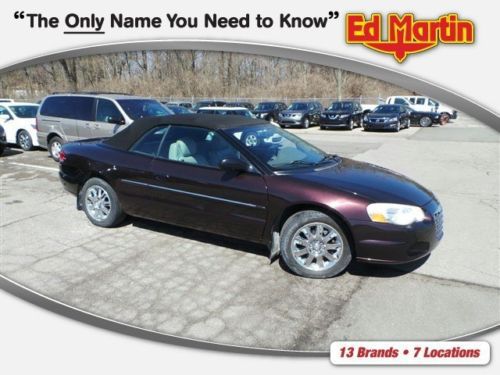

2002 Chrysler Sebring Lxi Convertible V6 Coupe 85k Orig Miles Florida/georgia on 2040-cars

Miami, Florida, United States

|

This car was my wife's daily driver until two years ago when her sister and husband came to the USA from Cuba. They needed a car so we gave this one to drive until they got on their feet. They are now doing well and recently purchased a brand new car. The car has a new roof as of two years ago. The front and back bumpers are in need of new paint. the interior needs a little sprucing up but other than that is is in good condition for a car its age. The car has issues. The first thing you need to know is that the transmission slips after it heats up (not sure what the problem is) , the second is the engine takes a few tries sometimes to get started (not sure if it needs a new ecu or a tune up) This car is located in Hialeah Florida. It has been only in Florida and Georgia its entire life ,so there is no rust . The car is available for personal inspection and test drive by appointment only . You will have to provide your own source of transportation out of Miami I do not recommend trying to drive this car long distance until you have made repairs.. Please note that we are selling this car as is no repairs prior to sale ,and no guarantees , no warrantees . . very simple you buy the car , take it away .and that is all there is . If you need to ask any questions feel free to call me at 404-451-2133 . I will be in Miami for two weeks only . this is CASH only no checks paypal can be used for deposit only .

must have made $500.00 deposit at time of purchase. |

Chrysler Sebring for Sale

Limited convertible 2.7l cd limited, chrome wheels, leather seats, power seat

Limited convertible 2.7l cd limited, chrome wheels, leather seats, power seat![2006 chrysler sebring touring convertible 2-door 2.7l [santa fe, texas 77510]](/_content/cars/images/41/888341/001.jpg) 2006 chrysler sebring touring convertible 2-door 2.7l [santa fe, texas 77510](US $5,980.00)

2006 chrysler sebring touring convertible 2-door 2.7l [santa fe, texas 77510](US $5,980.00) 1998 chrysler sebring jxi 2.5l v6 auto low mileage loaded no accidents 2 owners(US $6,900.00)

1998 chrysler sebring jxi 2.5l v6 auto low mileage loaded no accidents 2 owners(US $6,900.00) 2004 chrysler sebring touring convertible automatic 4 cylinder no reserve

2004 chrysler sebring touring convertible automatic 4 cylinder no reserve 2002 chrysler sebring lxi convertible blue no reserve

2002 chrysler sebring lxi convertible blue no reserve Convertible chrysler sebring low miles automatic transmission power equipped

Convertible chrysler sebring low miles automatic transmission power equipped

Auto Services in Florida

Zip Auto Glass Repair ★★★★★

Willie`s Paint & Body Shop ★★★★★

Williamson Cadillac Buick GMC ★★★★★

We Buy Cars ★★★★★

Wayne Akers Truck Rentals ★★★★★

Valvoline Instant Oil Change ★★★★★

Auto blog

Chrysler readying Hellcat V8 with Viper-like power

Tue, 21 May 2013A monstrous supercharged V8 engine could be in store for Chrysler and SRT products, if recent rumors are to be believed. Allpar is reporting that the forced-induction V8 - Chrysler's first, if this goes down - could make its debut this summer.

The story goes that the Hellcat would be based on a 6.2-liter Hemi engine, rather than on the existing 5.7- or 6.4-liter versions of the company's vaunted mill. In any case, the general consensus is that the motor will have gobs of power. Modest estimates call for between 500 to 570 horsepower, with some outliers predicting a figure as high as 600 hp. That figure would put the output would place the Hellcat awfully close to that of the 640-hp V10 in the SRT Viper, too. Allpar contends that a slightly lower powered version would allow Chrysler to keep costs below that of the more powerful Ford Shelby GT500, which might be a sweet spot.

The Hellcat could debut in a number of SRT products. SRT versions of the Charger, Challenger and 300 are all up for grabs, as is the rumored SRT Barracuda.

Fiat Chrysler taps Amazon, Shell execs to fill roles

Fri, Dec 7 2018MILAN — Fiat Chrysler Automobiles is tapping executives from Amazon and Shell Oil Company with previous automotive industry experience to fill its ranks. CEO Mike Manley said in a letter to employees Thursday that Mark Stewart would join FCA as chief operating officer of North America from Amazon, "a company known for its culture of innovation, and obsession with delivering incredible value to customers." At Amazon, Stewart led teams focused on advanced robotics, artificial intelligence and automation methods. He previously was COO of ZF TRW automotive components supplier. Niel Golightly was named head of global communications. He was most recently Shell's vice president for external relations in North and South America, with a focus on reputation, brand and stakeholder engagement beyond communication strategies. He previously held roles at Ford Motor Company. Related Video: Image Credit: REUTERS/Rebecca Cook Hirings/Firings/Layoffs Alfa Romeo Chrysler Dodge Fiat Jeep RAM FCA Amazon shell Mike Manley

Chrysler recalling 49K Chargers for headlight components

Fri, 14 Mar 2014Chrysler has issued a recall for about 49,375 2011 and 2012 Dodge Chargers with halogen headlamps due to a problem with the lights. The automaker says that there could be an issue with the jumper harness and other related components.

The automaker says that 43,450 cars are affected in the US, 2,850 in Canada, 375 in Mexico and 2,700 outside of North America. The vehicles will have their headlight assemblies, including the jumper harnesses and bulbs, inspected and potentially replaced. Dodge says that its engineers investigated reports of that were similar to what was found when it recalled about 10,000 police Chargers in 2012 for overheating light components. There have been no injuries or accidents related to fault, according to Chrysler.

The automaker will be in contact with affected owners, and schedule the service. Naturally, any repairs will be free of charge. Scroll down for the company's full announcement.