrysler Ford Honda Jaguar Mazda Nissan Truck Crossover Minivan/Van SUV Electric Luxury Sedan north american car of the year NACTOY

SRT reveals Satin Vapor Edition 300, Charger and Challenger SRT models

Fri, 07 Feb 2014With the exception of some notable truck and van introductions, Chrysler brands have tended to use the Chicago Auto Show to bring out new special editions, pimp their aftermarket parts support or indulge in the occasional flight of fancy. That plan is holding true for 2014, as well. Cases in point are these new Satin Vapor Editions of the 2014-model-year Dodge Challenger, Dodge Charger and Chrysler 300 - all from SRT.

The Satin Vapor name may sound like a failed 1970s glam-rock band, or a pseudo-gynecological diagnosis from the Old West, but is, in fact, pretty much a tape-and-trim package for this trio of hi-po Mopars. 300, Challenger and Charger alike come shod with 20-inch aluminum wheels finished in Black Satin Vapor Chrome, and are accented with Satin Black bits aplenty. The 300 gets blacked-out mirrors, spoiler and roof; the Challenger applies it to mirrors and its fuel door; while the Charger has the stuff covering its roof, hood and Super Bee tail graphic.

Interiors of the cars have been mildly updated as well, with all three getting some combination of Nappa leather, ultra-suede and carbon-fiberish finishes.