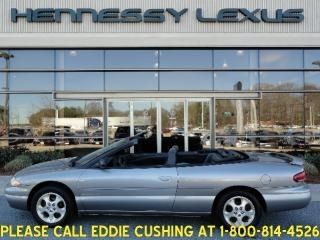

2002 Chrysler Sebring Lxi Sedan 4-door 2.7l Sunroof / Leather on 2040-cars

Manassas, Virginia, United States

Vehicle Title:Clear

Transmission:Automatic

Body Type:Sedan

Fuel Type:GAS

For Sale By:Private Seller

Mileage: 133,501

Make: Chrysler

Sub Model: LXI

Model: Sebring

Exterior Color: Silver

Trim: LXi Sedan 4-Door

Interior Color: Gray

Warranty: Vehicle does NOT have an existing warranty

Drive Type: FWD

Number of Cylinders: 6

Options: Sunroof, Cassette Player, Leather Seats, CD Player

Safety Features: Anti-Lock Brakes, Driver Airbag

Power Options: Air Conditioning, Cruise Control, Power Locks, Power Windows, Power Seats

Disability Equipped: No

Number of Doors: 4

Chrysler Sebring for Sale

2002 chrysler sebring 4dr sdn lx 1-owner low miles(US $7,900.00)

2002 chrysler sebring 4dr sdn lx 1-owner low miles(US $7,900.00) 2004 chrysler sebring limited convertible cold a/c good tires(US $6,420.00)

2004 chrysler sebring limited convertible cold a/c good tires(US $6,420.00) Bodyman special-- 2004 chrysler sebring lxi convertible

Bodyman special-- 2004 chrysler sebring lxi convertible 1998 chrysler sebring convertible jxi new top looks good(US $2,721.00)

1998 chrysler sebring convertible jxi new top looks good(US $2,721.00) 2000 chrysler sebring lx great & fun car to drive- no problems or issues(US $3,750.00)

2000 chrysler sebring lx great & fun car to drive- no problems or issues(US $3,750.00) 2002 chrysler sebring lxi convertible 2-door 2.7l(US $3,950.00)

2002 chrysler sebring lxi convertible 2-door 2.7l(US $3,950.00)

Auto Services in Virginia

Wiygul Automotive Clinic ★★★★★

Valle Auto Service ★★★★★

Trusted Auto Care ★★★★★

Stanton`s Towing ★★★★★

Southside Collision ★★★★★

Silas Suds Mobile Detailing ★★★★★

Auto blog

2022 New York Auto Show Roundup | All the reveals, reviews, pictures

Fri, Apr 15 2022NEW YORK ó In case you missed it, the New York Auto Show took place this year after being canceled in both 2020 and 2021 due to Covid. A lot of manufacturers showed up in force, but not everybody did. No matter, we were there, and we brought you news, photos and scoops from the floor throughout the show. All of our New York-related stories can be found at our central hub here, but if you¬íd rather just get a small taste of everything in a quick and digestible format, keep scrolling. 2023 Kia Telluride and its new X-Pro trim Kia revealed the Telluride¬ís first major refresh at New York, and it makes the three-row crossover a little bit more desirable without screwing up what we liked about it before. There¬ís a new X-Line and X-Pro trim for someone who might want a little more off-road capability, and a number of tech improvements. Most notably, a newly-designed dash features new and bigger screens. 2023 Hyundai Palisade The Telluride¬ís sister car from Hyundai was treated to a similar refresh. Like the Telluride, Hyundai gave the Palisade a slightly revised look, a new off-road trim (called XRT in the Palisade¬ís case), more tech inside and a new dash design with full-width air vents. If we had to choose, we¬íre a little more impressed with the Telluride¬ís refresh, as a number of us on staff actually prefer the pre-refresh Palisade styling over the new one. 2023 Jeep Wagoneer L and Grand Wagoneer L This one was inevitable. Jeep revealed the longer, roomier versions of its Wagoneer and Grand Wagoneer in New York, and they¬íre designated with an ¬ďL¬Ē at the end of their names. Total length grows by a foot, and the wheelbase goes up by 7 inches versus the standard Wagoneer models. Jeep has essentially allocated all this extra room to the cargo area, as it now offers a staggering 44.2 cubic-feet of space behind the third row. Besides the L, Jeep announced that its new Hurricane inline-six engine would find its first home in the Wagoneer. Efficiency gets a small boost, and power is more than sufficient at either 420 horsepower (standard output) or 510 horsepower (high-output version) from the twin-turbo I-6. Chrysler Airflow Graphite Concept The Stellantis party continues with Chrysler and its slightly revised Airflow. Re-styled for the New York market after initially debuting at CES in Las Vegas, the Airflow Concept gets new paint, changed accent colors, a slightly changed interior design and a new interpretation of the Chrysler logo.

