2004 Chrysler Sebring Limited Convertible Low Miles Garage Kept on 2040-cars

Sussex, New Jersey, United States

|

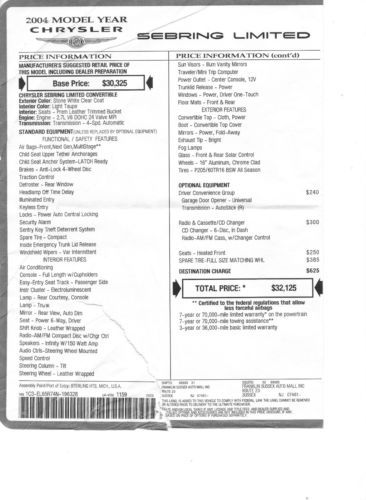

You are bidding on a 2004 Chrysler Sebring Limited Convertible. Stone White Clear Coat exterior and Light Taupe Premium Leather Bucket Seats. Kept in Heated Garage. Never driven in Winter. Mileage is 2,483 Original Miles. Interior and exterior are in near perfect condition. No accidents . Feel Free to run Car fax report. Runs great like new . Convertible top is perfect no wear or tear .Heated Front Seats. Please ask any questions before you bid. Pick up only or buyer handles shipping arrrangements |

Chrysler Sebring for Sale

2008 chrysler sebring limited automatic 2-door convertible

2008 chrysler sebring limited automatic 2-door convertible 2004 chrysler sebring

2004 chrysler sebring 2005 chrysler sebring convertible low miles florida car new top(US $5,900.00)

2005 chrysler sebring convertible low miles florida car new top(US $5,900.00) Inferno red convertible~new tires, canvas top, brakes & boot~chrome!! l@@k(US $6,981.00)

Inferno red convertible~new tires, canvas top, brakes & boot~chrome!! l@@k(US $6,981.00) We finance!!! one owner clean carfax touring convertible

We finance!!! one owner clean carfax touring convertible 2006 chrysler sebring base convertible 2-door 2.4l(US $5,200.00)

2006 chrysler sebring base convertible 2-door 2.4l(US $5,200.00)

Auto Services in New Jersey

Venango Auto Service ★★★★★

Twins Auto Repair Ii ★★★★★

Transmission Surgery & Auto Repair LLC ★★★★★

Tg Auto (Dba) Tj Auto ★★★★★

Szabo Signs ★★★★★

Stuttgart German Car Service ★★★★★

Auto blog

FCA's SEMA vans: A Ram ProMaster bar and a Mopar'd Pacifica

Tue, Nov 1 2016For this year's SEMA show, FCA created six machines that range from mild to wild, and what we have here are the two mildest examples: a custom Ram ProMaster and an accessorized Chrysler Pacifica. Of the two, the ProMaster is easily the more interesting. It's called the BrewMaster and it's a rolling bar. Get it? View 11 Photos The pub-themed interior has a variety of custom touches, including Mopar neon signs and beer taps with shift-knob handles. The outside gets some conceptual parts as well. The grille loses the crosshair design in favor of a large-font "RAM" badge in the center, similar to the one on the Ram Rebel. It also gets some custom 20-inch wheels and large fender flares to accommodate the wider rubber. The message here: Don't drink and drive, but definitely drive somewhere and drink. The Pacifica has far fewer custom goodies, and, sadly, no Hellcat powertrain, but that means what you see is something you could realistically replicate at a dealer. Called the Pacifica Cadence, this van is a rolling showcase of Mopar accessories. The newest piece is a running board that is designed to look like part of the sheetmetal, as opposed to a tacked-on aftermarket accessory. We'd say it's fairly successful if not super-exciting. View 7 Photos The Pacifica also features loads of other Mopar bits including the roof rack, dog kennel, all-weather floor mats, and wireless charging pad. Aside from the custom wrap and painted wheels, you could outfit your own Pacifica identically using a Mopar catalog. As for the BrewMaster, that might require a bit more custom work. Related Video: This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings. Image Credit: FCA, Joel Stocksdale SEMA Show Chrysler RAM Minivan/Van Concept Cars chrysler pacifica ram promaster SEMA 2016

SRT reveals Satin Vapor Edition 300, Charger and Challenger SRT models

Fri, 07 Feb 2014With the exception of some notable truck and van introductions, Chrysler brands have tended to use the Chicago Auto Show to bring out new special editions, pimp their aftermarket parts support or indulge in the occasional flight of fancy. That plan is holding true for 2014, as well. Cases in point are these new Satin Vapor Editions of the 2014-model-year Dodge Challenger, Dodge Charger and Chrysler 300 - all from SRT.

The Satin Vapor name may sound like a failed 1970s glam-rock band, or a pseudo-gynecological diagnosis from the Old West, but is, in fact, pretty much a tape-and-trim package for this trio of hi-po Mopars. 300, Challenger and Charger alike come shod with 20-inch aluminum wheels finished in Black Satin Vapor Chrome, and are accented with Satin Black bits aplenty. The 300 gets blacked-out mirrors, spoiler and roof; the Challenger applies it to mirrors and its fuel door; while the Charger has the stuff covering its roof, hood and Super Bee tail graphic.

Interiors of the cars have been mildly updated as well, with all three getting some combination of Nappa leather, ultra-suede and carbon-fiberish finishes.

Mopar-modified Chrysler 200 reappears in Chicago

Fri, 07 Feb 2014Chrysler made what was one of the biggest debuts of the 2014 North American International Auto Show last month when it debuted the heavily redesigned 200. While impressive on its own, the sleek sedan's Mopar counterpart, which was tucked away in a corner during the Detroit show, adds even more visual flair.

Based on the Chrysler 200S, the showcar had already benefitted from Lunar White Tricoat paint and meaty, 19-inch wheels (now in Satin Lite Bronze finish). White leather seats with bronze stitching accented the cabin treatment.

For Chicago, Chrysler added a Mopar body kit and new upper and lower grilles, both of which give the four-door a considerably more menacing look. The rear fascia is set off by a new bumper and a revised set of exhaust tips. The cabin is unchanged from the Detroit car.