|

|

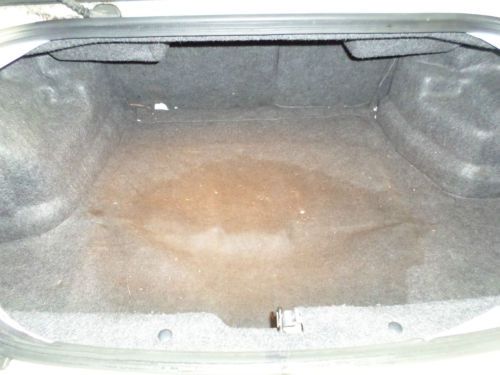

Chrysler Sebring for Sale

Summer fun 200 we finance

Summer fun 200 we finance 2002 chrysler sebring lxi convertible blue no reserve

2002 chrysler sebring lxi convertible blue no reserve Chrysler sebring- has new engine

Chrysler sebring- has new engine 2004 chrysler sebring lxi convertible heated seats loaded

2004 chrysler sebring lxi convertible heated seats loaded Black convertible~sandalwood top w/glass~spoiler~pleather~certified~03 04 05 06(US $4,988.00)

Black convertible~sandalwood top w/glass~spoiler~pleather~certified~03 04 05 06(US $4,988.00) 2dr touring convertible soft top 2.7l v6 leather heated seats cd keyless entry

2dr touring convertible soft top 2.7l v6 leather heated seats cd keyless entry

Auto blog

At meeting with automakers, Trump launches new attack on NAFTA

Fri, May 11 2018WASHINGTON — Ten American and foreign automakers went to the White House on Friday to push for a weakening of U.S. fuel efficiency standards through 2025, while President Donald Trump used the occasion to launch a fresh attack on the North American Free Trade Agreement that has benefited the companies. A draft proposal circulated by the U.S. Transportation Department would freeze fuel efficiency requirements at 2020 levels through 2026, rather than allowing them to increase as previously planned. Trump's administration is expected to formally unveil the proposal later this month or in June. "We're working on CAFE standards, environmental controls," Trump told reporters at the top of the meeting, referring to the Corporate Average Fuel Economy standards for cars and light trucks in the United States. Trump said he wants automakers to build more vehicles in the United States and export more vehicles. But much of the hour-long meeting focused on NAFTA. Trump blasted the pact involving the United States, Canada and Mexico as "terrible" and noted that negotiations to make changes sought by his administration were ongoing. "NAFTA has been a horrible, horrible disaster for this country and we'll see if we can make it reasonable," Trump said. Automakers have called NAFTA a success, allowing them to integrate production throughout North America and make production competitive with Asia and Europe, and have noted the increase in auto production over the past two decades with the deal in place. They have warned that changing NAFTA too much could prompt some companies to move production out of the United States. The chief executives of General Motors Co, Ford Motor Co, Fiat Chrysler, along with senior U.S. executives from Toyota Motor Corp, Volkswagen AG, Hyundai Motor Co, Nissan Motor Co, Honda Motor Co , BMW AG and Daimler AG met with Trump, as did the chief executives of two auto trade groups. Major automakers reiterated this week they do not support freezing fuel efficiency requirements but said they want new flexibility and rule changes to address lower gasoline prices and the shift in U.S. consumer preferences to bigger, less fuel-efficient vehicles.

Weekly Recap: Lamborghini to build SUV

Sat, May 30 2015Finally, Lamborghini will build a sport utility vehicle. The Italian supercar maker confirmed this week that it will launch a luxury SUV in 2018. It will be built at Lamborghini's soon-to-expand factory in Sant'Agata Bolognese in Italy, and will double the company's current sales volume. Lamborghini did not announce a name for the vehicle or other details, but noted a concept version, the Urus, was displayed at the Beijing motor show in 2012. It will be sold around the world, but it's expected to be a critical offering in the United States, China, and the Middle East. The automaker projects the SUV will sell about 3,000 units per year, and it will be the third product in Lamborghini's portfolio. It currently sells the Huracan and Aventador supercars. "The introduction of a third model line endorses the stable and sustainable growth of the company and signifies for us the beginning of a new era," Lamborghini chief executive Stephan Winkelmann said in a statement. The project is also a boon for Italy, which will get 500 new jobs in the Emilia Romagna region as Lamborghini's factory will nearly double in size. Ian Fletcher, principal analyst for IHS Automotive, said the SUV will position Lamborghini for future growth. "It could well also bring new customers to the brand [who] may find the dramatic styling of Lamborghini products appealing, but find its typical sports cars restrictive," he said. "If it is a success, the SUV could be a catalyst to Lamborghini broadening its portfolio further." OTHER NEWS & NOTES GM invests in Chevy Camaro factory General Motors is investing $175 million to upgrade its factory in Lansing, MI, to build the 2016 Chevy Camaro. The investment will pay for new tooling and equipment. The improvements include three new paint systems and two new robotic framers. GM will add a second shift at the factory to build the Camaro, resulting in 500 jobs. The automaker had dropped the plant to one shift last year amid slow sales for its products, the Cadillac ATS and CTS. GM is spending $5.4 billion over the next three years to upgrade its US facilities. Last week, GM announced plans to spend $439 million to build a new paint shop for the Chevy Corvette. While the Camaro and Corvette plant improvements are intriguing to enthusiasts, GM also confirmed this week that it is investing $1.2 billion in its Fort Wayne (IN) factory that builds trucks.

Google-FCA deal is a coup for both sides

Fri, May 6 2016FCA made a savvy play this week to team with internet giant Google. It's not as sexy as partnering with Apple, but it's almost as good. This move positions FCA to expand its capabilities in the autonomous driving field, and connecting with Google could boost the automaker's image. FCA will provide Google with about 100 Chrysler Pacifica hybrid minivans specially developed for autonomous testing. Google will integrate its sensors and computers into the vehicles. They'll work together at a site in Southeast Michigan and test the prototypes on Google's private test track in California. It's looks like an equitable deal and a win for both sides. "This marks a watershed event for the auto industry on two major levels: contract manufacturing for high tech firms and allowing such firms a clear pathway into the brain of the car," Morgan Stanley researchers said in a note. Don't underestimate how big this is for Google. The deal more than doubles the size of the tech firm's fleet, and does so with the Pacifica, a potentially segment-defining entry. Currently, it's using Lexus vehicles and other modified prototypes as testers. Though FCA is the smallest of Detroit's carmakers, it's also viewed as nimble and willing to embrace change. The Jeep and Ram divisions are as strong as any brand in the industry, and the Hellcats and Viper reinforce FCA's enthusiast cred. Google doesn't need those things, but they're pretty cool associations, nonetheless. If Ferrari can try to position itself as a leather goods maker, Google can have a little octane in its system. While experts expect Google to eventually partner with other automakers or to license its technology (FCA chief Sergio Marchionne reportedly said the deal isn't exclusive), FCA is positioned to get a head start. IHS Automotive predicts there will be 10.5 million self-driving or driverless cars used around the world by 2030. General Motors, Mercedes, Tesla, Volvo, Ford, and others have launched or are planning to roll out their own versions of autonomous driving technology. For now, FCA goes from having no apparent autonomous plans to potentially being among the leaders, and Google secures a legitimate automotive partner. Like we said, it looks like a win-win. NEWS & ANALYSIS News: Sergio Marchionne is taking over the CEO job at Ferrari. Analysis: This is a consolidation of Marchionne's power over the famous Italian sports-car maker and racing team.