What car should James Robertson buy to drive his famous 21-mile commute?

Thu, Feb 5 2015The Internet has been abuzz this week with the story of Detroit resident James Robertson, the 56-year-old factory worker who has walked some 21 miles to work for the last 10 years. The Detroit Free Press brought Robertson's story to the fore, helping an online fundraising campaign to generate more than $275,000 (as of this writing). The original goal was just $5,000, or about enough to replace the used Honda that died on Robertson back in 2005, and left him walking. So, newly flush with funds, what's the perfect car for Robertson to buy? Let's look at the specifics of his situation, and try to pick out the best options. Here's what we know: Robertson's commute is (famously) 21 miles; he lives in downtown Detroit (for now) and seems pretty humble, so something very flashy is probably out; former Honda aside, his ties to the city (and statements about being a Ford fan) seem to indicate a Detroit Three company product is best; he's a single guy with a girlfriend; he's got to deal with Michigan weather, and the sometimes fickle snow removal processes in The D. Here are some choices: Ford F-150 Robertson is on record as being a Taurus fan, and after a decade of walking I've no doubt that the big sedan would offer a cozy respite. Still, as a car guy and a student of the industry, I'd have a hard time recommending a sedan so clearly in need of replacement. Especially when The Blue Oval has such great stuff within the rest of its roster. The 2015 F-150 seems almost perfect for Robertson. Opting for either of the new EcoBoost V6 engines should help keep fuel bills in reasonable check, while healthy ride height and four-wheel drive will get him to work on time even during the snowiest of snow days. Better still, with a fat options sheet and car-like ride quality, Robertson can have just about every amenity he might want, in a package that won't disrespect his blue-collar roots. Chevrolet Colorado You guys saw this one coming, right? The smaller footprint of the midsize Chevy pickup, relative to some of the other options here, should be an advantage for urban parking and driving. And again, 4x4 is an option for the nasty weather, the running costs should stay pretty low and there aren't many tech/luxury features that can't be had in-cabin. I'd go ahead and splash out on the Crew Cab bodystyle, too, just in case Robertson feels like starting a carpool.

FCA to pay buyers $1,700 to swap out of scandal-mired VWs

Tue, Oct 6 2015FCA is trying to gain some sales from arch-rival VW in the competitive European market by offering potential buyers in Italy up to $1,700 to swap into an FCA group car. While the promotion isn't specifically targeted at TDI owners affected by the emissions scandal, it is clearly intended to turn dissatisfaction with VW's defeat device cheat into additional sales, Bloomberg reports. The 500-1,500 euro incentive (roughly $560-1,700, depending on vehicle) stacks on top of any other rebates or deals applicable, and applies if a buyer brings in any of Volkswagen Group's cars Ė including Audi, Skoda, and SEAT, among (many) others. As Bloomberg notes, it's normal for automakers to offer "conquest" deals ¬Ė giving a buyer cash for trading in a competitor's vehicle. Those deals aren't usually limited to one company's products, however; FCA's program looks specifically to take advantage of VW's legal and public relations nightmare. FCA isn't the only automaker trying this trick in Italy. Automotive News Europe also reported that Ford is offering approximately $840 in incentives across its entire range to owners of VW vehicles seeking to trade in for a Ford. No word of yet as to whether these incentives will spread beyond Italy or to other automakers.Related Video: